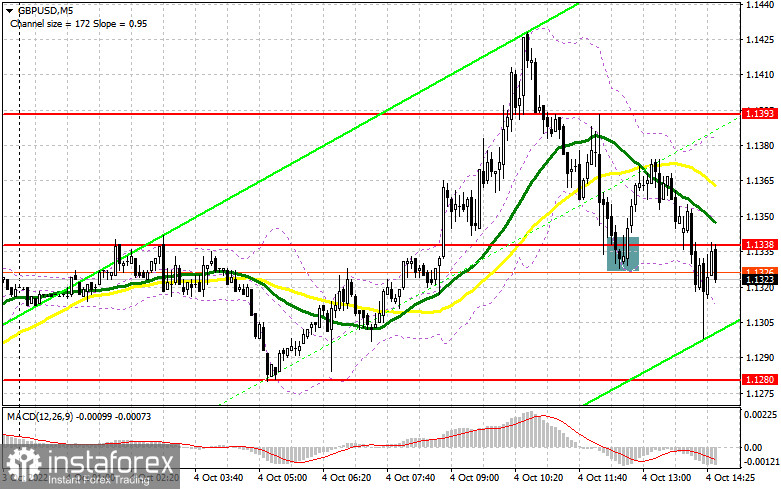

In my morning forecast, I paid attention to the 1.1338 level and recommended making decisions on entering the market from it. Let's look at the 5-minute chart and figure out what happened. After a slight Asian correction, buyers of the pound returned to the market, counting on more global support from the Bank of England. The breakthrough of 1.1338 occurred without a reverse test from top to bottom - literally, a few points were missing. This did not allow you to enter into purchases immediately. After returning to this level closer to the middle of the day, a false breakdown led to a buy signal, as a result of which the pair recovered by more than 35 points. In the afternoon, the technical picture was completely revised.

To open long positions on GBP/USD, you need:

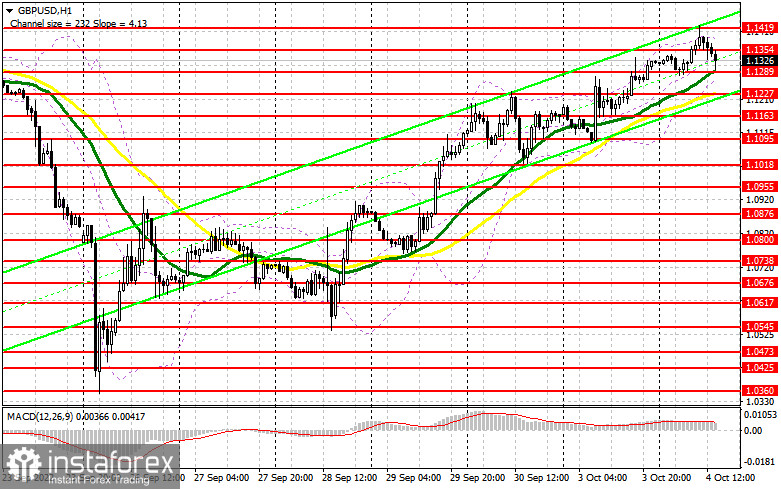

The statements of the American representatives of the Federal Reserve System will have little effect on the British pound, so optimism about the prospects for further recovery of the pair may continue in the afternoon. Despite this, you must be very careful with purchases at current highs. In the case of hawkish statements by FOMC members Loretta Mester and John Williams, the pair may adjust downwards: this is where the big players must show themselves. The optimal scenario for buying will be the formation of a false breakdown in the area of 1.1289, where the moving averages are playing on the buyers' side. This will give an excellent entry point to return to the 1.1354 level formed at the end of the first half of the day. Only after getting above this range will it be possible to talk about building a further upward correction for the pair to move to 1.1419 – a new maximum this week. It will become more difficult for buyers to control the market there. A more distant target will be the 1.1495 area, leading to a fairly large market capitulation of sellers. I recommend fixing profits there. If the GBP/USD falls against the background of hawkish statements by representatives of the Federal Reserve System and the absence of buyers at 1.1289, the pressure on the pound will return. If this happens, I recommend postponing long positions to 1.1227. I advise you to buy there only on a false breakdown. It is possible to open long positions on GBP/USD immediately for a rebound from 1.1163, or around the minimum of 1.1095, with the aim of correction of 30-35 points within a day.

To open short positions on GBP/USD, you need:

Protecting the nearest resistance of 1.1354 remains almost the most important task for the second half of the day. Only the formation of a false breakdown at this level will return pressure on the pound and give a chance for a larger downward correction with a breakdown of today's lows in the area of 1.1289. A breakthrough and a reverse test from the bottom up of this range will determine the entry point for sale with a fall to a minimum of 1.1227. Still, a much more interesting target will be the area of 1.1163, where the lower boundary of the ascending price channel from September 28 passes. With the option of GBP/USD growth and the absence of bears at 1.1354, the situation will return to the control of buyers, which will lead to an update of the weekly maximum of 1.1419. Only a false breakout at this level forms an entry point into short positions in the expectation of a downward correction. If there is no activity, there may be a jerk up to the maximum of 1.1495. I advise you to sell GBP/USD immediately for a rebound, counting on the pair's rebound down by 30-35 points within a day.

Signals of indicators:

Moving Averages

Trading is conducted above the 30 and 50-day moving averages, indicating the bulls' attempt to build a correction.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of growth, the upper limit of the indicator around 1.1400 will act as resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

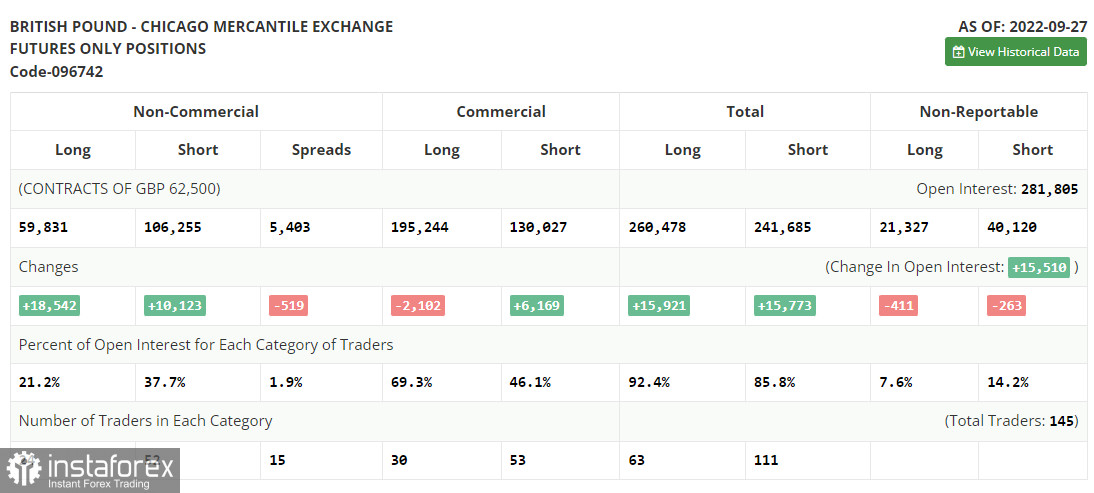

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română