In the last week, both the euro and the pound sterling have shown a craving for life. This is good news since the downward trend section for both instruments is already pretty tired. Both currencies have been declining in pairs with the dollar for too long. As they say, "this is too much." I cannot say that the fall of both currencies was not logical. After all, the world has long been accustomed to the fact that it is better to buy a stable dollar in any incomprehensible situation. Therefore, we can see another corrective wave with the resumption of decline for both instruments. The wave markings of both instruments have long since gone beyond the boundaries of the "classics" - five waves on the trend, three against. Thus, we can see as many waves down as we want before constructing an upward trend section begins.

Let me remind you that one of the main reasons for the increase in demand for the dollar is the Fed's monetary policy. The Fed was one of the first central banks in the world to raise the interest rate and is doing it very aggressively and systematically from meeting to meeting. However, against which the FOMC's actions are directed, inflation is in no hurry to slow down. And since many central banks of the world have declared war on it, logically, the rate should be raised until inflation is at least halfway to its target value, which, if anyone does not remember, is almost the same for everyone – 2%. In America, we saw two consecutive decelerations in the consumer price index, but the second was significantly weaker than the first. Everything speaks in favor of the fact that the rate needs to be increased several more times.

This is exactly the idea voiced by the president of the Federal Reserve Bank of New York, John Williams, on Monday. He said inflationary pressure on the economy turned out to be too stable, so the Fed should continue tightening. "The Fed's monetary policy has already begun to restrain demand in the economy and ease inflationary pressure, but our work is not done yet. I believe we still have a long way to go," Williams said. Let me remind you that when the interest rate reaches its peak, this does not mean that the Fed will immediately begin to slow it down. It will remain at a high value for some time, continue to reduce demand, and slow down inflation. And by this period, analysts also have a lot of questions. After all, every next month at high rates slows down inflation and demand, and economic growth. The longer the rates are high and "restrictive," the more the American economy will shrink. However, there is no talk of even stopping the tightening so far. Since the Fed will continue to work with the rate, the demand for the US dollar may recover. Therefore, I believe the joyful exclamations about the end of the downtrend may be premature.

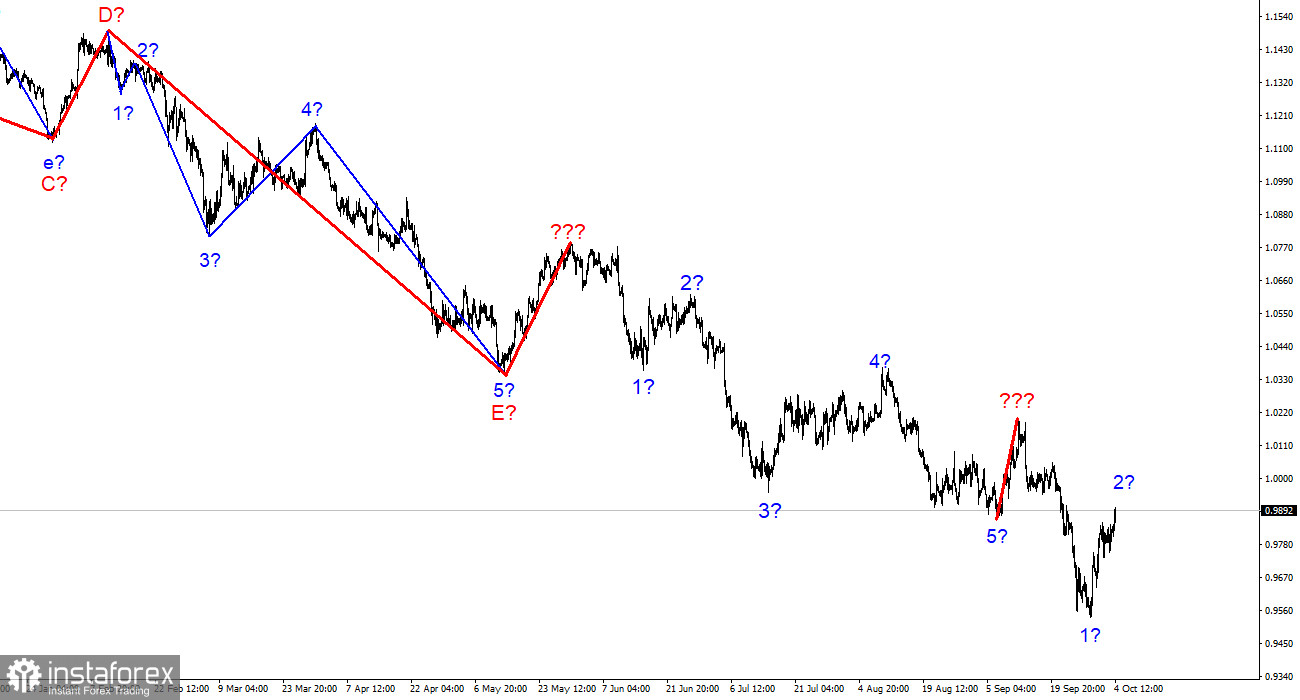

Based on the analysis, I conclude that the construction of the downward trend section continues but can end at any time. At this time, the tool can build a corrective wave, so I advise selling with targets near the estimated 0.9397 mark, which equals 423.6% Fibonacci, according to the MACD reversal "down," since this wave (if corrective) can end very quickly. I urge caution, as it is unclear how long the general decline of the euro currency will continue.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română