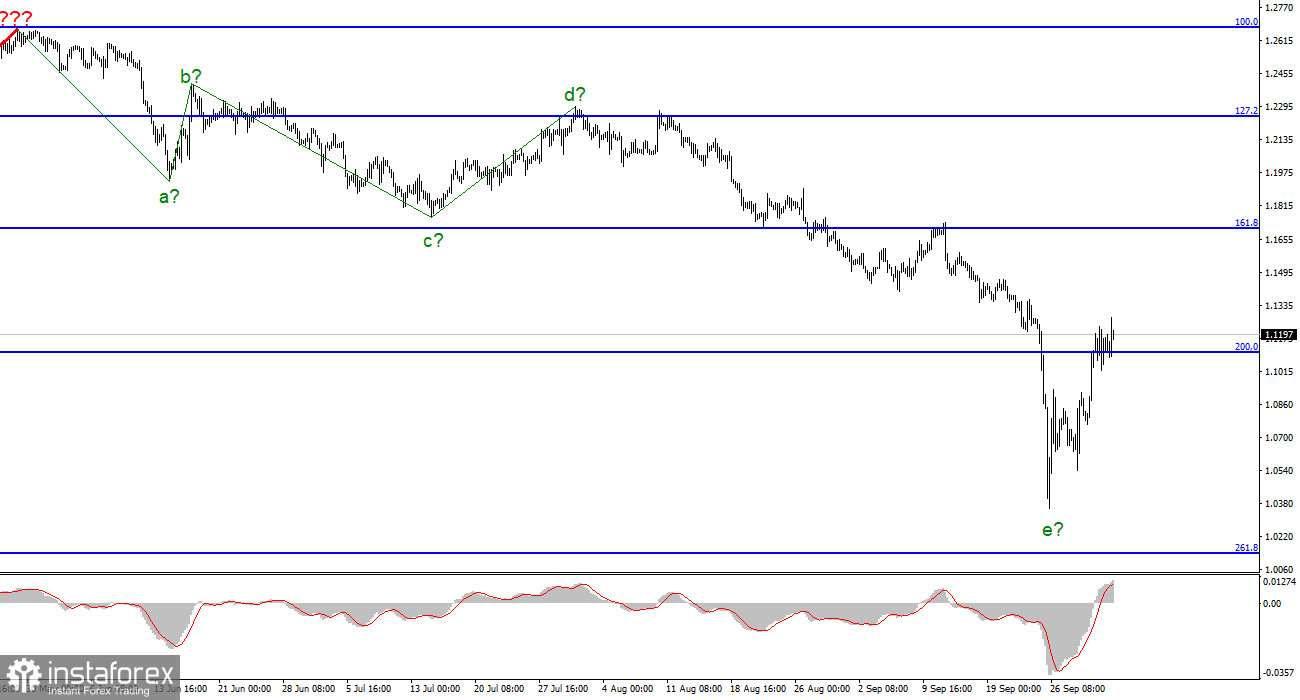

For the pound/dollar pair, the wave marking looks complicated at the moment. However, it remains unchanged. The upward wave, which was built between May 13 and May 27, does not fit into the overall wave pattern. It can still be considered corrective as part of the downtrend section. It appears the downtrend sections is still being built. At the moment waves a, b, c, and d have been completed. It means that the pair is inside wave e. This wave could also have completed its construction at the start of last week. Nevertheless, it is hard to say whether the entire downward section has been completed. The instrument may build a three-wave upward correction pattern or even one wave and then resume the decline. Both downward sections for the pound sterling and the euro may extend. Both instruments continue to move with almost no corrective structures. Therefore, we need to try to separate impulsive structures and focus on them.

UK government to make changes to its new tax curs initiative

The pound/dollar pair grew by 20 basis points on October 3. This morning, demand for the British currency rose sharply, which was quite logical. The pound sterling has been climbing steadily over the past week. However, last Monday many traders were puzzled by a 300 pip price change. Traders wondered why it occurred. The reason is simple. Last week, GBP slumped because of Liz Truss's plan to cut taxes in the UK. It was announced by Chancellor of the Exchequer Kwasi Kwarteng. However, after that, the pound sterling had been rising for a week. So, last Friday it was impossible to say exactly how traders reacted to the news about possible tax cuts.

Many analysts believe that this step may lead to devastating consequences. There were also those who were quite optimistic. The UK economy is widely expected to slide into a recession, BoE Governor Andrew Bailey said a few months ago. The regulator will continue to raise the key rate to cap soaring inflation and avoid a drop in the standard of living, mass layoffs, and a decline in industrial production. Tax cuts for households may help them cope with 2-3 times increased energy bills. The US government could also subsidize and limit electricity prices. Today, the US authorities announced they would not reduce taxes for households whose income is above £150,000 a year. Earlier, it was planned to make a 40% tax cut but this proposal was severely criticized in parliament. Nevertheless, some taxes will be slightly reduced but not earlier than next year.

Conclusion

The wave pattern of the pound/dollar pair suggests a further decline. It is better to sell the instrument on the MACD downward reversals. It is recommended to open short positions more cautiously. Despite a strong drop, the construction of a downtrend section may be completed in the near future. The target level of this section is located at 1.0140, which corresponds to the Fibonacci level of 261.8%. However, there may be a correction wave.

At larger timeframes, the pattern is very similar to the euro/dollar instrument. We can see the same upward sections, which do not fit in the current wave pattern. There are also the same five downward waves. Thus, the downtrend section continues its construction and may be of almost any length.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română