Australia's central bank made an unexpected move and lifted the interest rate by just 0.25% to 2.60% instead of the expected rise of 0.50% to 2.85%. The regulator indicated its intention to continue the streak of rate hikes

At its recent policy meeting, the Reserve Bank of Australia raised the key interest rate to 2.6%, its highest level in the past 9 years. This was the sixth consecutive rate increase in the past few months. According to Philip Lowe, the head of the central bank, such a moderate increase was enough considering the previous big rate hikes.

Against this backdrop, the Australian dollar depreciated against its American counterpart although the decline was minor. The policy of the regulator hasn't changed much and simply displayed a slight slowdown in the pace of monetary tightening. So, where will the Aussie move next given the overall market situation?

Since stock and commodities markets have somewhat stabilized, commodities and stock indices are very likely to rebound in the near term. Obviously, investors understand that markets have been largely oversold lately. A prolonged period of sell-offs might be followed by a demand recovery. An important signal of a shift in the market sentiment is a rapid drop in US Treasury yields that came after their purchases surged. Thus, the benchmark 10-year Treasury fell to 3.621% from 3.816% on Monday. At the moment of writing, the 10-year government bond yield is declining by 0.71% to 3.625%. Besides, a decisive rise in European and American stock futures serves as additional proof that the market sentiment is changing. This may also mark a positive shift in the European stock market.

As global markets are getting more optimistic, all currencies trading against the US dollar may start to recover slightly. The Australian dollar is very sensitive to any changes in risk sentiment, just like the euro. This means that AUD is set to appreciate further against USD. Even a lower-than-expected rise in the key rate is unlikely to stop the uptrend.

It is difficult to predict whether this optimistic sentiment will persist. A lot will depend on the US jobs report that is due on Friday. One thing is clear: markets will be recovering from a recent massive sell-off.

Daily forecast:

AUD/USD

The pair is approaching the resistance level of 0.6520. Its breakout may pave the way for the upside target of 0.6580.

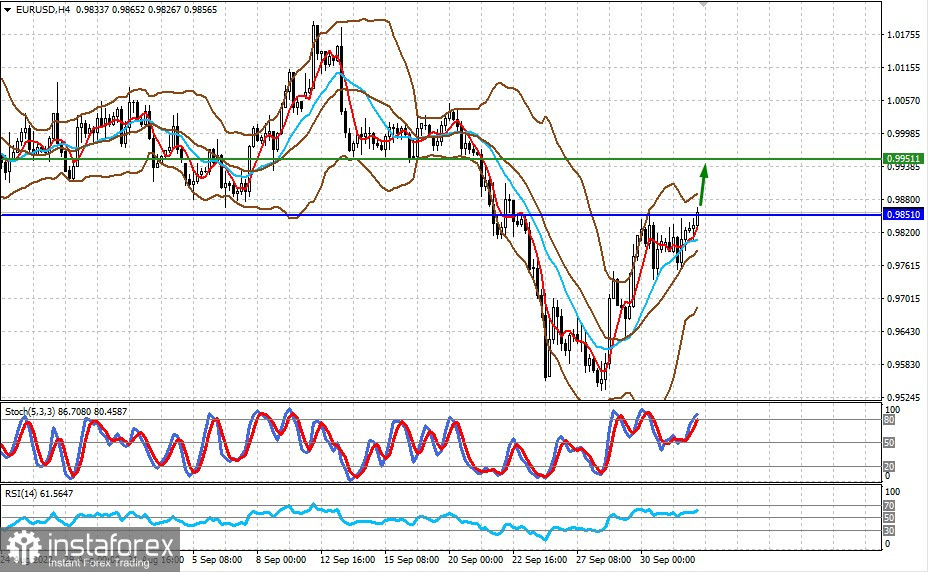

EUR/USD

The pair has hit the resistance level of 0.9850. A break above this range supported by the overall positive sentiment in the market may push the price higher to 0.9950.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română