US stock futures rebounded slightly, and Treasury yields rose after the Federal Reserve signaled it would try to curb inflation even though there were risks of recession. This resulted in monetary tightening from other central banks.

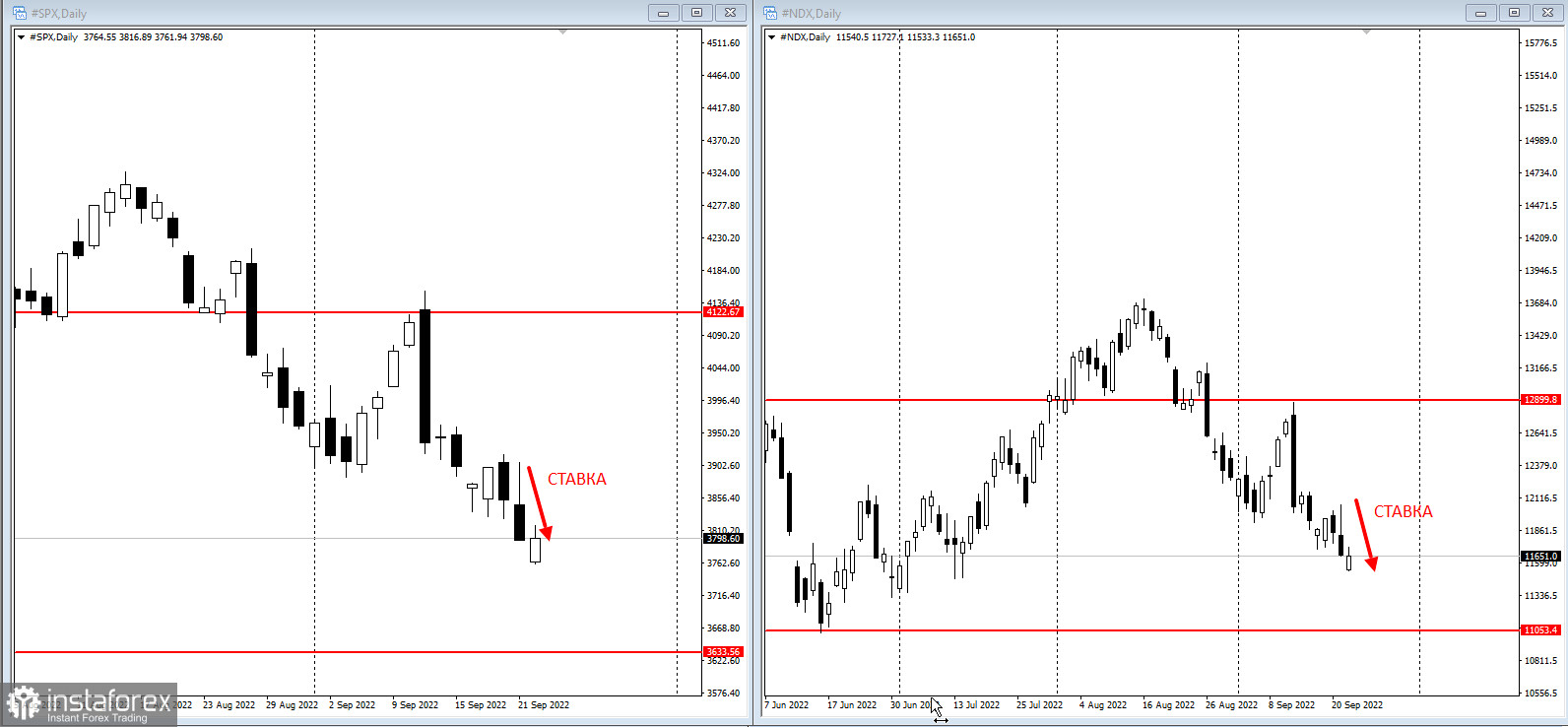

S&P 500 futures fluctuated after the benchmark fell on Wednesday when the Fed announced its third consecutive 75 basis point hike and indicated that another similar rate increase could be scheduled for November. Two-year Treasury yields rose to 4.11%, reinforcing the inversion of the yield curve that signals economic headwinds.

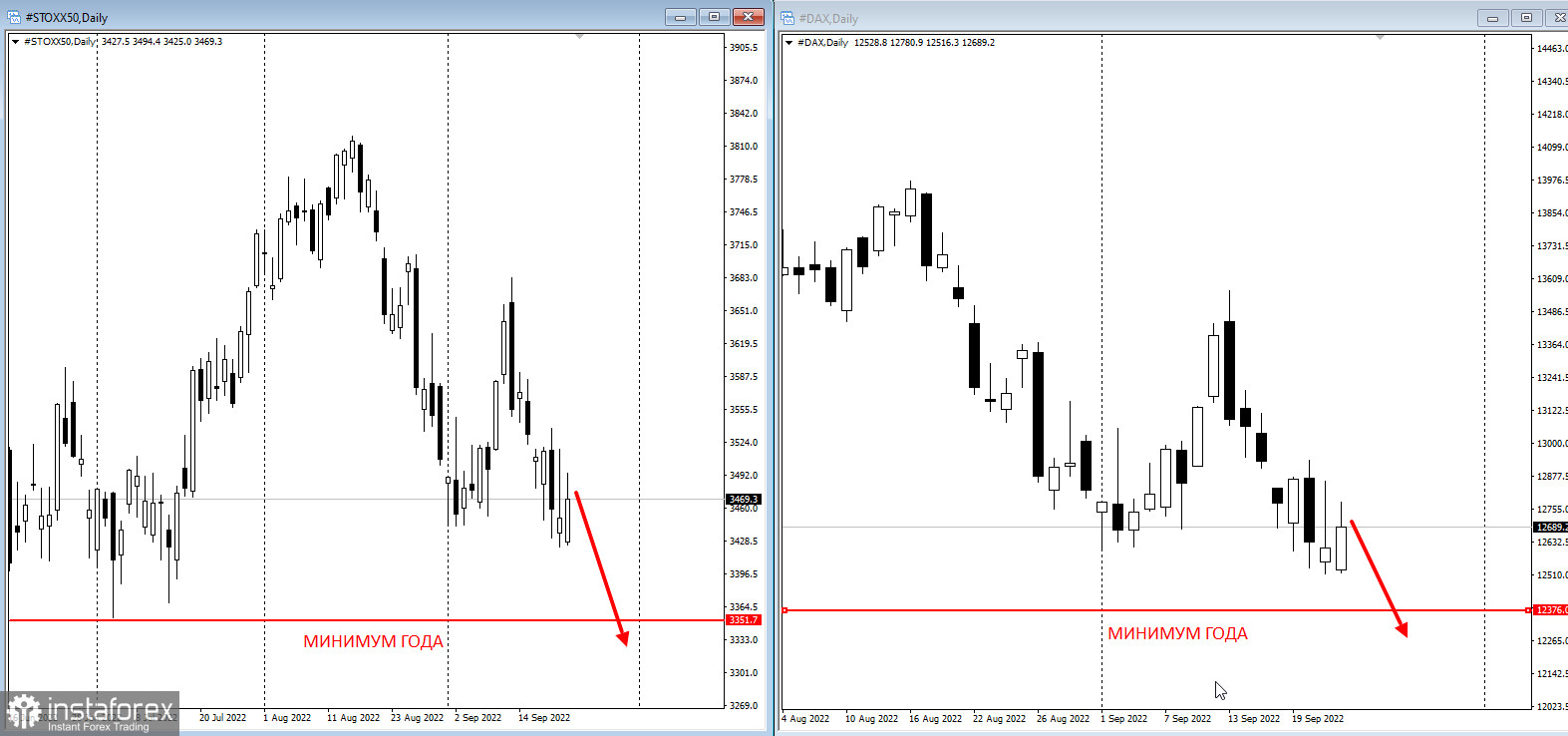

European stocks fell by more than 1%, followed by interest rate sensitive sectors including real estate, technology and construction.

The Fed gave its clearest signal yet that it was willing to tolerate a recession as the necessary trade-off for regaining control of inflation, with officials forecasting a further tightening of 1.25 percentage points of tightening by the end of the year. Switzerland, Norway and Britain followed with rate hikes as officials rushed to get to grips with rampant price increases.

"With the new rate projections, the Fed is engineering a hard landing - a soft landing is almost out of the question," Seema Shah, chief global strategist at Principal Global Investors, wrote in a note following the Fed's decision. "Powell's admission that there will be below-trend growth for a period should be translated as central bank speaks for 'recession'. Times are going to get tougher from here."

The Moscow Exchange Index is gradually recovering after its decline by 500 points. It occurred after Putin's speech. He announced plans to hold referendums and declared partial mobilization in the country.

Key events this week:

- Bank of Japan monetary policy decision, Thursday

- The Bank of England interest rate decision, Thursday

- US Conference Board leading index, initial jobless claims, Thursday

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română