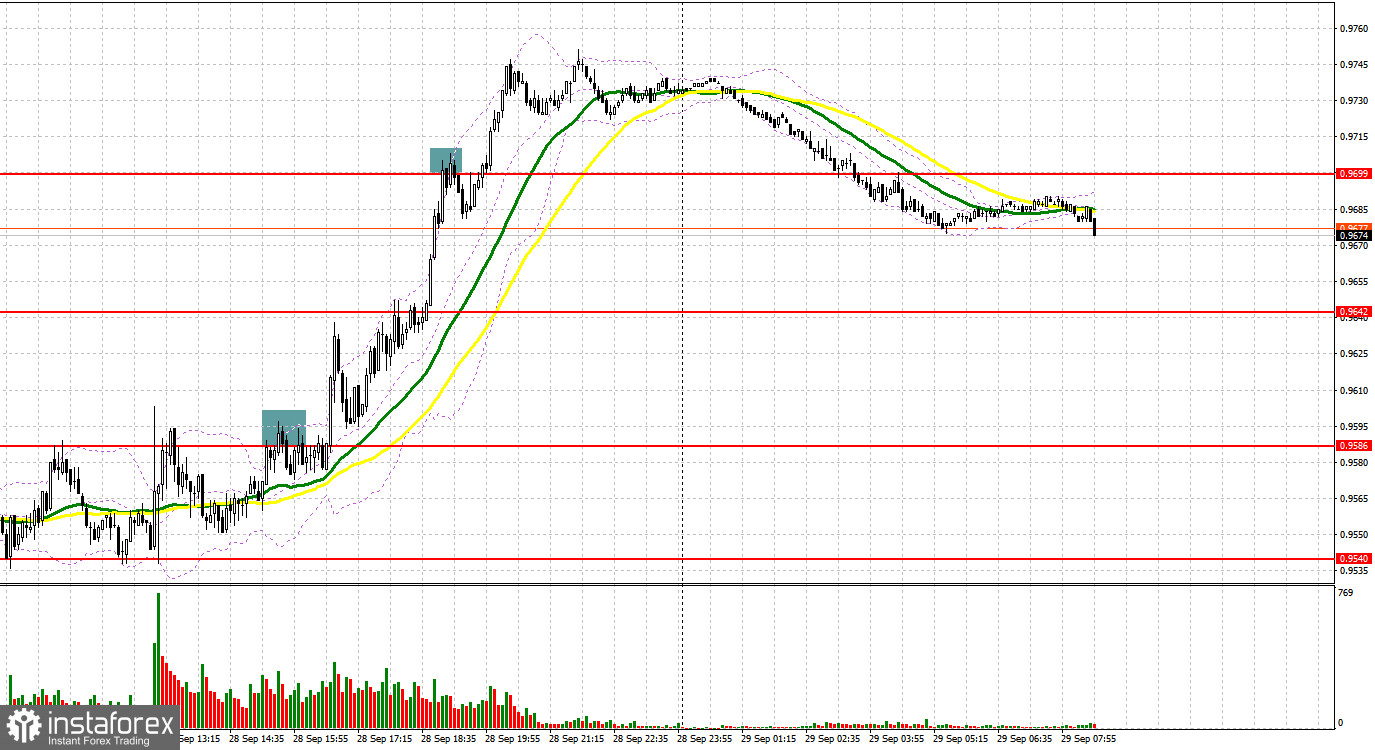

Several market entry signals were formed yesterday. Let's take a look at the 5-minute chart and see what happened. I paid attention to the 0.9556 level in my morning forecast and advised making decisions on entering the market there. The German data was ignored and the bulls' return above 0.9556 at the beginning of the European session occurred without a normal reverse test, after which the level was smeared. The bears tried to protect 0.9586 in the afternoon and even formed a sell signal, but it never came to a major downward move. Only a false breakout in the area of 0.9699, to which the euro rose amid weak statistics on the US, made it possible to get an entry point for short positions. But even there the downward correction did not exceed 15 points.

When to go long on EUR/USD:

Another series of speeches and interviews by representatives of the European Central Bank is expected today. Little depends on their statements, since the central bank's strategy is clear and understandable to everyone, especially after ECB President Christine Lagarde yesterday once again confirmed her hawkish attitude towards future policy. ECB Executive Board Member Fabio Panetta and ECB Vice President Luis de Guindos are speaking today. Much more interesting will be the data on the indicator of consumer confidence in the euro area, which is likely to decline over the reporting period, which will put even more pressure on the euro. The increase in the consumer price index in Germany in September this year, on the contrary, may trigger the euro's growth, as this will mean a direct increase in interest rates in the future. In case the pair goes down, only a false breakout in the area of 0.9646 creates a new buy signal. There are also moving averages, playing on the bulls' side. The target of the upward correction in this case will be the level of 0.9695, which was formed following the results of today's Asian session. A breakthrough and test from top to bottom of this range, along with strong statistics from Germany, could hit the stops of speculative bears, forming an additional signal to open long positions with the possibility of a surge up to this week's high at 0.9745. A more distant target will be resistance at 0.9807, where I recommend taking profits.

In case EUR/USD falls, which is more likely, and the bulls are not active at 0.9646, the pressure on the pair will increase, which will lead to the continuation of the bearish trend. Strong US statistics will help push the euro to new yearly lows. In this case, the best decision to open long positions would be a false breakout around 0.9596. I advise you to buy EUR/USD immediately on a rebound only from 0.9540, or even lower - in the region of 0.9490, counting on an upward correction of 30-35 points within the day.

When to go short on EUR/USD:

The bears missed the market, but in the current situation it is hardly possible to say that the situation has stabilized. Demand for risky assets in the face of growing geopolitical tensions will continue to be limited, and the prospects for the European economy will certainly not add confidence to investors in the next six months of the year. The bears' initial task is to protect the intermediate resistance at 0.9695. Forming a false breakout at this level will provide an excellent entry point for short positions, and weak data from Germany will allow for a sharper movement of the pair down to the 0.9646 area. A breakdown and consolidation below with a reverse test from the bottom up of this range creates another sell signal with the removal of bulls' stop orders and a larger fall to the 0.9596 area. A more distant target will be the area of 0.9540, where I recommend taking profits.

If EUR/USD jumps during the European session, and there are no bears at 0.9695, the demand for the euro will return, which will lead to a more powerful upward correction. In this case, I advise you not to rush into short positions. The growth of EUR/USD will give a chance to test the resistance of 0.9745. In this scenario, I recommend opening shorts only if a false breakout is formed. You can sell EUR/USD immediately for a rebound from the high of 0.9807, or even higher - from 0.9853, counting on a downward correction of 30-35 points.

COT report:

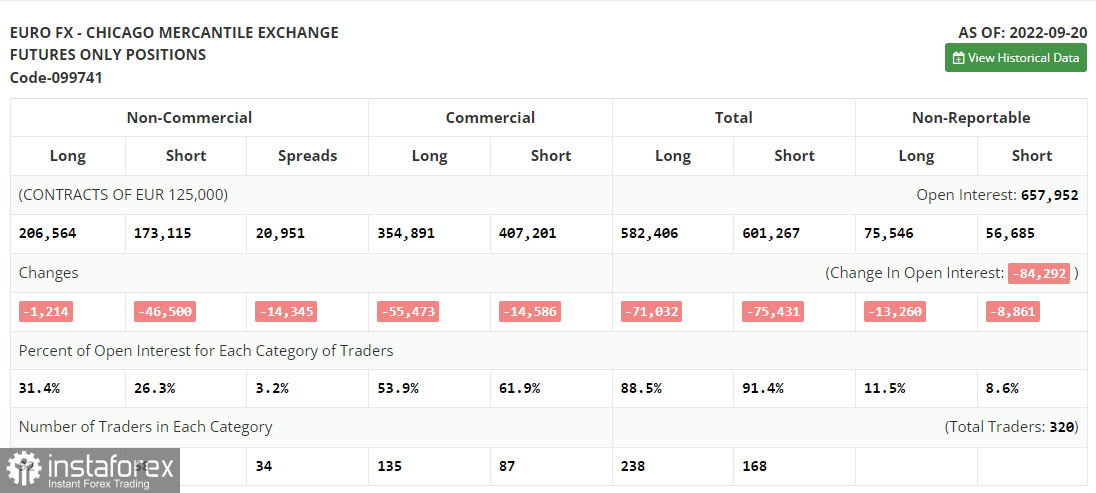

The Commitment of Traders (COT report) for September 20 logged a decline in both short and long positions. These data already take into account the September meeting of the European Central Bank and a sharp increase in interest rates immediately by 0.75%, which affected the alignment of positions. However, it must be understood that these data do not take into account the Federal Reserve's recent meeting, which made a similar decision, which kept the gap between central banks' interest rates, increasing pressure on the euro. And in general: everything that is happening now with the eurozone economy is clearly reflected in the euro's rate, which has already fallen to the level of 0.95 and is not going to recover yet. The deterioration of the geopolitical situation in the world, which to a greater extent concerns the eurozone, will greatly slow down the European economy in the autumn-winter period and will surely lead it to recession in the spring of next year. It is not yet possible to talk about medium-term growth prospects for the euro. Even if bad fundamental data comes out in the US, and they will, it will not help the euro especially, as investors will still give preference to safe-haven assets and the US dollar. The COT report indicates that long non-commercial positions decreased by 1,214 to the level of 206,564, while short non-commercial positions fell immediately by 46,500 to the level of 173,115. At the end of the week, the total non-commercial net position became positive and increased from -11,832 to 33,449. This indicates that investors are taking advantage of the moment and continue to buy cheap euros below parity, as well as accumulate long positions, counting on the end of the crisis and the pair's recovery in the long term. The weekly closing price increased and amounted to 1.0035 against 0.9980.

Indicator signals:

Moving averages

Trading is conducted above the 30 and 50-day moving averages, which leaves bulls a chance for a correction.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of growth, the upper border of the indicator in the area of 0.9790 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română