The EUR/USD currency pair easily continued its downward movement on Monday. Of course, the news could have arrived on Saturday or Sunday, and the reaction to it could have followed on Monday. However, the first thing to note is that the European currency did not lose too much on Monday. Yes, there was a collapse at night, but at the moment, the euro was falling by only 130 points, which is not a big deal in current realities. If you look at the 24-hour TF, it becomes clear that the European currency continues the movement in which it has been for more than a year. From time to time, the market pauses, followed by a new sharp collapse. In our last article, we gave a lower volatility target of 0.9576. This level worked out perfectly, and the drop in quotes did not continue during the day. Thus, we believe everything will take its course in full accordance with the fundamental, geopolitical, and macroeconomic backgrounds now available to traders.

In short, we believe that even economic factors are not the reason for the new collapse of the euro. The market had plenty of opportunities to work out high gas prices, high oil prices, and a likely recession in the Eurozone. We also recall that in the Eurozone, a recession is also planned. It has already started in the States, but we don't see that the US dollar is worried about this. Thus, it turns out that either traders completely ignore all the negative data from overseas but work out the negative from the EU with pleasure, or this news does not matter to the market now. We are leaning towards the second option.

What then influences it? As banal as it sounds, we believe it is precisely because of the geopolitics of the euro currency that continues to show negative dynamics. Last week's news about the mobilization in Russia gave rise to a huge number of new forecasts, starting with the prolonged military conflict in Ukraine for many years and ending with nuclear strikes, which will provoke a third world war. In principle, the parties to the conflict have already openly stated that, if necessary, they will press the "red button." What state should traders and investors be in if the world's top officials openly discuss nuclear war? Risk avoidance is the name of what we currently see in the markets. It's strange, but bitcoin is practically not falling in price at this time.

The results of the elections in Italy do not matter much.

Let's immediately make clear what we mean by this subtitle. Of course, they have a meaning. This is a new government that will build a new relationship with Brussels. But the government changes regularly in many countries. How many times has the government changed in each country that is part of the EU during the entire existence of the EU? There is no so-called "good" or "bad" government. There are specific people with whom we will now have to have a dialogue. Yes, the winning parties are far-right, which can complicate any negotiation process with Brussels and other EU members. But let us recall that Rome did not immediately acquire the status of a "troublemaker of the European Union," and the European Union itself is not 2-3 countries that are obliged to follow Rome's lead.

Recall that Hungary, whose Prime Minister, Viktor Orban, very often makes such statements that go against European values, may already fall under the sanctions of the European Union. Do many EU leaders openly talk about why the EU needs Hungary if it does not adhere to a common vector of development, the only one of all those blocking certain decisions? We are discussing freezing 7.5 billion euros of aid to Hungary as a preventive measure. And if Orban's policy does not undergo certain changes, Hungary's EU membership may be suspended. Simple or complex majority of votes. Therefore, let's be honest. If Italy's policy changes dramatically and radically, the country that received the most from the European budget during the pandemic can quickly be torn away from the "European feeder." Now the principle of "every man for himself" does not work. The principle of "one for all and all for one" is working. Therefore, those who only want to receive benefits and preferences for themselves but at the same time do not agree with the "general policy of the party" can very quickly find themselves on free bread. The UK has left the EU and looks at where the pound and the British economy are.

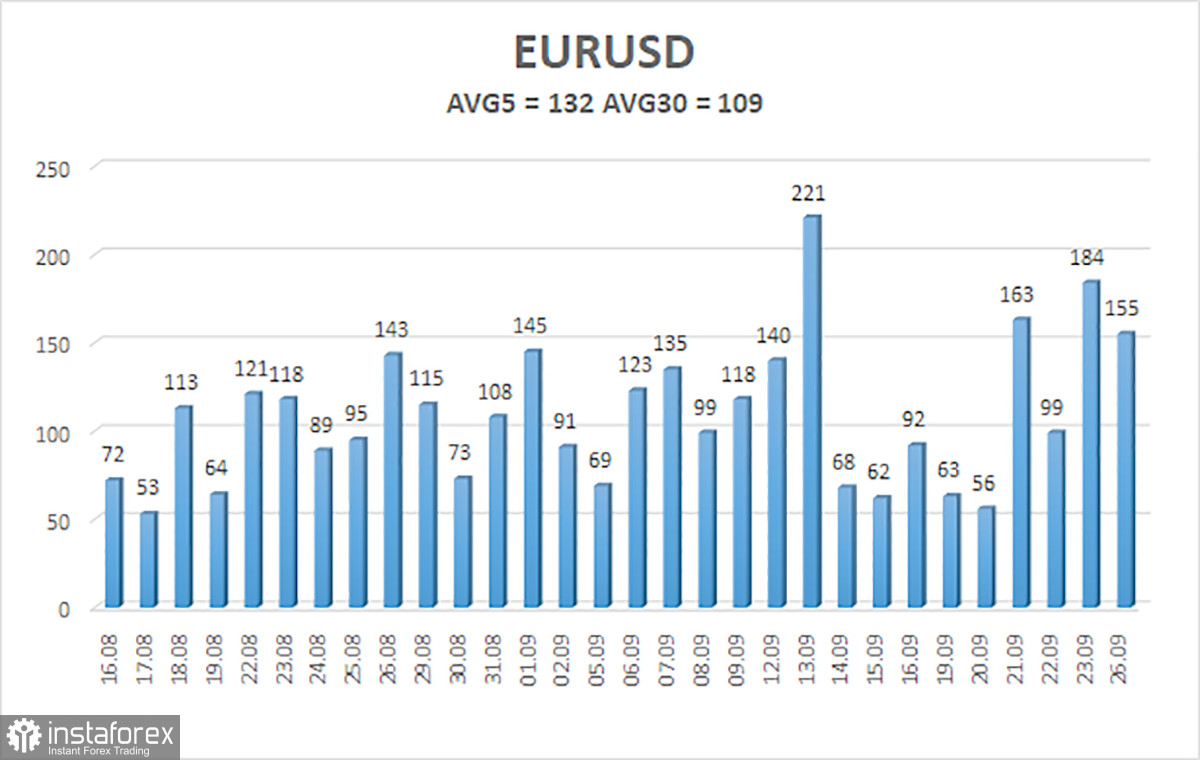

The average volatility of the euro/dollar currency pair over the last five trading days as of September 27 is 132 points and is characterized as "high." Thus, we expect the pair to move between 0.9488 and 0.9752 levels on Tuesday. The upward reversal of the Heiken Ashi indicator signals a round of upward correction.

Nearest support levels:

S1 – 0.9521

Nearest resistance levels:

R1 – 0.9644

R2 – 0.9766

R3 – 0.9888

Trading Recommendations:

The EUR/USD pair continues a strong downward movement. Thus, you should stay in short positions with targets of 0.9521 and 0.9488 until the Heiken Ashi indicator turns up. Purchases will become relevant no earlier than fixing the price above the moving average with goals of 0.9888 and 1.0010.

Explanations of the illustrations:

Linear regression channels help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) identifies the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română