The dollar is so scary that its opponents don't even think about how to stop it. They just ran from the battlefield. The yen was not helped by the first currency interventions since 1998, the pound by fiscal incentives from the new British government, and the euro by the confident victory of the alliance led by Georgia Meloni in the snap elections in Italy. According to RAI forecasts, she won 43% of the popular vote, which implies 114 Senate seats. The majority required 104. A strong Cabinet of Ministers is good news for EURUSD, as political risks are reduced. However, this does not save the main currency pair.

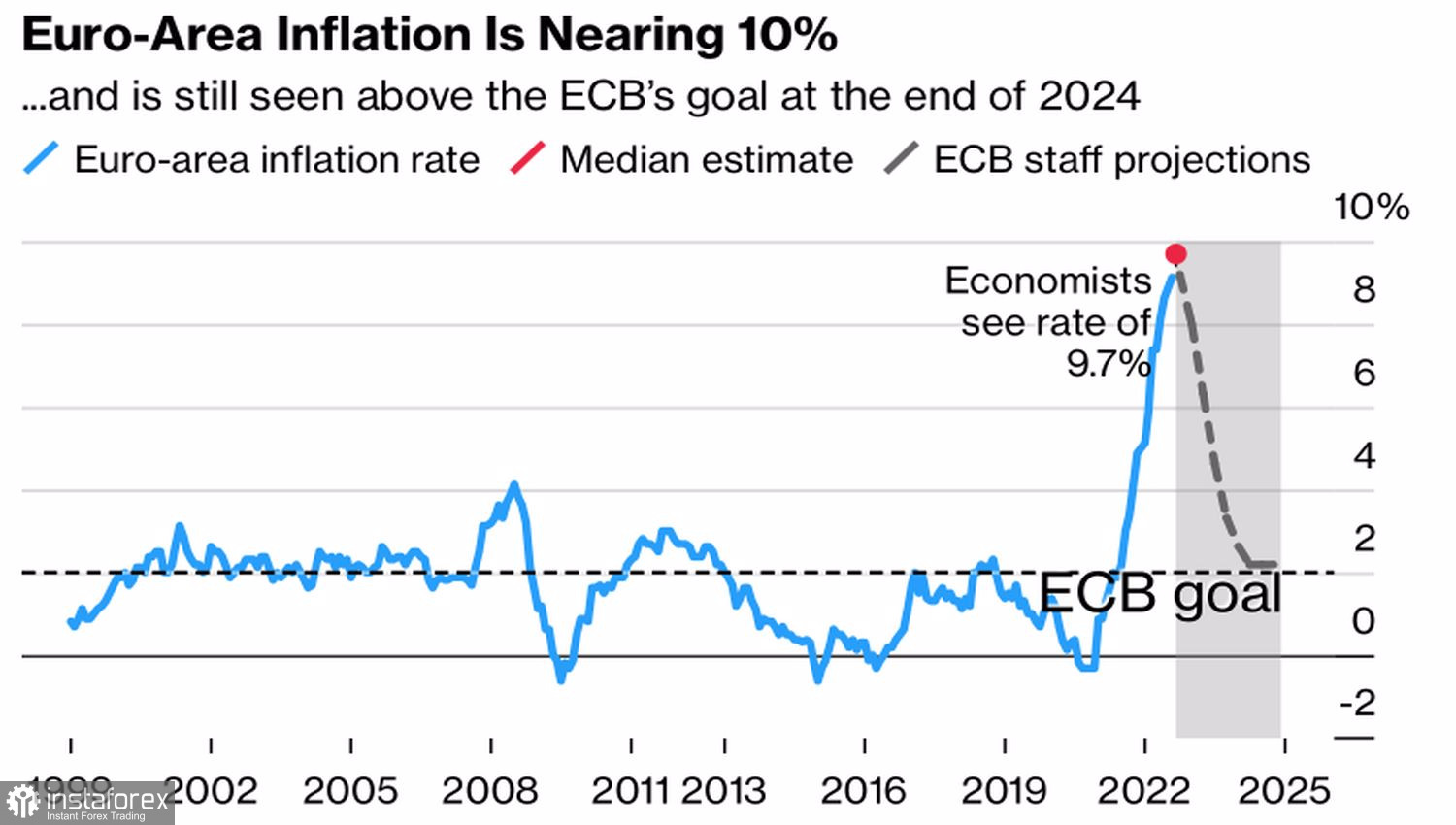

Neither the expectations of the acceleration of European inflation from 9.1% to 9.6% in September nor the "hawkish" rhetoric of the members of the Governing Council helped the euro. According to the head of the Bank of Lithuania, Gediminas Simkus, the minimum size of the deposit rate increase in October is 50 bps. His colleague from Latvia, Martins Kazaks, is ready to vote for +75 bps. The rally in gas futures and the cancellation of measures to mitigate the impact of high prices in Germany can push the eurozone CPI to a new record peak.

The dynamics of European inflation

However, no matter how much good news there is for the euro, it cannot resist the US dollar. For the USD index to begin to decline, two conditions are required: an improvement in global risk appetite; and, secondly, the global economy being ahead of the American economy in terms of growth rates. Neither one nor the other is currently unrealistic.

The Fed is the pack's leader, and all the other central banks are moving after it. And judging by the massive tightening of monetary policy, they took to heart Jerome Powell's statement about his willingness to sacrifice the economy to defeat inflation. Thus, the United States exports to the rest of the world at high prices and as a cure for them in the form of aggressive monetary restrictions. And this does nothing good for competitors. Their economies are slowing down, and stock indexes worldwide are falling, and so is global risk appetite. As a result, the demand for the US dollar as a safe-haven asset is growing.

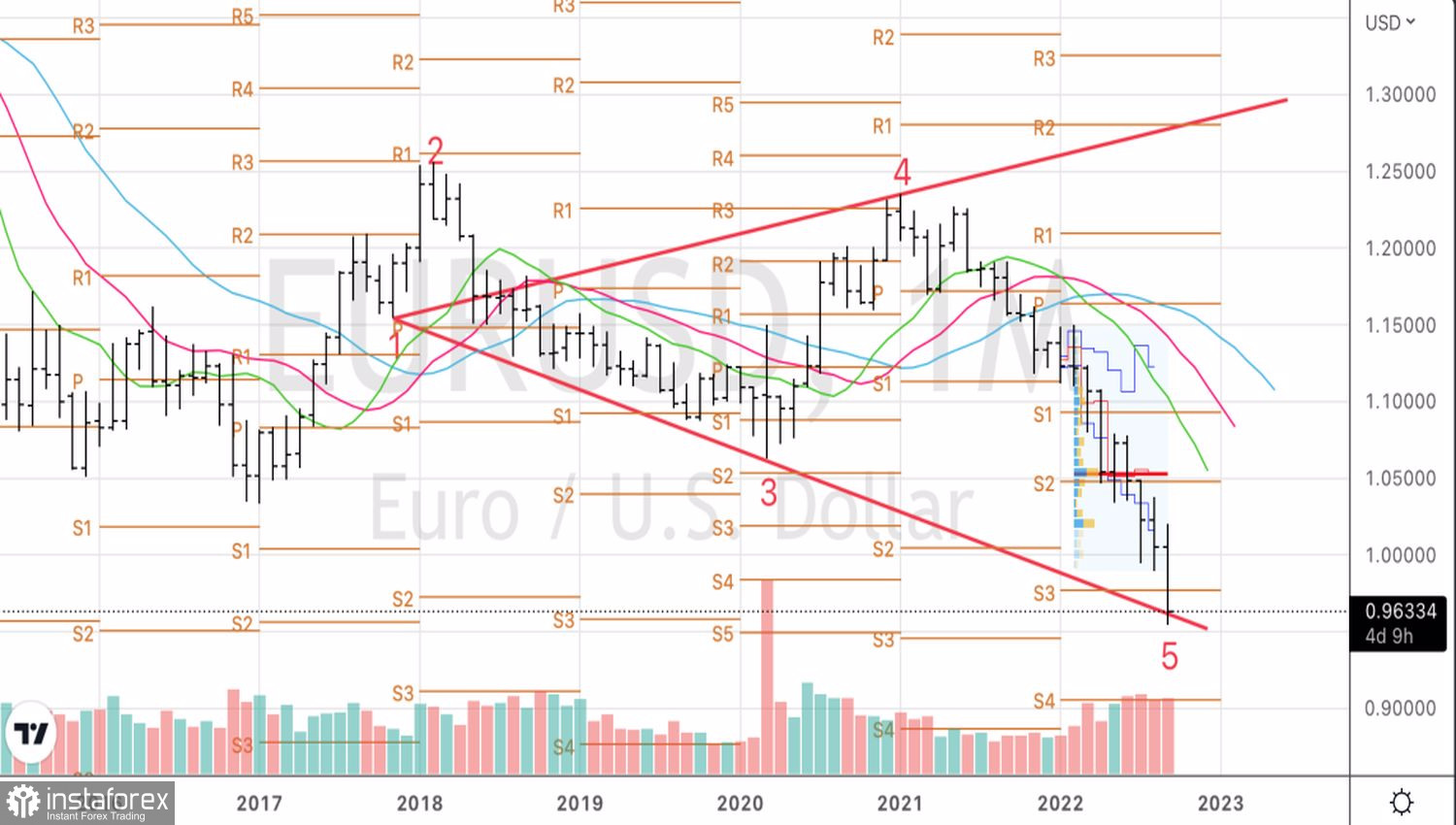

The divergence in US economic growth with the rest of the world is also expanding because the United States is a net energy exporter, they sell LNG, and the energy crisis has affected them to a lesser extent than the eurozone, Britain, and Japan. The state of the current accounts of these countries is rapidly deteriorating, which has led the euro to a 20–year bottom against the dollar, the yen to a 24–year low, and the pound to a record low. It is unlikely that the situation will change in the near future. Especially considering the onset of cold weather in the Old World ahead of time. They will push gas prices up and the EURUSD – down, in the direction of 0.9.

Technically, the formation of Wolf Waves has been completed on the monthly EURUSD chart. A necessary condition for a reversal of the downtrend requires the pair to return above the lower limit of the fair value of 1.018-1.14, which so far looks unlikely. We continue to sell euros with targets of 0.945-0.95 and 0.915.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română