After a highly volatile Friday, some assets are correcting upwards, but the overall trend remains extremely negative. Global yields resumed growth, the trade-weighted dollar index reached a record high. The updated OECD forecast assumes a slowdown in world growth to 2.2%, which is below the 2.8% in June, further growth in rates following inflation looks inevitable.

At the moment, it is assumed that Germany will enter recession earlier than the US, which is experiencing a short-term recovery. After Europe has refused Russian energy supplies, being unable to replace supplies, such a scenario looks almost inevitable.

We expect that after a short corrective growth, global trends will again become relevant. The US dollar will not miss the lead.

EUR/USD

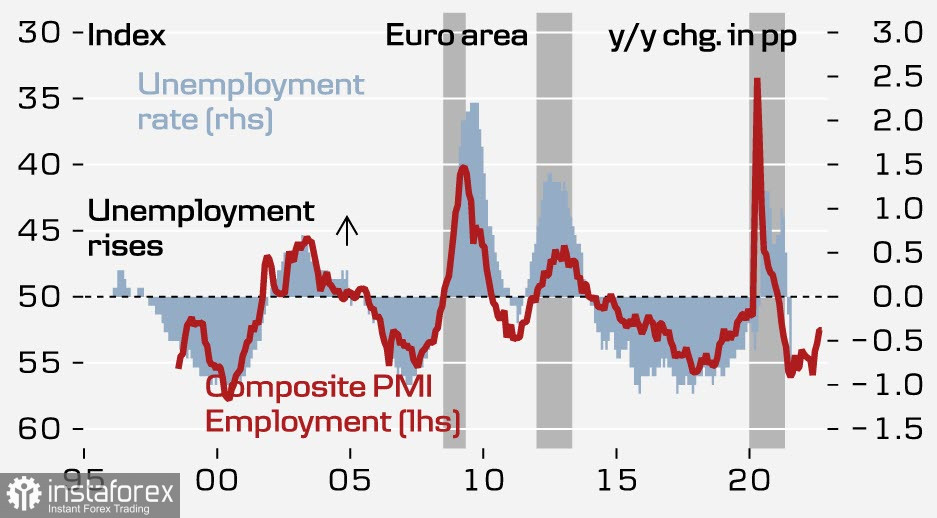

The risks of a recession in the eurozone are becoming apparent. A sharp decline in production has been reported for the third consecutive month, weaker demand, especially in Asia, and high inventory levels point to risks of a further downturn in manufacturing activity. The service sector looks more stable, but there is already a drop in demand for non-essential services.

The threat of energy rationing and the approach of winter suggest further inflation growth, which is expected to reach double digits in the 4th quarter. The job market is saturated, but new hires have begun to slow down.

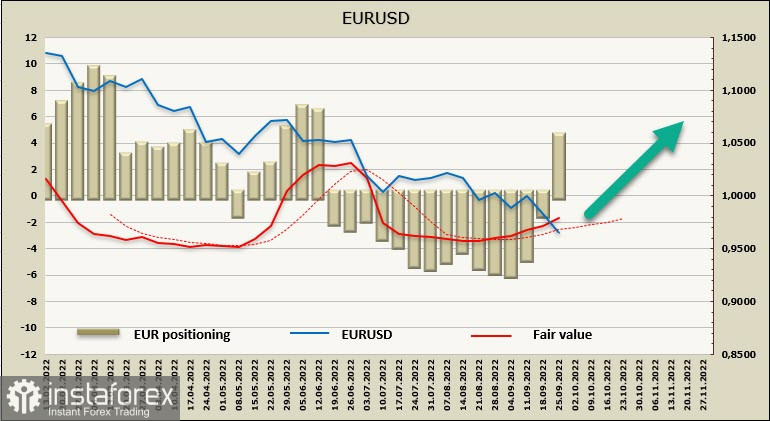

The CFTC report showed a strong growth in the long position on the euro, but it is no longer possible to take these data into account. It should only be noted that investors before last week expected that the European Central Bank, as part of the fight against high inflation, would strengthen policy tightening, this was expressed in the expectation of another rate hike of 0.75% in October plus 0.50% in December and February, which would allow them to get close to the then predicted levels of the Federal Reserve and reduce the rate differential between the dollar and the euro. However, recent events completely refute this scenario. We should expect a large-scale sale of the euro and a reversal of the estimated price down in the next report.

EURUSD has been in a bearish channel since February, and the ECB's efforts to tighten policy "faster than expected" have not yet been successful. The target is the lower limit of the 0.9410/40 channel, the resistance is 0.9868, and even if the corrective impulse to the upside, which is long overdue, takes place, it is unlikely to allow a return to parity.

GBP/USD

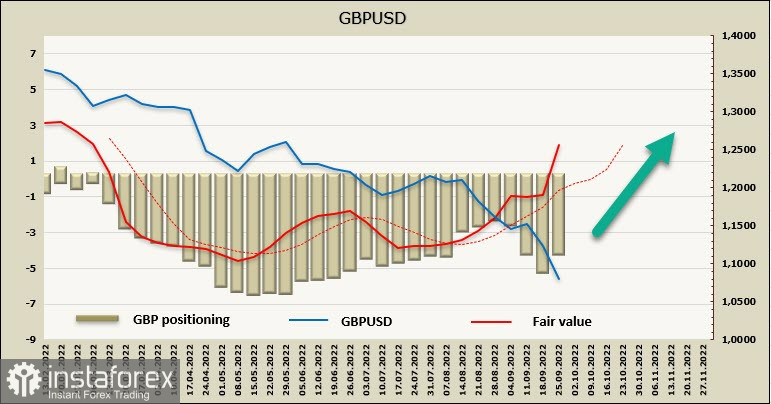

A wave of news from the UK brought down the pound to a historic low of 1.035 at the beginning of the Asian session. Over the next few hours, the situation recovered, as rising securities yields and expectations of the Bank of England's actions supported the pound, and the currency returned slightly above Friday's close, reaching 1.093 at some point.

The UK government announced the biggest tax cuts since 1972, including the abolition of the top income tax rate from 45% to 40%, large-scale fiscal support for households and businesses from the protection of high energy prices. Reducing the fiscal burden will lead to a lack of funds to finance the budget, while the current account deficit is more than 8% of GDP.

The markets took the changes extremely seriously, the pound collapsed as expectations for the BoE rate rose sharply, and moreover, there were fears that a new QE program would be required in the context of lower tax revenues. The BoE was forced to urgently issue a special statement in which it said that it was closely monitoring market movements after the collapse and would not hesitate to adjust the rate as necessary. There will be no unscheduled meeting. The rates will change at the next scheduled meeting.

The CFTC report published on Friday was outdated at the time of release, as it does not take into account recent events. Meanwhile, we can note a reduction in short speculative positions on the pound amid a decrease in open interest, that is, currency traders did not expect such decisive steps from the government at all and were focused on the fact that the pound would try to restore some positions after the BoE meeting. The estimated price has gone up sharply, which can be interpreted as a good opportunity for long positions in hopes that the pound will try to win back part of the fall.

However, since the markets are now managed manually and the CFTC reports are clearly late, it is impossible to be guided by long-term speculative rates now, since they will inevitably be revised in the very near future.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română