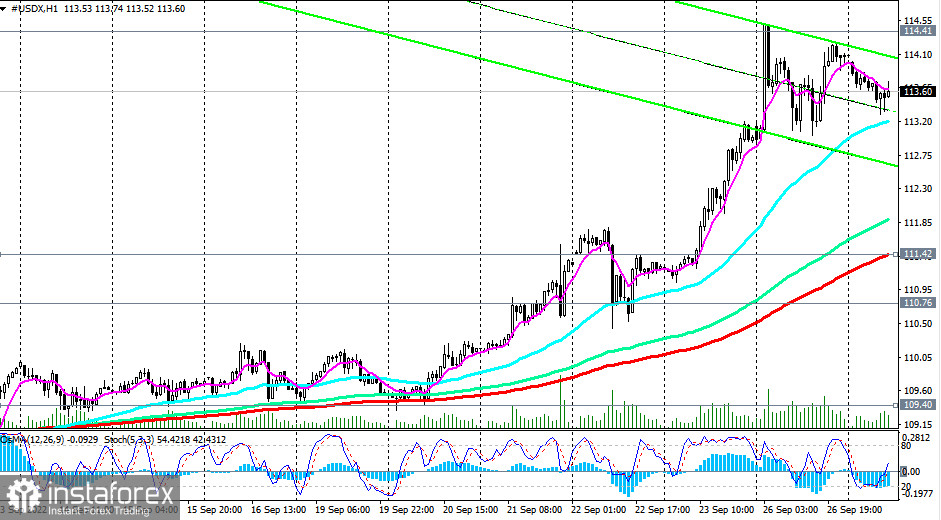

As of writing, the dollar index (CFD #USDX) is trading near 113.55, down from yesterday's new local high near 114.41.

The dollar's upward trend continues, pushing the DXY to new highs on its way to over 20-year highs near 120.00, 121.00. The break of yesterday's local high at 114.41 will be a confirmation signal of our assumption.

Alternatively, the very first signal for short-term selling will be a breakdown of the short-term support level 113.12 (200 EMA on the 15-minute CFD #USDX chart). The target is the important short-term support level 111.42 (200 EMA on the 1-hour chart). Its breakdown, in turn, may provoke a deeper correction to the support levels of 109.40 (200 EMA on the 4-hour chart), 108.75 (50 EMA and the lower line of the rising channel on the daily chart). However, once again we note that this is an alternative and theoretically possible scenario.

Strong bullish momentum prevails based on fundamental factors, favoring long positions.

Support levels: 113.12, 111.42, 110.76, 109.40, 108.75, 105.00, 103.35

Resistance levels: 114.00, 114.41, 115.00

Trading Tips

Sell Stop 112.90. Stop Loss 114.30. Take-Profit 111.42, 110.76, 109.40, 108.75, 105.00, 103.35

Buy Stop 114.30. Stop-Loss 112.90. Take-Profit 114.41, 115.00, 116.00, 120.00

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română