The dollar is the real star of the last year and a half. However, now the picture is developing in such a way that this star may fall. How realistic are such forecasts and what are they connected with?

The technical reversal pattern "Shooting Star" appears on the weekly chart of the dollar index. The unstoppable greenback for the first time in a long time shows such a clear configuration for the decline. Is the exchange rate still going to fall and the 114.00 mark is a certain ceiling for the growth of the index?

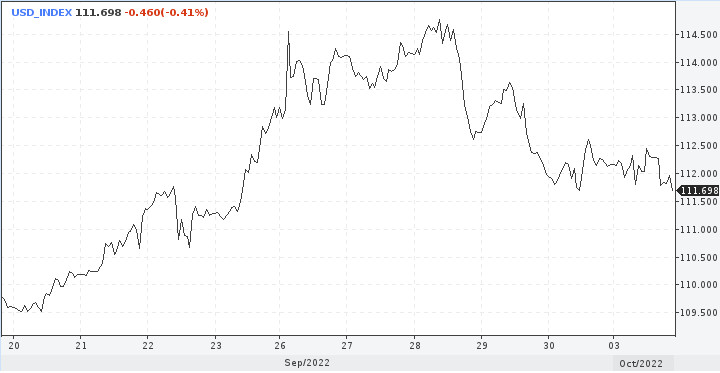

Since August, the dollar started from 104.5 points and reached a height of 114.7 points. Last week, the dollar closed at 112.1, leaving behind the height and plans to break through the value of 115.00. The new week opened lower than 112.00 points.

What do we see now? Extreme levels seem to be over, but bulls are also not going to give up just like that. So far, the indicator has found strong support around 111.50. You need to observe the direction from this mark. If the greenback develops a wave of recovery, then in the short term it will be able to return to the highest levels of this year, broken at the end of September - 114.7.

Prospects for further appreciation will remain unchanged as long as the index trades above 107.20.

A key US employment report should play its role in positioning the dollar. Analysts at Wells Fargo are predicting another significant wage increase of 275,000, above the market consensus of 250,000.

Meanwhile, the number of non-farm payrolls rose by 315,000 last month, with industrial employment gains back across the board. Despite the increase, the data still speaks of a decline, given the 402,000 that were recorded in the previous three months. Nevertheless, this is a good result.

For example, in the 2010s, the number of jobs in the non-agricultural sector grew by an average of 167,000 per month. Therefore, a new significant increase in the number of employees will be positive for the Federal Reserve, which is trying to improve the demand and supply of labor.

How deep can the dollar correction be?

Dollar correction does not just happen, usually something follows. The current downward descent is more like a pause, since the main drivers for the dollar's growth have not gone away, but, on the contrary, should increase even more. The Fed's toughness has not gone away, although on Monday investors again began to hope that the slowdown in the US and global economies will force the Fed to stop raising the rate.

Geopolitical tensions are in force, pushing investors to buy protective assets, as well as recession risks in leading countries, inflation and the weakness of the European economy.

Everything is good for the dollar, but there is one "but". Strong and continuing its ascent, the American began to strongly irritate other world central banks. It drives up the price of imports too much. Loans are becoming more and more expensive, most of which are in dollars. It's all at the wrong time.

It means a lot that the Bank of Japan started to snap. In September, it intervened to support the national currency. The inherent English stiffness and calmness was violated by the British central bank. The sharp drop in the pound and talk of parity made the British stir.

To calm the panic in the markets, the Bank of England announced the purchase of long-term bonds. The goals were partially achieved. The GBP/USD pair managed to return to the 1.1200 mark.

The euro also pulled up, as European Central Bank President Christine Lagarde became generous with even tougher rhetoric to beat inflation.

All this speaks of one thing - the rejection of the strongest rally in the dollar. This has already happened in history - in 1985. As a result, an agreement was concluded between Great Britain, France, Germany, Japan and, importantly, with the United States. This means that the countries did not oppose, but supported coordinated measures to weaken the dollar.

Now it would be appropriate to assume that the rally of the US currency will slow down. The upward trend will certainly continue, but there will no longer be fundamentally new sky-high cosmic heights.

Correction of the dollar index is likely to continue with the target of 110.00-109.8. A new high near 115.00 will be the strongest and most unreachable resistance level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română