EUR/USD

Higher timeframes

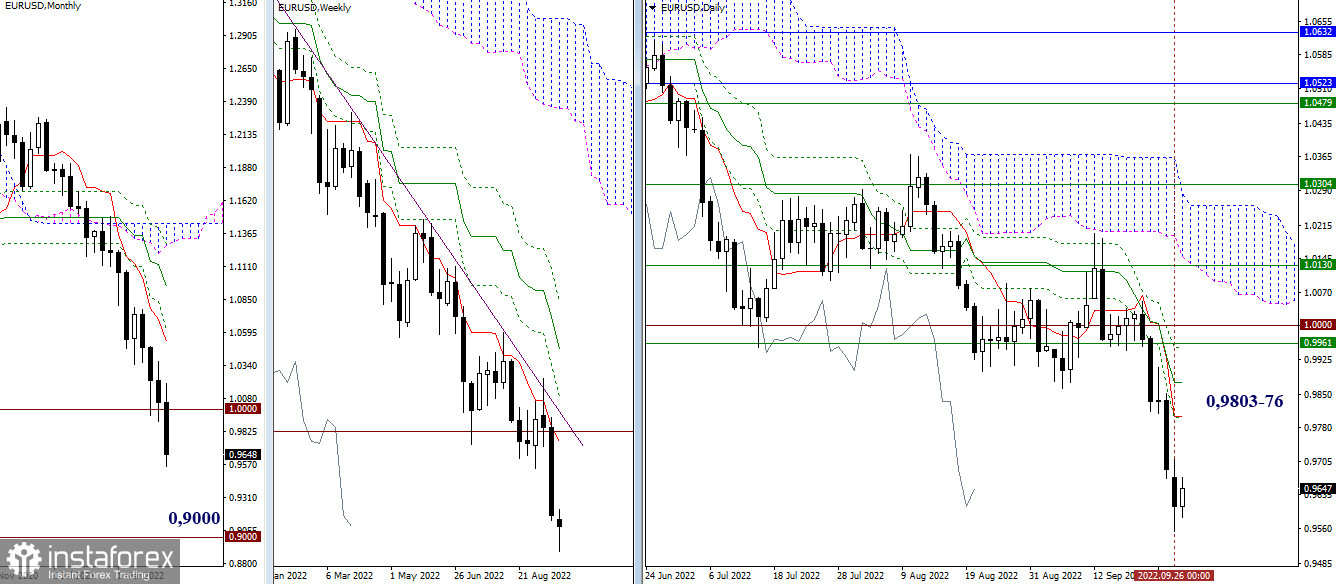

The decline continued yesterday. Bears retain the advantage and the development of the downward trend. The next significant downward benchmark in this area from the higher timeframes is the psychological threshold of 0.9000. In case of a slowdown and an upward correction, the resistances of the daily Ichimoku death cross will be the first to interact. They are currently located at 0.9803 (short-term trend) and 0.9876 (medium-term trend).

H4 – H1

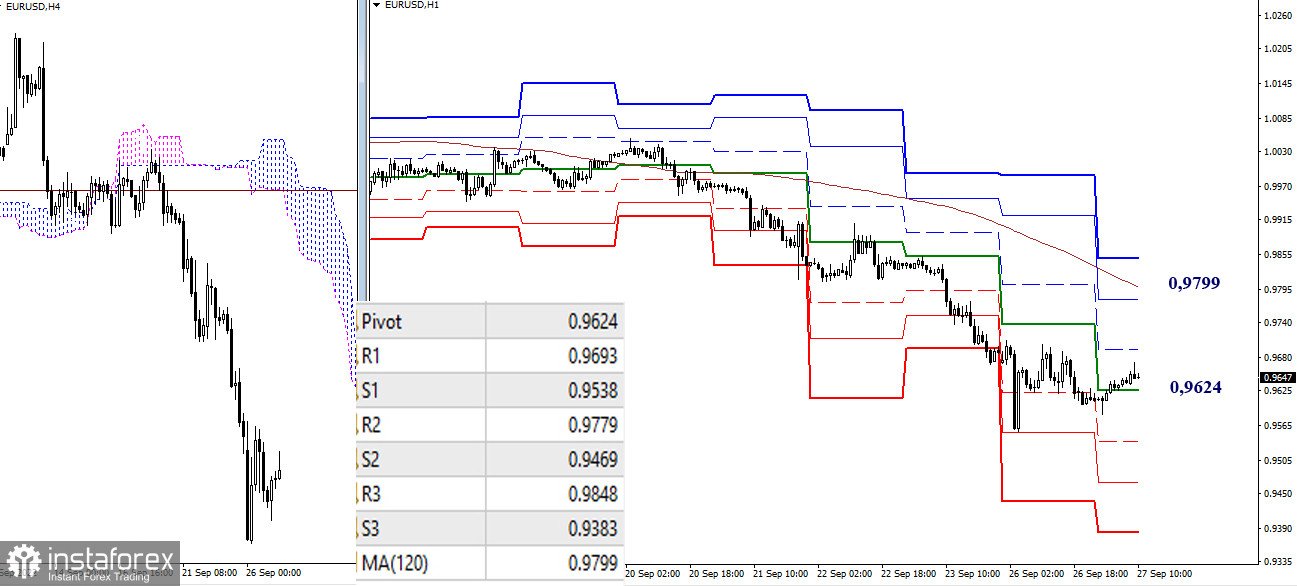

As of writing, the pair continues to be in the correction zone. Now trade is being carried out in the area of the central pivot point (0.9624). The main reference point for the rise in the current situation is the weekly long-term trend (0.9799); intermediate resistance along this path can be noted at 0.9693 (R1) and 0.9779 (R3). When leaving the correction zone (low at 0.9554), relevance and interest will return to the support of the classic pivot points, which today are located at 0.9538 - 0.9469 - 0.9383.

***

GBP/USD

Higher timeframes

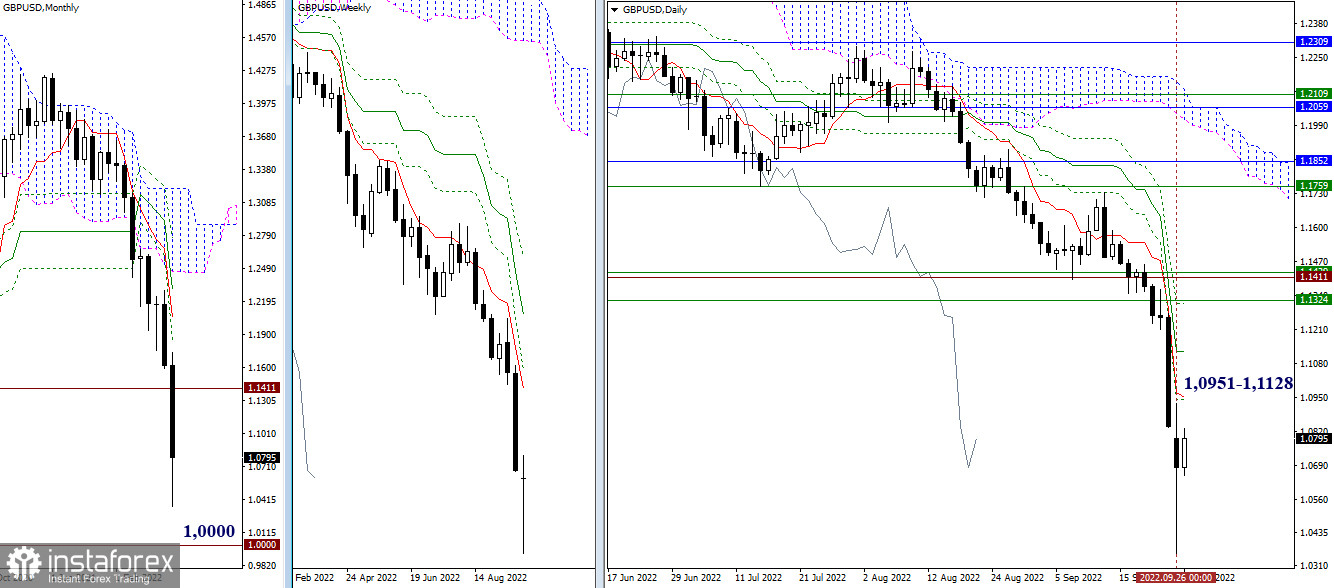

The pair realized a fairly deep decline yesterday. However, the result of the day was a fairly deep descending shadow, which indicates the strength of corrective sentiment. The nearest targets for the development of an upward correction today can be noted at the boundaries of the daily death cross at 1.0951 (short-term trend) and 1.1128 (medium-term trend). For bears, the psychological threshold of 1.0000 is still crucial.

H4 – H1

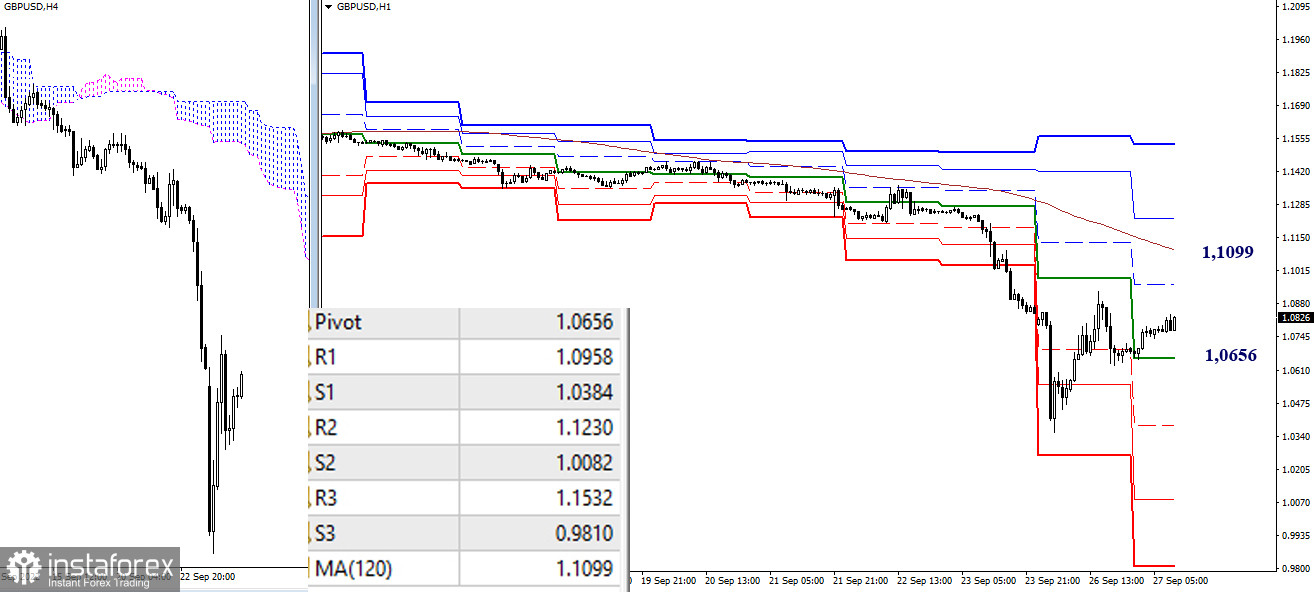

As of writing, the pair is trading in the correction zone, keeping uncertainty for quite a long time. Downside targets today can be noted at 1.0656 - 1.0384 - 1.0082 - 0.9810 (classic pivot point). Upward intraday targets are now represented by resistances 1.0958 – 1.1230 – 1.1532 (classic pivot points) and the level of 1.1099 (weekly long-term trend), which is the most significant for the distribution of the balance of power on the lower timeframes.

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1- Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română