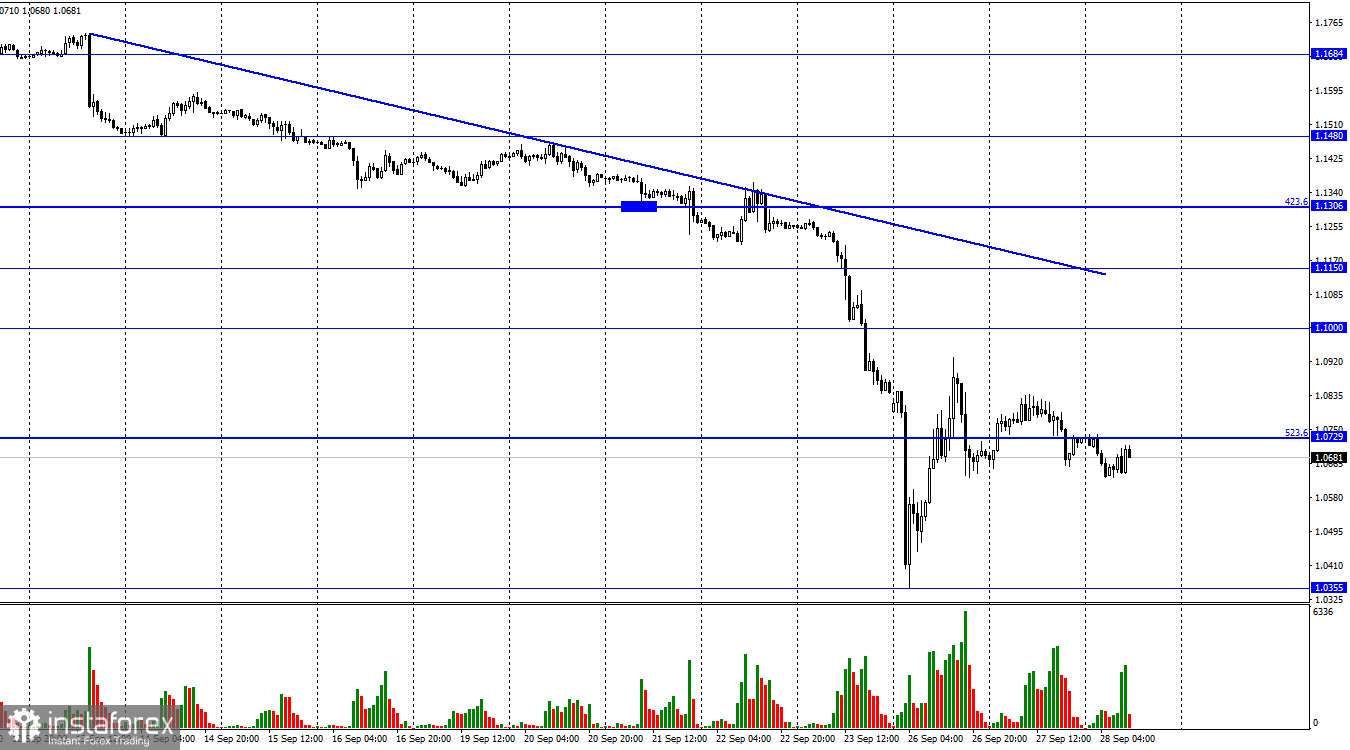

On Tuesday, GBP/USD reversed in favor of the US dollar on the 1-hour chart and resumed its fall after settling below the Fibonacci level of 523.6% located at 1.0729. So, the pound may continue to slide towards the level of 1.0355 that was reached on Monday. Currently, I see no reasons for the reversal of the trend and no conditions for the pound to develop a sustainable rally. Despite the fact that there is no clearly negative news coming from the UK, traders cannot switch to buying the pair. Technical analysis also confirms the bearish trend. Bulls will now have to put a lot of effort to outperform bears.

Here is the recent news from the UK. The government announced a new stimulus plan to support the economy which is based on cutting taxes. This initiative has already faced a backlash from some policymakers who believe that this step will hit the already weak economy. Time will show whether this is true or not. In the meantime, UK households are in desperate need of support as their burden is getting heavier every day due to soaring oil and gas prices. Oil has declined recently which is definitely good news but gas prices are still elevated. Even if the UK has enough gas in its storage, the overall market deficit may keep pushing prices higher. There may be no gas shortage in the country itself but its citizens will still face unbearable energy costs. Yesterday's explosions of the Nord Stream pipeline mean that Russian gas supply to Europe will drop significantly or will fully stop. The cost of gas is not rising yet but its recent rally has already brought the price to unprecedented levels. Today, markets will also take notice of Jerome Powell's speech. The Fed Chair may confirm the remarks by James Bullard about the next increase in the interest rate. Traders may downplay these comments but the US dollar may continue to rise.

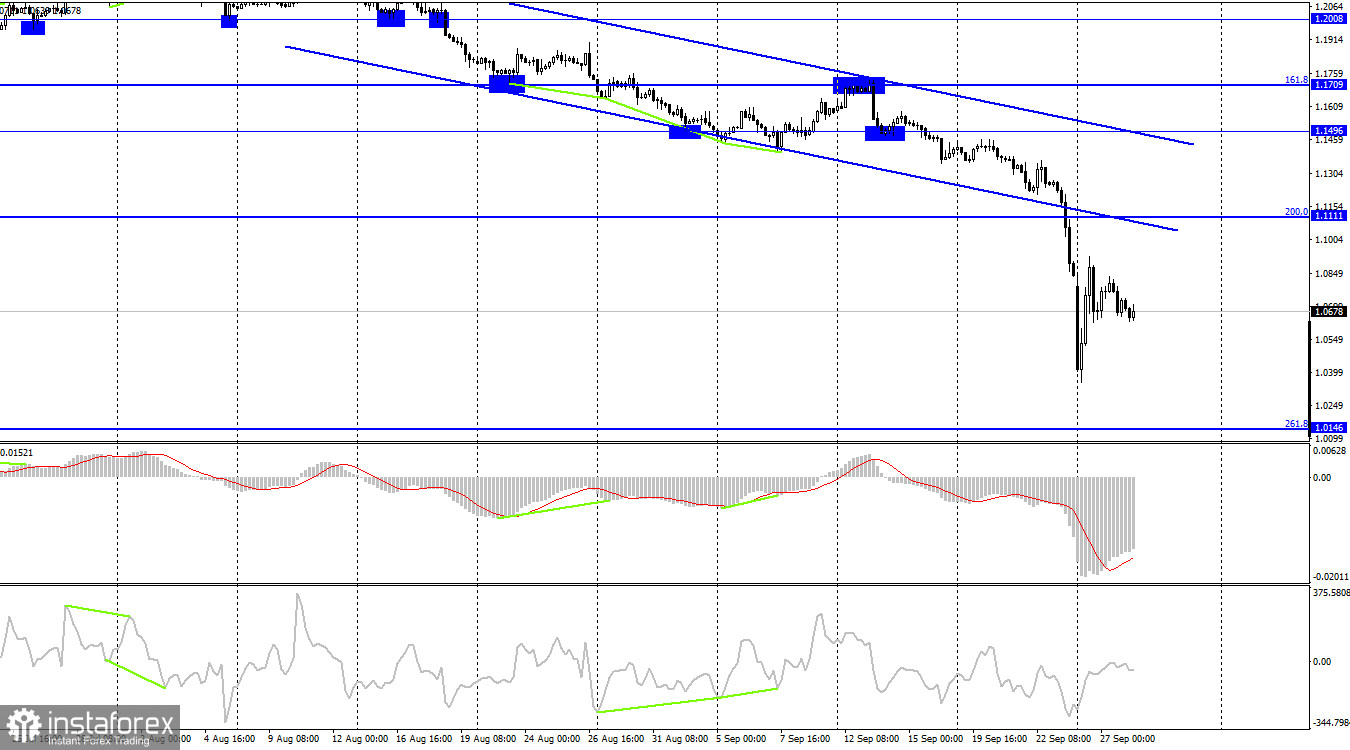

On the 4-hour chart, the pair settled below the Fibonacci level of 200.0% located at 1.1111. This opens the way towards the next retracement level of 261.8% found at 1.0146. None of the indicators is showing any divergencies coming. The descending channel still indicates that the bearish sentiment prevails in the market.

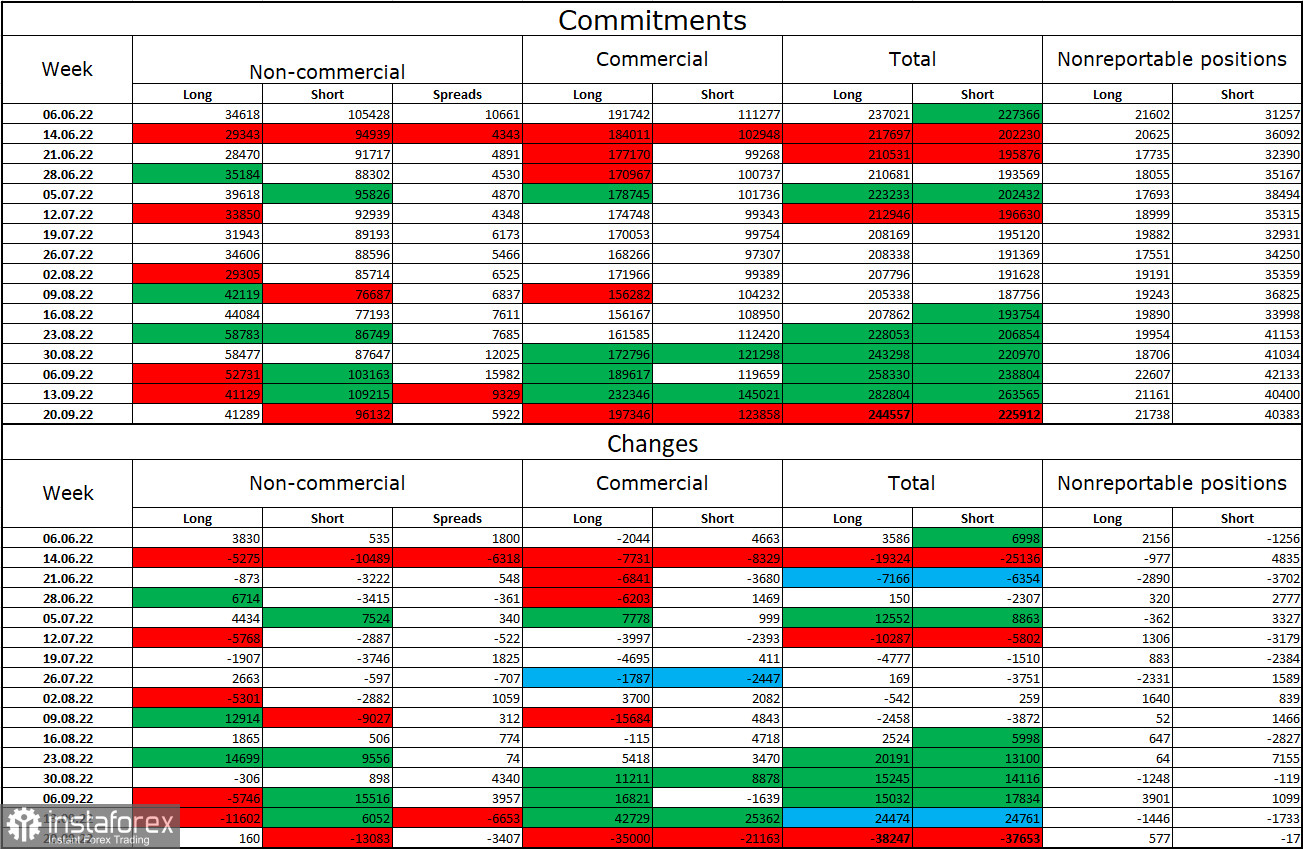

Commitments of Traders (COT) report:

Commitments of Traders (COT) report:

Last week, the non-commercial category of traders became much less bearish on the pair than the week earlier. Long contracts rose by 160 units while short contracts declined by 13,083. Yet, the overall sentiment of large market players remains bearish as the number of short contracts still outweighs the number of long ones. Looking at this report and recent events, I can say that my outlook for the British pound became even more pessimistic. Large market participants prefer to sell the pound even though their sentiment has been slowly changing towards bullish in recent months. However, we can see that the number of short positions is increasing even though this tendency is not reflected in COT reports. Meanwhile, the pound is rapidly losing ground, so the change in the market trend will take a lot of time. It is not even clear when this process will start. Amid the current information background, the pound may slide forever.

Economic calendar for US and UK:

US - Fed Chair Jerome Powell speaks (14-15 UTC).

There is only one important event on Wednesday that can provide even more support to the US dollar that is already gaining weight day to day. The impact of the information background may be moderate on Wednesday.

GBP/USD forecast and trading tips:

I would recommend selling the pair when the price closes below the level of 1.1496 on H4 with the targets located at 1.1111, 1.1000, and 1.0729. All these targets have already been tested. New short positions can be opened with the target at 1.0355 as the price has closed below the level of 1.0729. Buying the pair is not recommended at this point.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română