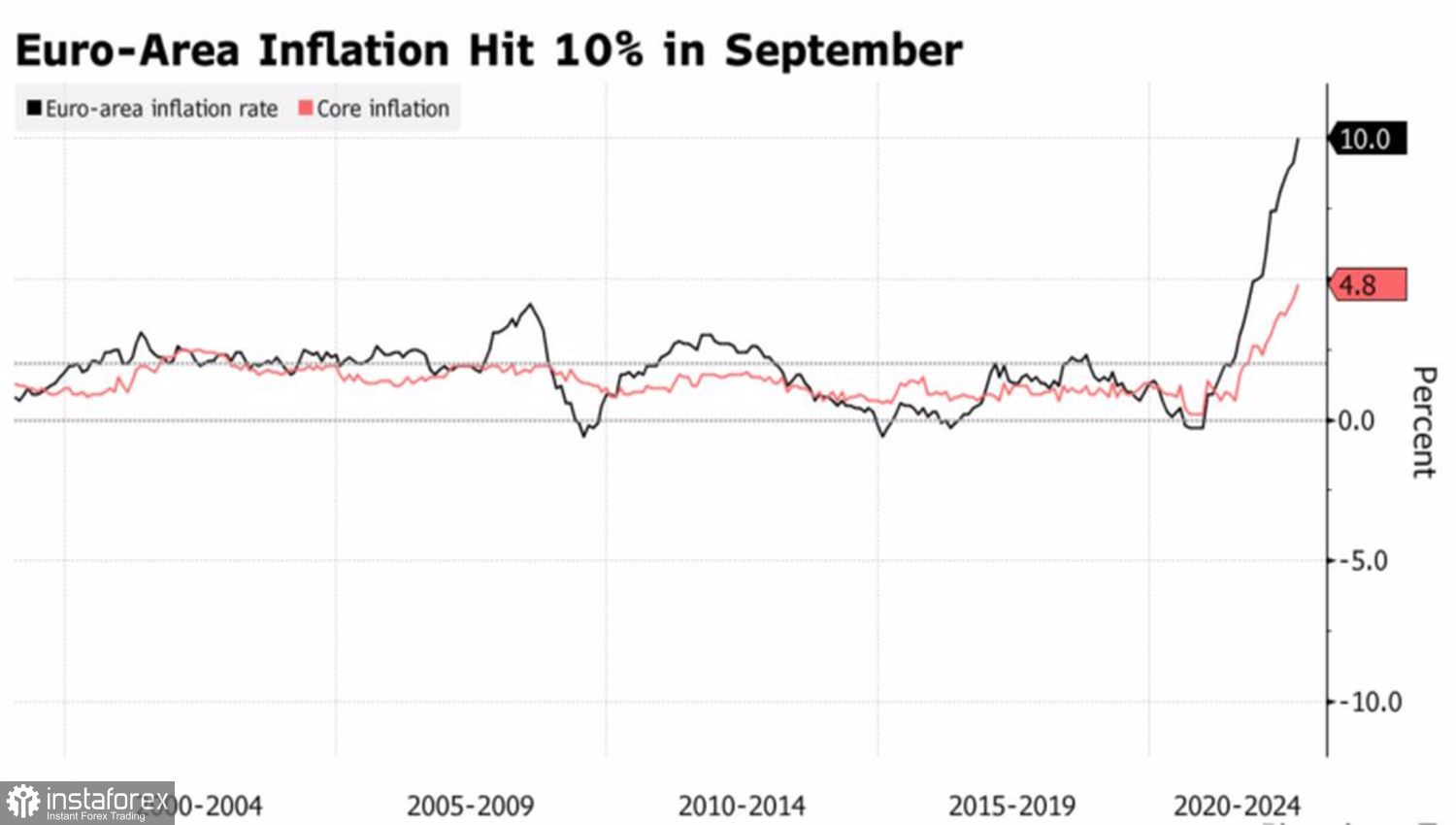

History is repeating. Just as in the case with the release of the August inflation data, the EUR/USD pair was initially confidently going up and then stumbling down. Nothing changed in September. Speculators played back the principle "buy a rumor, sell a fact" and the acceleration of consumer prices in the Eurozone to 10%, which is higher than the Bloomberg experts' consensus forecast of 9.7%, allowed them to lock in profits. No one really wants to go push the pair up. Everyone is well aware of how this may end.

Inflation in the EU is likely to stay near 10% for several months in a row. After that, it may decline. To anchor inflation expectations, the ECB should act here and now. Not surprisingly, Governing Council officials spoke about tightening monetary policy.

EU inflation rate

Christine Lagarde said that rates would be increased in the next few meetings. Even though economic activity will slow significantly. She did not elaborate on the monetary restriction but her colleagues were less restrained. The heads of central banks in Lithuania, Latvia, Slovenia, Slovakia, and Austria did not just talk about increased borrowing costs but gave a specific figure of 75 bps. At this rate and level of inflation, the deposit rate could easily go up to 3%. However, this is unlikely to save the EUR/USD pair.

The Bank of England triggered the September correction in the euro. Its decision to suspend the quantitative easing program knocked down a rally in bond yields around the world and strengthened the British pound. The latter was followed by other European currencies on the pullback. However, is it a sign that the turmoil in the UK financial markets is over? When monetary policy aims to curb demand and fiscal policy aims to stimulate it, troubles await around the corner.

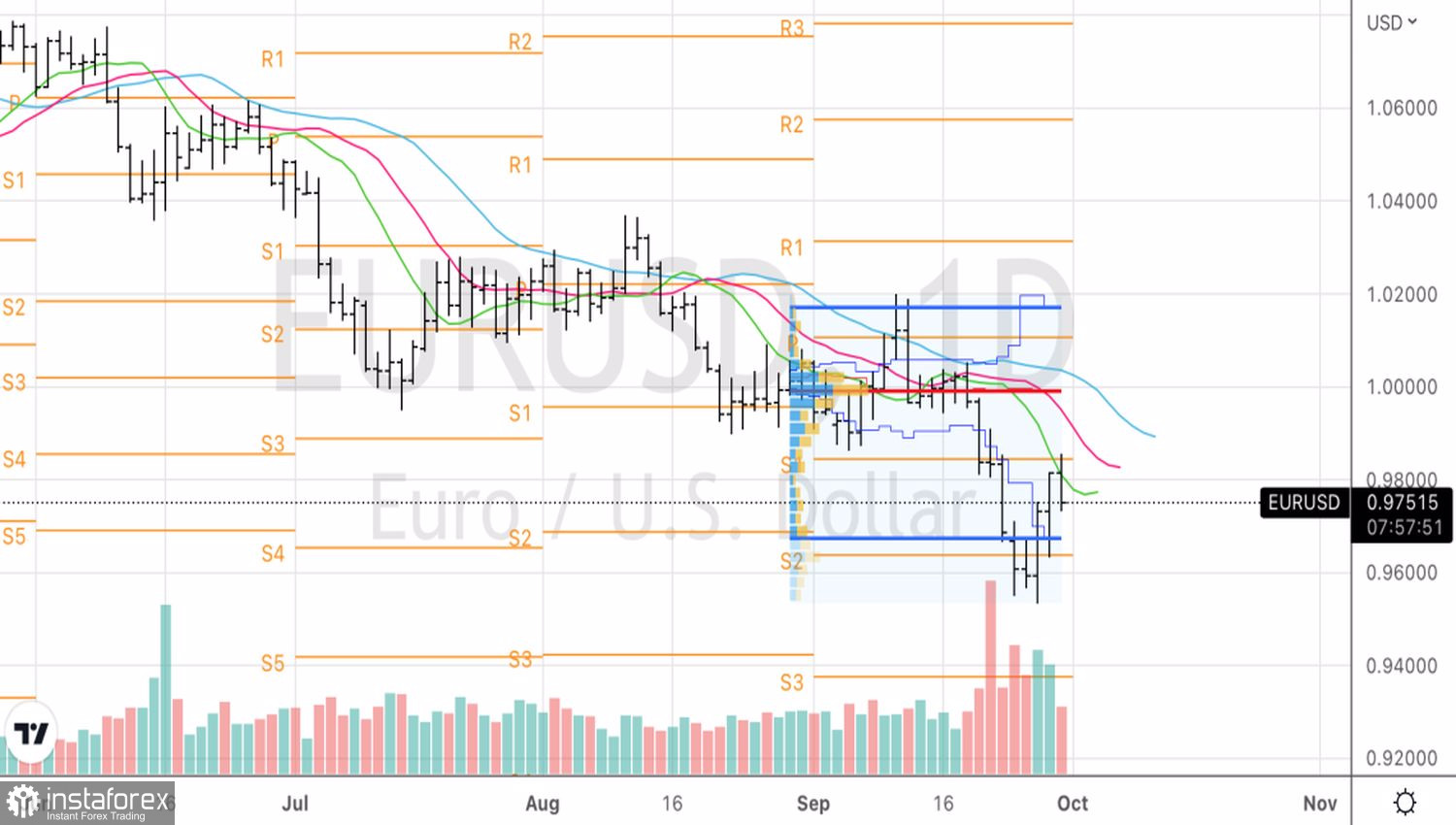

The Bank of England is unlikely to reverse the rally in US Treasury yields, while sellers of these securities are encouraged by the idea of raising the federal funds rate above 5%. The best-case scenario would be a stabilization, which would result in the euro/dollar pair consolidation in the range of 0.9600-0.9850. If the US debt rates restore the uptrend, the major currency pair may reach new 20-year lows.

Although the euro managed to show some resilience, the situation on Forex has not changed much. The US dollar is still getting support due to increased demand for safe-haven assets amid a collapse in the US stock market, a strong economy, and aggressive actions from the Fed.

Technically, on the EURUSD daily chart, bulls failed to push the price to the pivot level at 0.9850 with the subsequent closing below the green moving average. This indicates their weakness and increases the risks of the downtrend recovery. As for now, it would be better to sell the euro.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română