The European currency last week showed at least some kind of craving for life. The demand for it has been falling for more than a year, and the whole downward section of the trend has been complicated many times. The current news background, including geopolitical news, does not allow the market to look "into a bright European future," and the demand for the EU currency remains quite low. However, it could have been higher, as the ECB stopped doing nothing and started raising the interest rate. Faced with a fair amount of criticism in the summer, the European regulator has already raised the rate twice by 125 basis points. The ECB president said several times that the rate would continue to grow at the two remaining meetings at a high pace. It may take up to five meetings for the rate to rise to a "restrictive level," at which the economy will slow down, and inflation will fall. On Monday, the President of the Central Bank of Lithuania, Gediminas Simkus, said that he expects a rate increase of at least 50 points in October. He noted that "the inflationary threat is intensifying, and a rise of 50 points is the minimum possible scenario of the ECB." Earlier, the President of the Central Bank of Latvia, Martins Kazaks, said he was ready to support a 75% rate increase. The current levels of inflation and unemployment, and consumer demand will be considered when deciding.

Let me remind you that the Fed is also actively raising its rates simultaneously and will not abandon its plans at the next meeting. Therefore, both rates are already rising at this time, but the American one is much higher, which could be one of the reasons for the high demand for the dollar in recent months. If the market reacts to the ECB and Fed rates in this way, then the situation will not change in the next few months since the ECB will not be able to catch up with the Fed quickly. The European regulator began to raise its rate only a few months after the start of a similar procedure by the Fed. Consequently, he is at least several months behind schedule. In such conditions, the demand for the European currency may remain low for several months. The key moment for the euro currency will be the end of the tightening monetary policy cycle in the United States, but it will have to wait a long time.

Meanwhile, inflation in the EU continues to grow. Last week, it became known about the growth of the consumer price index to 10%. Based on the new acceleration in consumer prices, I assume that the ECB rate will rise again by 75 basis points. The decision of the regulator may cause an increase in demand for the euro currency. Still, since the meeting will not take place in the coming days, in any case, we will have to wait for some time during which the euro currency needs to hold at least those positions that were achieved last week. But even with this task, the market may be unable to cope.

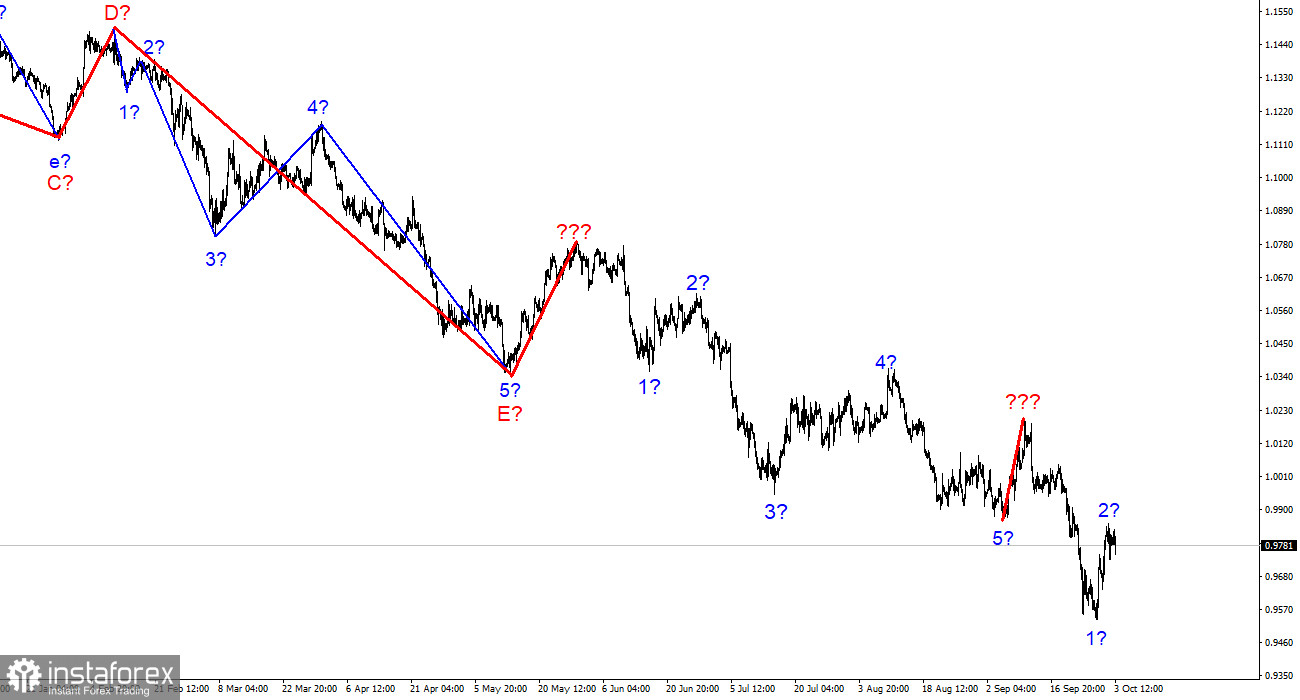

Based on the analysis, I conclude that the construction of the downward trend section continues but can end at any time. At this time, the tool can build a corrective wave, so I advise selling with targets near the estimated 0.9397 mark, which equals 423.6% by Fibonacci, by the MACD reversal "down," since this wave (if corrective) can end very quickly. I urge caution, as it is unclear how long the general decline in the euro currency will continue.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română