Demand for US stock indices still persists today. Futures on US indices continue to rise as investors have bet on the end of monetary policy tightening at the end of this year. Against this backdrop, the US dollar is retreating, giving risky assets a chance to recover.

Futures on the high-tech Nasdaq 100 jumped more than 2.1% and futures on the S&P 500 rose by 1.7%, signaling a rally in the markets for the second day in a row. European stock indices also had their best day since June. Two-year Treasury bond yields fell below 4% and oil rose on expectations that OPEC+ will cut production substantially.

Investors are digesting weaker-than-expected fundamental data in the US that supports the Federal Reserve's dovish stance after interest rate hikes of more than 3 bps began to affect the economy. Money markets are expecting the federal funds rate to be at 4.5% by March 2023. There are also growing talks that the global wave of disruptive monetary tightening is coming to an end, especially after the Reserve Bank of Australia raised rates by half as much as expected.

The rational approach outlined by the RBA does not suggest further rate cuts but it does provide an opportunity to abandon a more aggressive policy. This implies stronger bullish sentiment in bond markets and should provide some support to stock markets if other central banks follow suit.

As I noted above, the futures market expects the Fed to raise rates by 125 basis points by March, up from the 165 points expected after the third three-quarter point hike last month. The revised expectation triggered a rise in Treasuries and a strengthening of risky assets. The 10-year bond rate fell by 5 basis points and the two-year bond yield fell by as much as 12 basis points to 3.99%.

The rejection of the UK's tax cut plan has calmed investors' nerves about the government's financial health, although doubts about the currency's prospects remain.

West Texas Intermediate crude oil climbed above $84 a barrel, jumping more than 5% on Monday and continuing its strong gains today. The Organization of Petroleum Exporting Countries and its other members, including Russia, are expected to consider cutting production by more than 1 million barrels a day at a meeting Wednesday.

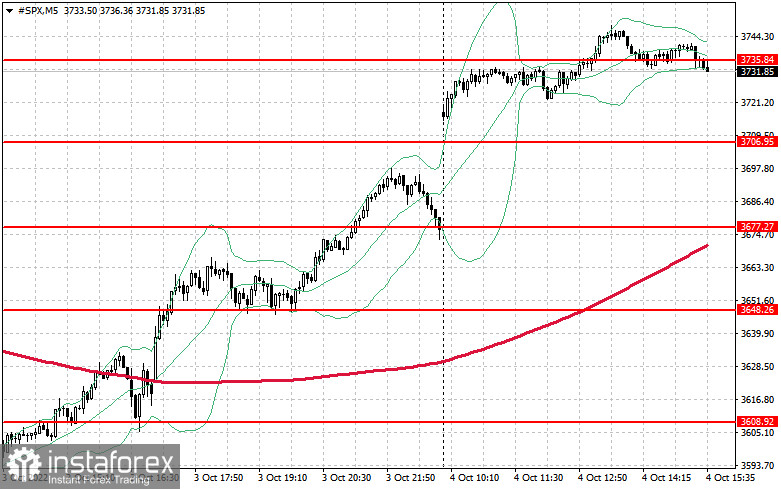

As for the technical picture of the S&P500, after yesterday's rise, the demand for the index persists. Bulls have already regained the level of $3,735 and are counting on another pullback to $3,773, which will leave hope for a further upward correction. Bulls need to stay above $3,735 to start it. After that, it will be possible to count on a breakthrough to the area of $3,773. If the price pierces this range, it may give a new upward momentum aimed at the resistance of $3,801. The next target is in the area of $3,835. If the trading instrument declines, bears should break through $3,706. It will quickly push the trading instrument to $3,677 and $3,648, opening the way to the support of $3,608. Below that range, you can bet on a larger sell-off in the index to the low of $3,579, where the pressure might ease a bit.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română