The EUR/USD pair could not decide on the vector of its movement amid a contradictory fundamental picture. On the one hand, there is a record increase in European inflation, on the other hand, there is an increase in the PCE index, the most important inflation indicator for the Federal Reserve. On the one hand – the strengthening of hawkish rhetoric from the European Central Bank, on the other hand – the hawkish results of the Fed September meeting. Such contradictions do not allow EUR/USD bears to develop a downward trend. Bulls, in turn, were unable to organize a corrective counterattack. The pair updated the weekly high on Friday, but did not hold its positions. In a few hours, the price dropped by more than a hundred points. Plus, there is the Friday factor, which also plays a role in the situation.

In other words, if we talk about intraday trading on Friday, then the pair is actually marking time here. But if we consider the situation in a wider time range, then here we can observe the usual corrective pullback after a sharp decline to a 20-year price low, to the level of 0.9540. European inflation reports have only increased interest in short-term long positions on the EUR/USD pair. But looking ahead, it should be noted that long positions still looked risky: there were no grounds for a trend reversal. Therefore, it was advisable to stay out of the market until the correction is completed.

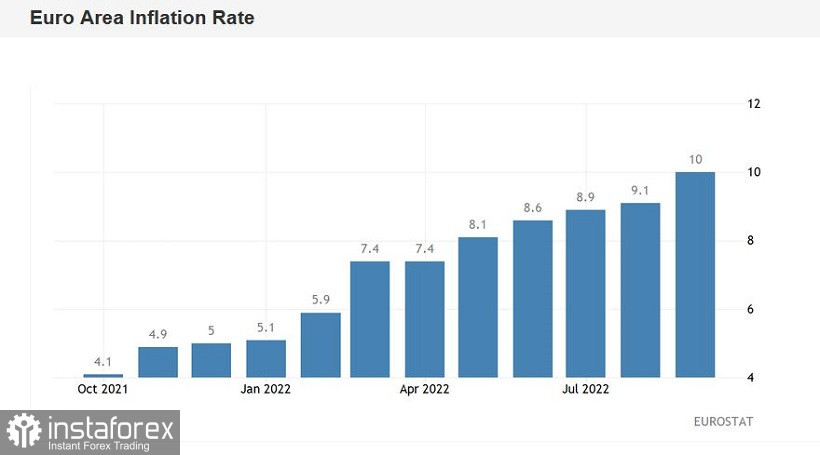

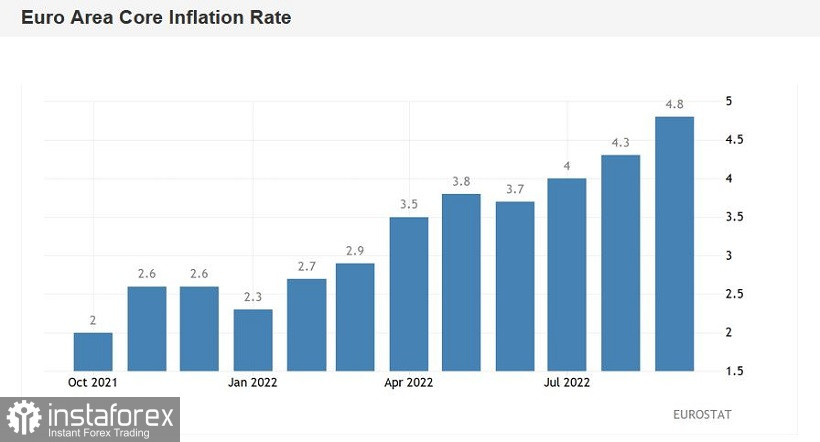

So, this week, key data on inflation growth in the main EU countries and in the eurozone as a whole were published. Almost all reports were in the green zone, reflecting the increasing price pressure in the European region. In particular, the overall consumer price index in the eurozone has again updated its historical record, reaching a target of 10.0% in September (with a forecast of growth to 9.7%). The core inflation index, excluding volatile energy and food prices, rose to 4.8% (with growth forecast to 4.7%).

The structure of the release suggests that the most significant contribution to the growth of European inflation was made by energy prices, which increased by 40.8% in September, compared with 38.6% in August. Next are food, alcohol and tobacco, which have risen in price by almost 12% this month (in August, an increase of 10.6% was recorded). Non-energy industrial goods increased in price by 5.6% (against 5.1% in August), and services rose by 4.3% (in August, the increase was 3.8%).

It is worth emphasizing separately that inflation in the eurozone has reached double digits for the first time in history. This fact is rather symbolic, but still it played a role in the context of the upward pullback of EUR/USD.

In Germany, inflation also reached double digits (10.8%) in annual terms – for the first time in 71 years. In the Netherlands, prices rose by 17.1%, which is the highest since the Second World War. The most significant increase in prices in percentage terms was observed in the Baltic States: in Estonia, annual inflation was 24.2%, in Latvia - 22.4%, in Lithuania - 22.5%.

A record increase in inflation in the eurozone allowed the euro-dollar pair to adjust to the area of the 98th figure. But the latest inflation report on the growth of PCE (one of the main inflation indicators monitored by the Fed) offset the ambitions of EUR/USD bulls regarding the development of a large-scale upward counteroffensive to the level of parity. The release reflected the acceleration of the growth of this most important inflation indicator for the Fed. Moreover, now we can talk about a renewed trend. On an annualized basis, the basic price index of personal consumption expenditures has updated a multi-month high. The indicator came out at 4.9% - this is the strongest result since April of this year.

The report plays an important role, especially amid fluctuations of some experts and members of the Fed, who recently reported that at the December meeting the US central bank will decide whether to raise the rate by 50 points or increase it again by 75 basis points. As for the November meeting, the situation looks more definite here: even before the release of the PCE index, the majority of economists surveyed by Reuters said that the 75-point scenario was highly likely to be implemented.

Thus, hawkish expectations regarding the Fed's further actions will only increase in the near future. As for the ECB, the rhetoric has also tightened here, but even before the release of inflation data. Earlier this week, many representatives of the ECB said that at the October meeting it was necessary to consider the option of a 75-point hike. Therefore, this fundamental factor has already been largely taken into account in prices.

Also, we must not forget that the euro is under pressure from other factors. Geopolitical tensions, the energy crisis, the risk of stagflation – all these circumstances play against the single currency. The dollar, in turn, acts as a beneficiary of the current situation, acting as a protective asset.

All this suggests that in the medium term, short positions on the EUR/USD pair will be relevant again. Longs, in my opinion, a priori look risky, given the vulnerability of the euro. The first, and so far the main bearish target is the 0.9690 mark. This price level corresponds to the lower line of the Bollinger Bands indicator on H4, which coincides with the Kijun-sen line.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română