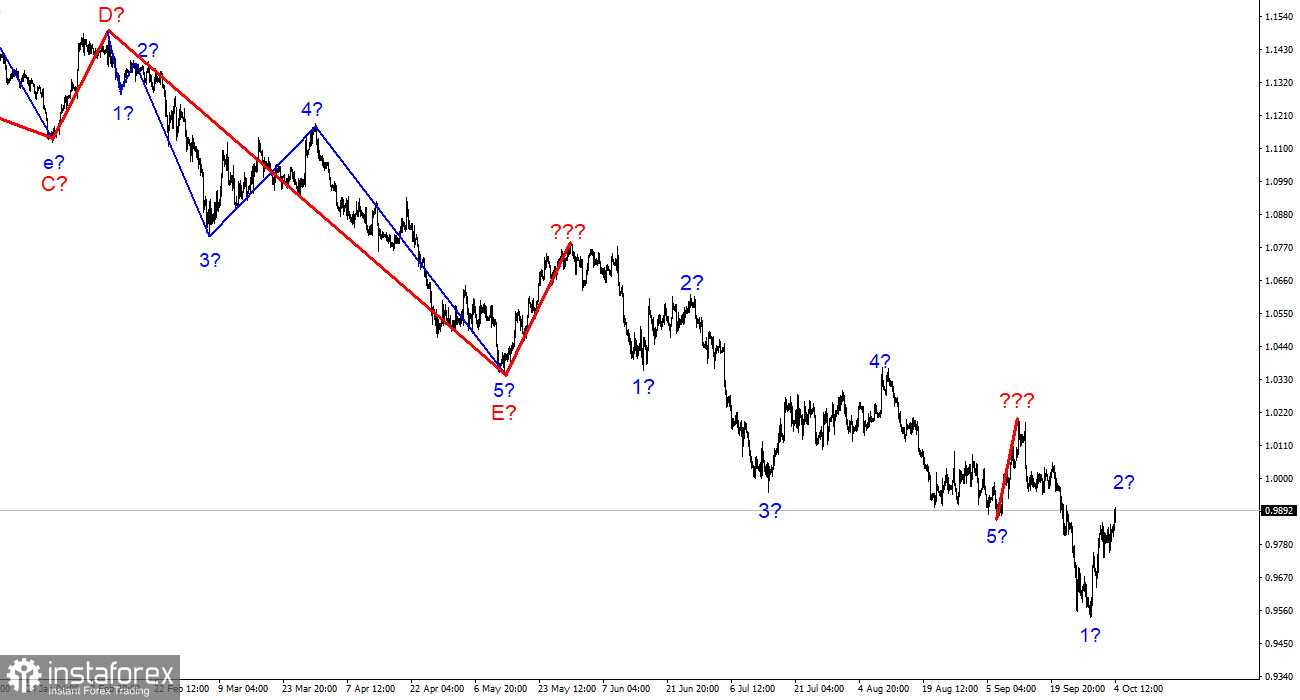

The wave marking of the 4-hour chart for the euro/dollar instrument still does not require adjustments, but it is undoubtedly becoming more complicated. It may become more complicated than once. We saw the completion of the construction of the next five-wave pulse descending wave structure, then one correction wave upward, after which the low wave 5 was updated. These movements allow me to conclude that the pattern of five months ago was repeated when the 5-wave structure down was completed in the same way, one wave up, and we saw five more waves down. There is no question of any classical wave structure (5 trend waves, 3 correction waves) right now. The news background is such that the market even builds single corrective waves with great reluctance. Thus, in such circumstances, I cannot predict the end of the downward trend segment. We can still observe for a very long time the picture of "a strong wave down - a weak corrective wave up." The goals of the downward trend segment, which has been complicated and lengthened many times, can be located up to 90 figures or even lower. A corrective wave 2 of a new downward trend section can be built at this time.

Demand for the euro may grow after Lagarde's speech

The euro/dollar instrument rose by 65 basis points on Tuesday and continues to recover after numerous downward waves. Nevertheless, at the moment, the quotes of the instrument could not even go beyond the peak of the last wave. And the euro currency will have to rise at least 300 more points to complete this step. Let me remind you that one of the simplest ways to determine the completion of a trend segment is to go beyond the peak or low of the last wave. If the quotes rise above the peak of September 12, I will start considering the option of ending the downward trend section. Without this, the entire wave marking can acquire an extended descending form.

Today, I recommend everyone to pay attention to the speech of ECB President Christine Lagarde. It will start at 15-00 Central European time, and I await the "hawkish" rhetoric. It should be remembered that the rhetoric of central banks now depends entirely on a single indicator of inflation. If inflation continues to rise, the regulator has no choice but to continue promising to raise the rate in the future. In the European Union, the latest inflation rate was 10%. That is, the consumer price index continues to grow. Therefore, the ECB should expect a powerful new rate hike at the next meeting. And from Christine Lagarde, we should expect words about rising inflation and the need to continue to fight it. If earlier the market paid almost no attention to such statements, now, when the demand for the euro is growing, they can help to continue this growth. If those analysts who believe that the downward section of the trend is over are right, then the demand for the euro will now grow despite the further increase in the Fed rate.

General conclusions

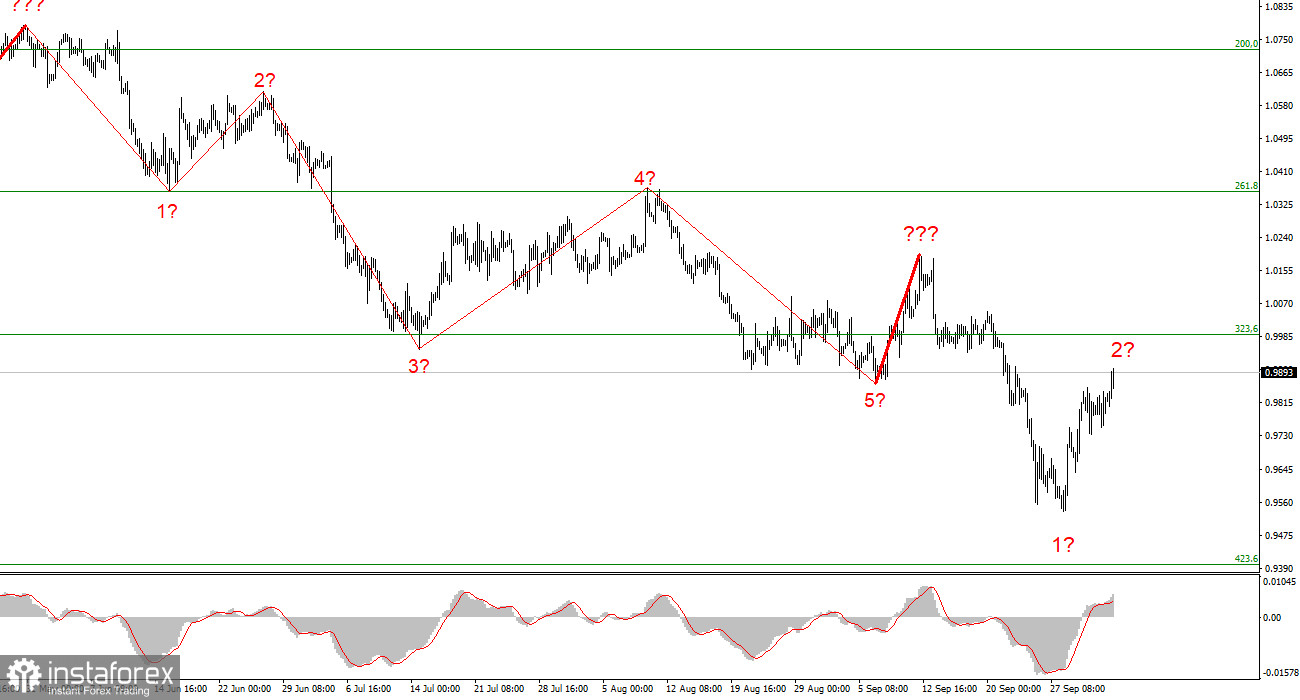

Based on the analysis, I conclude that the construction of the downward trend section continues but can end at any time. At this time, the tool can build a corrective wave, so I advise selling with targets near the estimated 0.9397 mark, equivalent to 423.6% Fibonacci, according to the MACD reversal "down." I urge caution, as it is unclear how much longer the decline of the euro currency will continue.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate three- and five-wave standard structures from the overall picture and work on them. One of these five–waves can be just completed, and a new one has begun its construction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română