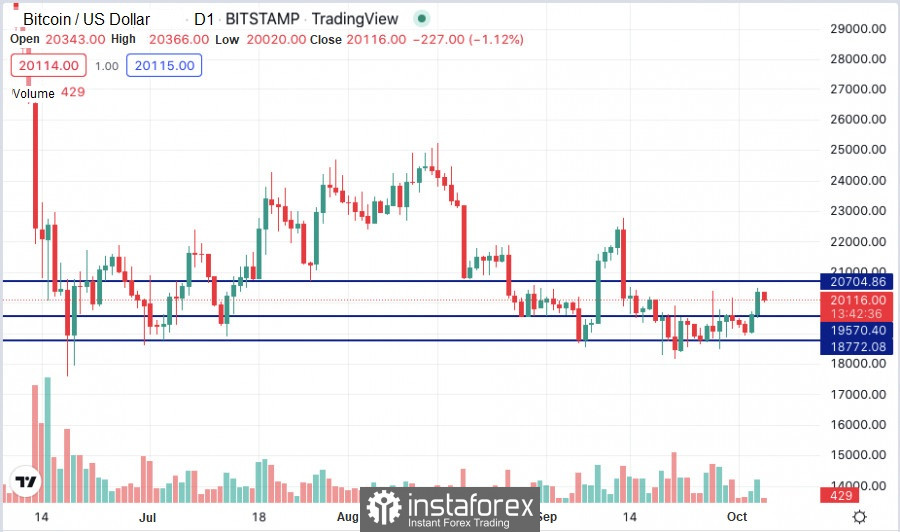

Bitcoin, having consolidated above the level of 19,600, is now facing the next local challenge—to overcome the highs of September 27. So far, BTCUSD has not succeeded, while the immediate target for growth remains the resistance of 22,700.

Meanwhile, the crypto community is discussing signs of a possible end to the capitulation of the crypto market.

Cryptocurrencies hit the bottom of a bearish cycle

Yassine Elmandjra, analyst at American investment management firm Ark Invest, argues that the cryptocurrency market is likely in the process of completing its capitulation. This conclusion is made based on the ratio of the net realized profit to the loss of Bitcoin.

The metric calculates the net profit or loss made by all coin holders. The short-term value of a bitcoin holder has fallen below its long-term value for the fourth time in history. This is another indication that the market is likely to have hit a cyclical bottom, Elmandjra said.

For now, the price of Bitcoin is stuck in a range between $19,000, the level that represents the investor's cost base, and $23,500, the 200-day moving average.

Now there is a battle between strong holders and an unfavorable macro environment. The related total capitalization of the cryptocurrency market exceeds $1 trillion.

A strong US dollar is putting pressure on world currencies and major European banks, so there is a lot of uncertainty in the markets. Moreover, the US Federal Reserve is likely to continue raising rates.

At the same time, the main cryptocurrency continues to benefit from strong holder behavior. The supply of long-term holders rose to 71.5% of the total outstanding supply.

Elmandjra notes that the decision of either party will have a major impact on Bitcoin price behavior in the medium term. According to the analyst, the miner capitulation also appears to be complete as the hash rate compression period has ended.

Threat of liquidation cascade on BTC derivatives

According to open interest (OI) data from CryptoQuant, the BTC derivatives market may be poised for a liquidation cascade. The analysis shows that if the price of BTC deviates far enough from current levels, traders who work with long or short futures may encounter some difficulties.

The blockchain and crypto market analysis platform highlights that the concern is due to the fact that OI has been rising since BTC reached its approximate bottom of $17,500 in June.

Since then, the price of the main cryptocurrency has ranged from a high of $22,000 to a low of $18,000, preventing mass liquidations from occurring. There were only three significant hourly liquidations, one of which occurred on the same day that $5.8 million worth of BTC short liquidations were recorded. However, this may change if the price moves outside this range.

The analyst writes:

"Recently, the price has fluctuated too much for these large liquidations to occur. That's something to keep an eye on."

As OI builds up, there is the possibility of a liquidation cascade (for both short and long positions) if the price deviates far enough from this range.

BTC futures continue to be stable

Currently, there is no sharp increase in liquidations in the futures market. According to Coinglass, a modest 19,780 traders have lost about $47 million as a result of liquidation in the last 24 hours. It is noteworthy that the last massive cascade of liquidations in the market was caused by a drop in prices caused by the activity of short-term holders in the market.

Bitcoin benefits from the collapse of fiat currencies

In recent weeks, it has become clear that Bitcoin can benefit from the fragility of fiat currencies. The main cryptocurrency shows good results not only in terms of price, but also trading volume.

In fact, when the British pound hit a new all-time low against the US dollar at $1.03 on September 26, BTC/GBP trading pairs on various exchanges became very active, climbing over 47,000 BTC.

Bitfinex and Bitstamp, the two cryptocurrency exchanges that list the pair, saw a phenomenal jump in trading volume on the same day, reaching $881 million.

That cost is 12 times the two firms' average daily revenue of $70 million over the past two years, according to CoinShares head of research James Butterfill.

Bitcoin as a hedging tool or a subject of speculative interest?

This latest surge in bitcoin trading volume has sparked discussions about whether there is currently significant demand for cryptocurrency hedging or whether the asset has become the subject of speculative interest.

In the face of impressive trading volumes registered on Bitstamp and Bitfinex since the collapse of the British pound, analysts are still divided on what this means.

Some believe that the surge in volume may be the result of a significant number of investors now choosing the main cryptocurrency to protect themselves from the fall in the value of fiat currencies.

Others have reason to believe that this may be caused by traders looking to profit from the surge in volatility.

An analyst at Bitfinex believes that an increase in trading volume of this magnitude shows how Bitcoin can benefit from the "apparent fragility of fiat currencies."

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română