For a long time, bitcoin and US stock indices, hand in hand, walked along the same road. As a result, the 60-day correlation between the S&P 500 and the leader of the cryptocurrency sector reached 0.72, which is slightly lower than the May record. At the same time, the collapse of the stock market, provoked by the increase in the federal funds rate to 3.25% in September, causes less and less panic in the ranks of the BTCUSD bulls. The token managed to cling to the psychologically important level of 19,000. Has it really hit the bottom, or is the crypto winter far from over?

The dynamics of bitcoin proves that investors have classified it as a risky asset, the value of which is affected by the Fed's monetary policy. In this respect, BTCUSD's 70% drop from November highs and 60% YTD can be easily explained by the Fed's changing mindset. If in 2021 it was confident in the temporary nature of high inflation and was in no hurry to get rid of monetary incentives, in 2022, everything turned upside down.

Raising the federal funds rate from 0.25% to 3.25% and scaling up the quantitative tightening program to $95 billion a month pushed real Treasury yields to levels last seen in 2011. Such a surge in real rates could not but affect the positions of risky assets, which are now in the black.

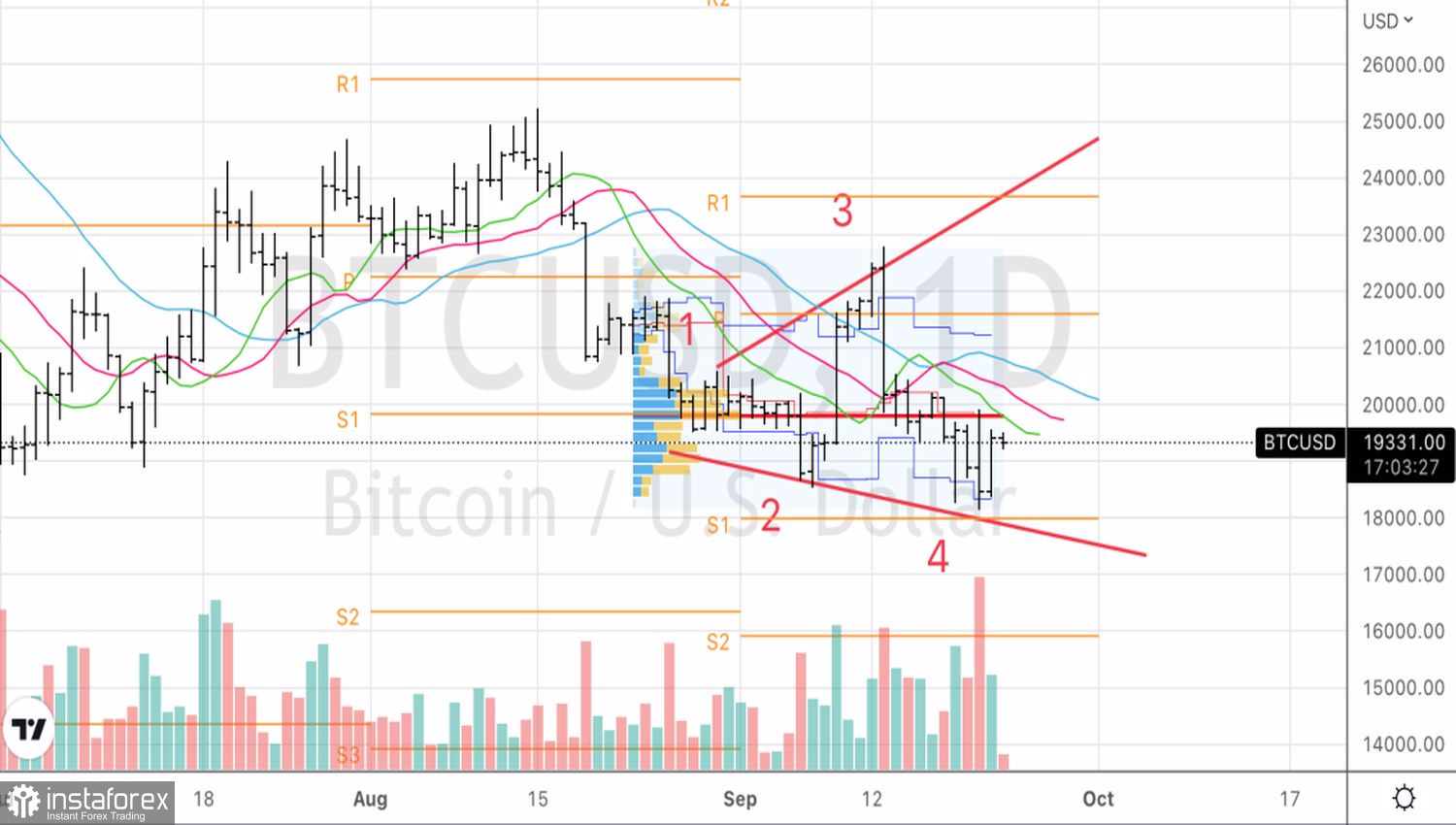

Dynamics of BTCUSD and S&P 500

With 85% of stocks in the S&P 500 having a higher earnings forecast for the next 12 months than before the pandemic, and 81% trading below their values from those days, it seems that the stock index has room to rise. However, it should be borne in mind that at the height COVID-19 pandemic, the profits of companies, especially technology companies, have increased significantly. Their fundamental estimates, on the contrary, fell due to the Fed's monetary restriction. In addition, the stock market does not fully take into account the high probability of a recession, which allows us to talk about the untapped potential for its collapse and is bad news for BTCUSD.

Why, then, did bitcoin manage to clutch at a straw like a drowning man? Even with information that the federal funds rate could rise to 4.6% in 2023, in line with FOMC forecasts?

In my opinion, it is due to the overflow of capital. Money is running out of stocks and bonds, resulting in higher yields for the latter. At the same time, the presence of the US dollar in the area of 20-year highs suggests that the currency is overvalued. Where else can the capital be directed? Why not in the crypto sector? Whose assets, on the contrary, look oversold against the background of grandiose collapses from the levels of November highs.

Technically, on the daily chart of BTCUSD, the bulls do not give up hope of completing the formation of the Broadening Wedge reversal pattern. To do this, they need to raise bitcoin quotes above 22,800. Risky entries into longs are associated with the storm of resistance at 19,800 and 20,200, where the fair value and moving averages are located.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română