German inflation surprised. All components of the latest report came out in the green zone, despite the rather bold forecasts of most experts. However, the real results exceeded the expected ones. And despite the fact that de facto this report, in my opinion, has a limited impact (amid the latest statements by the European Central Bank representatives), it still allowed EUR/USD bulls to organize a correction in the area of the 97th figure. This is primarily due to the fact that annual inflation has overcome the psychologically significant 10 percent mark. Moreover, this level was overcome by both the main and the basic consumer price index.

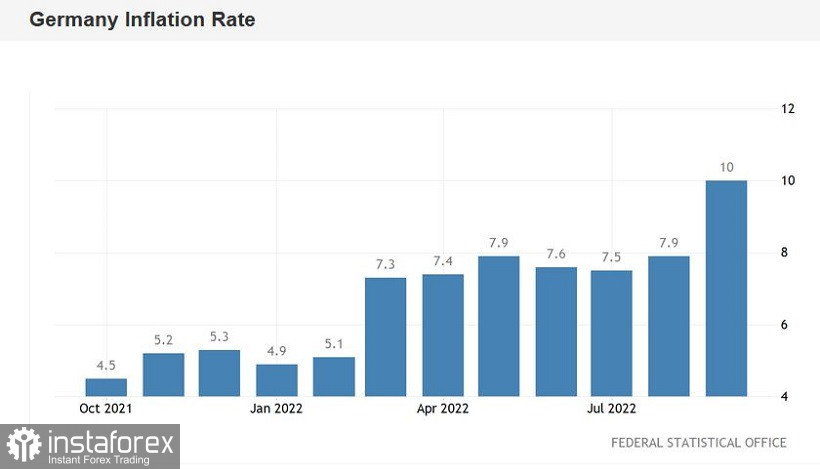

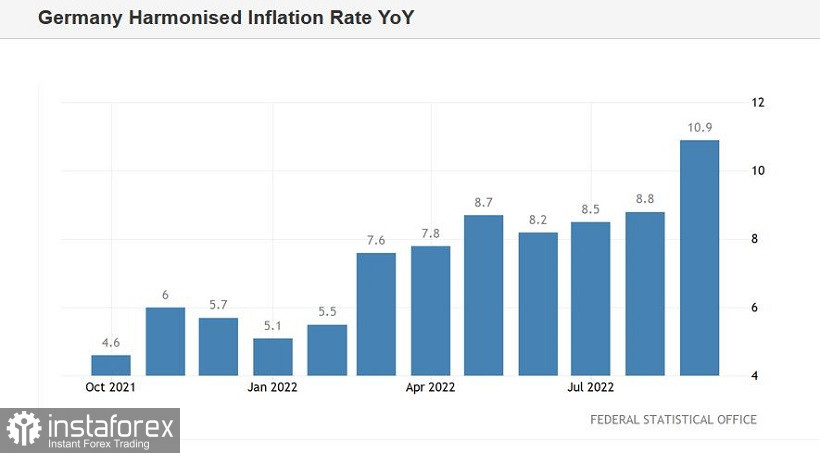

Thus, on a monthly basis, the overall CPI continued its upward trend in September, rising to the level of 1.9% (with growth forecast to 1.5%). On an annualized basis, positive dynamics was also recorded: the index is consistently growing and has reached the level of 10.0% with a forecast of growth to 9.4%. For comparison, it can be noted that an increase of 7.9% was recorded in August. The regional reports of the German CPI reflected the widespread acceleration of inflation indicators in annual terms. The harmonized consumer price index also showed a record strong result – both monthly (2.2%) and annual (10.9%).

These are long-term records. According to statistics, the last time double-digit inflation in Germany was recorded 71 years ago, when the country was recovering after World War II. So, in the 4th quarter of 1951, it was 11%.

To date, the increase in inflation in Germany (and in Europe as a whole) is taking place amid the worsening energy crisis. A sharp increase in the cost of gas has led to an equally sharp rise in energy prices and a large-scale decline in the purchasing power of Europeans. The structure of the latest release suggests that the cost of energy in Germany increased by almost 44% year-on-year (for comparison, the indicator increased by 35% in August), and food - by almost 19% (in August, an increase of 16.6% was recorded).

In other words, German inflation really surprised with record strong figures, which became a harbinger of the growth of pan-European inflation. According to preliminary forecasts, the overall consumer price index in the eurozone should rise to 9.7%, and the core index to 4.7%. But taking into account the dynamics of German inflation, it can be assumed that the annual pan-European inflation rate will also reach the 10% mark.

Given this disposition, legitimate questions arise: will there be a corresponding reaction to the published figures from the ECB? Can the euro count on the ECB's support? And in the end: isn't it risky to go into EUR/USD shorts amid record growth in European inflation?

In my opinion, the ECB reacted to the yet unpublished releases, so to speak, "ahead of time". Earlier this week, representatives of the ECB noticeably tightened their rhetoric: some of them directly called for raising the interest rate in October by 75 points. Others have made it clear that they will support such an initiative. The distinguished hawks are Peter Kazimir, Olli Rehn, Madis Muller and Robert Holzmann. While the ECB representative Gediminas Simkus said that a 50-point rate hike in October is a "guaranteed minimum." The head of the Bundesbank, Joachim Nagel, did not talk about specific values, but at the same time said that in his opinion, the ECB needs "a decisive increase in rates." ECB President Christine Lagarde, and her deputy, Luis de Guindos, voiced more "streamlined" rhetoric, noting that "the number and size of increases will be determined by incoming macroeconomic data."

But in general, if we summarize all the theses voiced by ECB representatives, we can conclude that the central bank will raise the interest rate by either 50 or 75 basis points at the October meeting. An abrupt increase in German inflation, and a similar increase in pan-European inflation, will obviously tip the scales in favor of the second option. But this scenario has already been largely taken into account in prices, amid increasing hawkish rhetoric from representatives of the ECB.

Thus, a record increase in inflation in Germany, as well as a possible 10% increase in pan-European inflation, will not be able to reverse the downward trend of EUR/USD. First of all, because the ECB members will not jump "above the ceiling" – the option of a 100-point hike is not even discussed. Moreover, according to Mario Centeno, a member of the Board of Governors of the central bank, a faster rate hike "than is justified" may lead to "the opposite results." It can be assumed that Centeno's position is shared by some of his other colleagues.

Therefore, European inflation releases, in my opinion, will provide only short-term support for the euro.

Also, do not forget that the most important release for dollar pairs will be published on Friday – the main index of personal consumption expenditures (PCE). This is the most important inflation indicator that is monitored by members of the Fed. According to preliminary forecasts, Friday's report will reflect a further increase in inflation in the United States. The basic price index of personal consumption expenditures should rise to 4.8% (y/y) after a slight decline. But if it also overcomes the psychologically important 5% target, the dollar will receive significant support throughout the market.

To date, it is advisable to take a wait-and-see position for the EUR/USD pair - until the upward corrective momentum fades away. Traders reacted too emotionally to the German inflation report, and perhaps they will react in a similar way to the pan-European release (which will be published 3.5 hours before the release of the PCE index). In conditions of such "emotional instability", it is best to stay out of the market, at least until the release of the US inflation report.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română