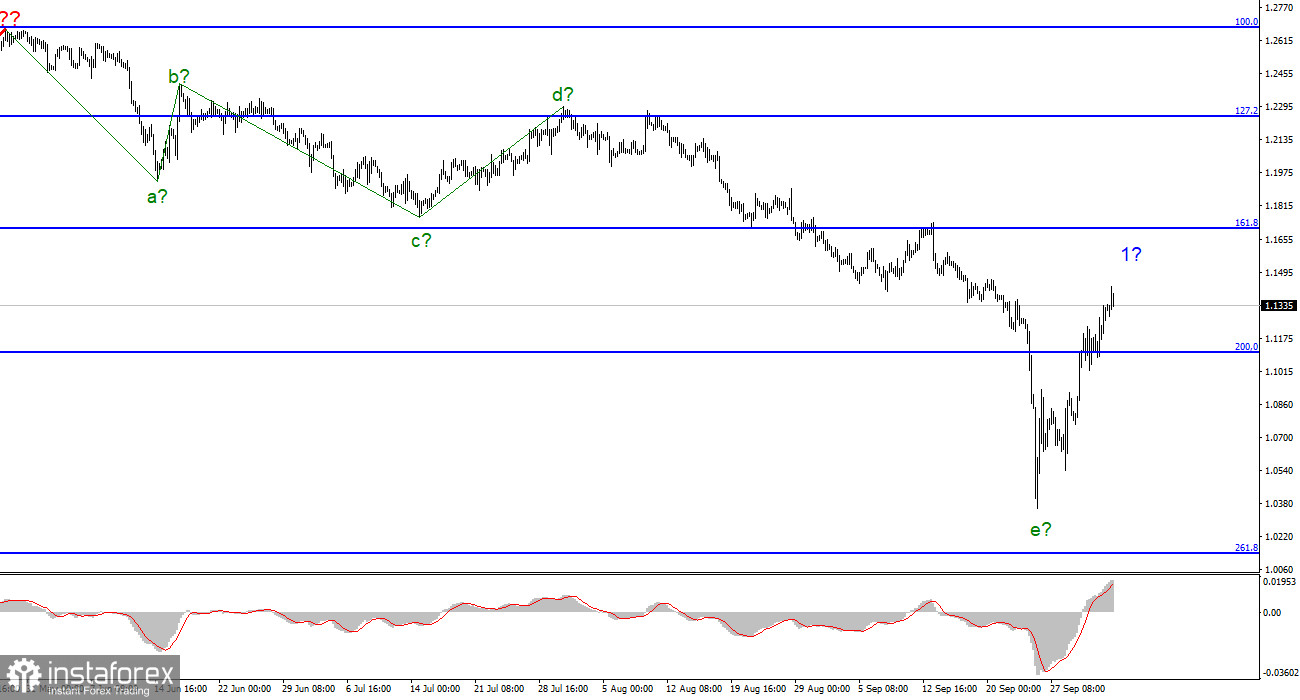

For the pound/dollar instrument, the wave marking looks quite complicated at the moment but still does not require any clarification. We have a supposedly completed downward trend segment consisting of five waves a-b-c-d-e. If this is the case, the increase in quotes has begun and continues within the framework of wave 1 of a new upward trend segment. Unfortunately, I have no confidence in this particular scenario since the instrument must go beyond the peak of the last wave to show us its readiness to build an upward section of the trend and not complicate the downward one once again. And the peak of the nearest wave is located at about 23 figures. Thus, even after the pound has increased by 1000 points, you need to go up another 1000 points to reach this peak. This is a very significant distance. I understand that many people have seen strong British growth in a short time, so they are "itching" to open purchases. However, let me remind you that even if the upward section has started building now, we should see another downward correction wave (after completing 1). If the quotes do not fall below the low wave e (which is very difficult but not impossible), then you can also expect to build a new upward wave 3 and buy.

The British pound has grown up quickly, but to continue to grow, you need reasons.

The exchange rate of the pound/dollar instrument increased very slightly on October 4, but at the same time, the British dollar continued to grow for more than a week, and today is not over yet. Thus, even considering the slowdown in the rate of increase, wave 1 can continue its construction. The news background should now be considered in the context of whole weeks or longer periods. Let me remind you that last Monday and the Friday preceding it, the pound quotes collapsed by 900 basis points after it became known about the initiative of the British government to lower several taxes. However, last week it became known that most taxes will not be reduced, as the government led by Liz Truss was "poorly prepared" for this plan and faced harsh criticism from the British Parliament.

Now we are talking about reducing only the most "basic" taxes. Thus, the British pound is simply rolling back from the "false start." On the news of tax cuts, it fell by 900 points, and there will be no tax cuts (of such a large scale), so the Briton has recovered to its original position. That is why I believe that the further growth of the British is not obvious. There is no news background favorable for him now. The market played back the news with the rollback of tax initiatives. After the current upward wave, at least one correction is needed. Its depth will show whether the market has moved into the stage of buying the pound or what we have seen recently is just an accident caused by a news shock.

General conclusions.

The wave pattern of the Pound/Dollar instrument suggests a continued decline in demand for the pound. I advise now selling the instrument, as before, on the MACD reversals "down." It is necessary to sell more cautiously since, despite a strong decline, a downward trend section could be constructed. If not, then the goals of this section are scattered up to the 1.0140 mark, which corresponds to 261.8% Fibonacci. There should be a decrease in any case since a corrective wave is needed.

The picture is similar to the euro/dollar instrument at the higher wave scale. The same ascending wave does not fit the current wave pattern, the same five waves down after it. The downward section of the trend can turn out to be almost any length, but it can also be completed.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română