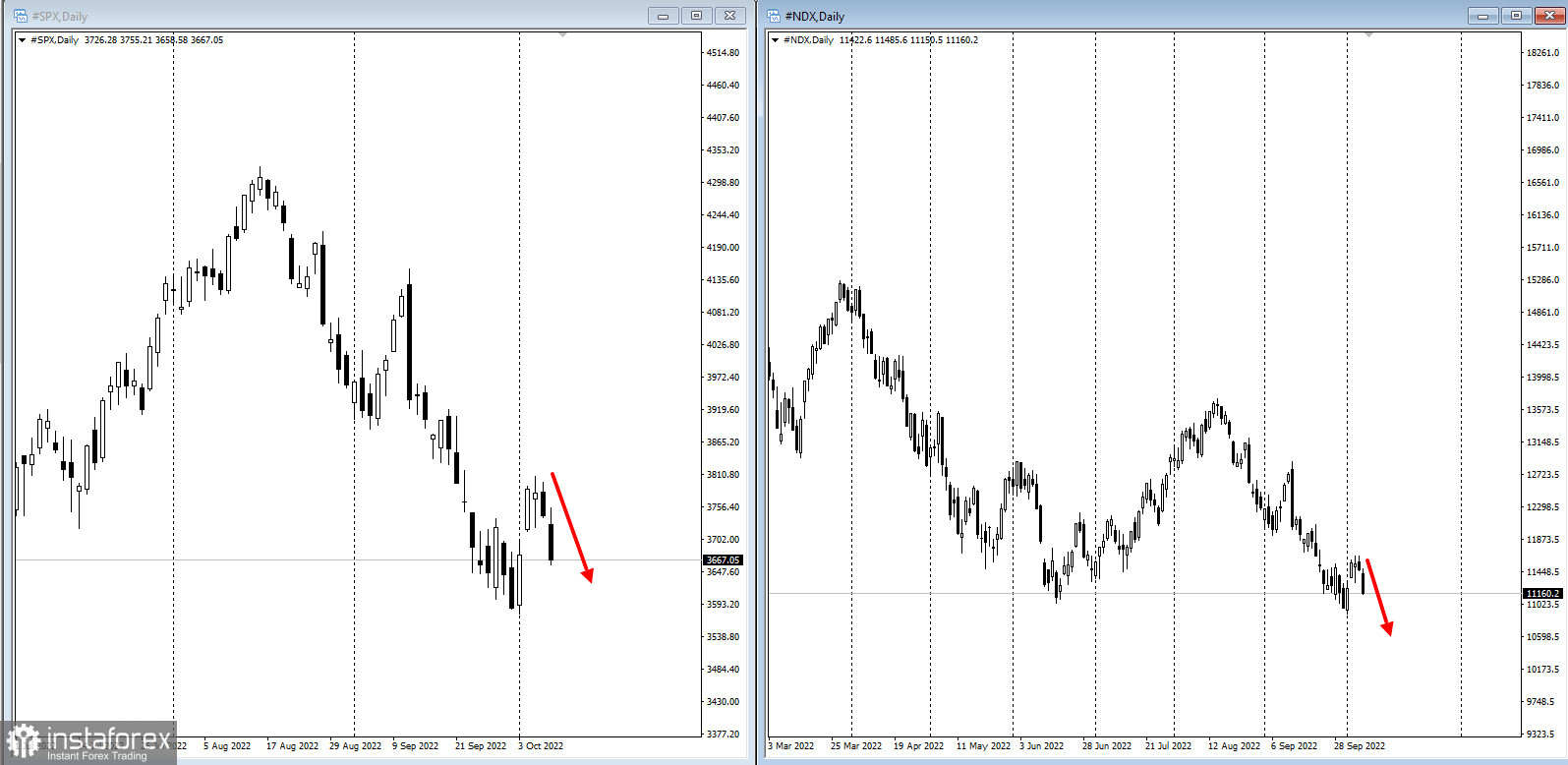

Stocks opened lower and Treasury yields rose as the strong report reaffirmed bets that the central bank would continue to be aggressive with its tightening campaign. Odds of a 75-basis point hike increased to a certainty following the report.

Aside from the anxiety that usually precedes these numbers, traders had to digest remarks from a raft of Federal Reserve speakers who sounded unequivocally committed to crushing inflation with rate hikes. The hawkish rhetoric helped push the S&P 500 to its second straight day of losses, while lifting the dollar and Treasury yields. Oil topped $88 a barrel.

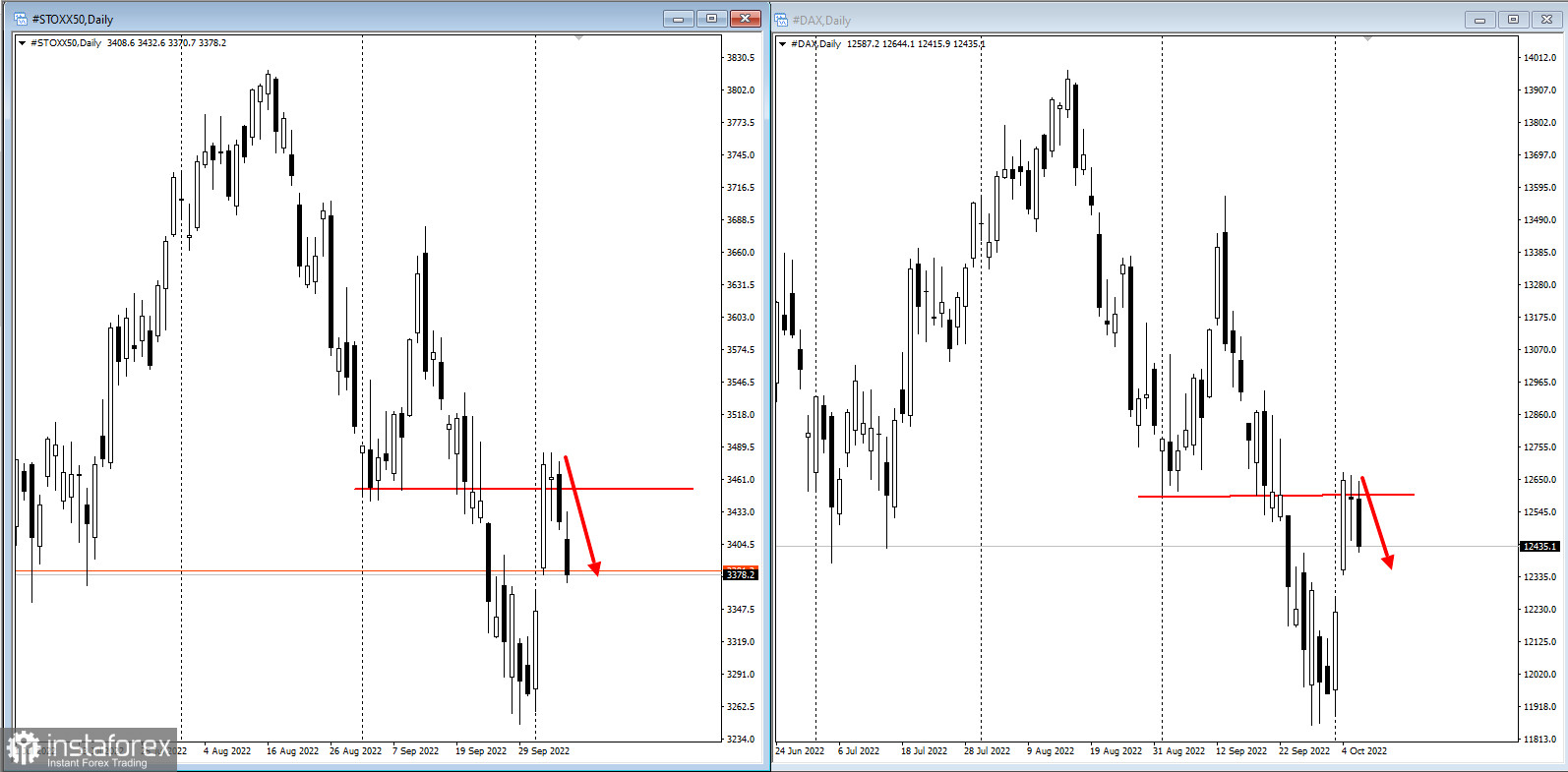

European stock indices are in a downtrend with the target of updating year lows:

This is the last jobs report Fed officials will have before their November policy meeting as they consider a fourth-straight 75-basis point interest rate hike. Fresh inflation data coming out next week will also play a fundamental role in their decision making. The report is projected to show the depth and breadth of the Fed's inflation problem, with a key indicator of consumer prices potentially worsening. The Moscow Exchange Index failed to hold above 2,000 and continued its decline:

Key events this week:

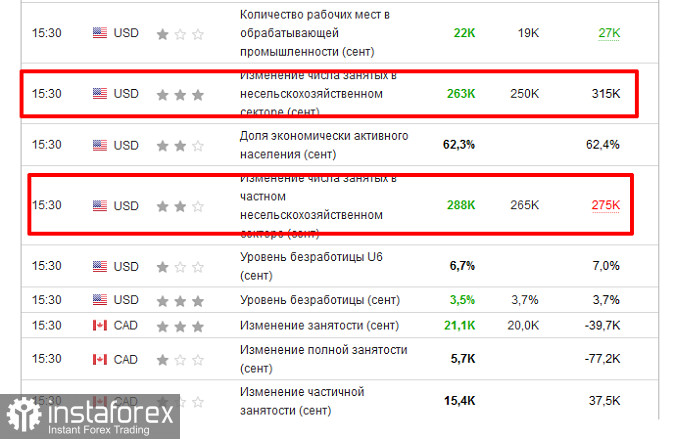

- US unemployment, wholesale inventories, non-farm payrolls, Friday

- Bank of England Deputy Governor Dave Ramsden speaks at event, Friday

- Fed's John Williams speaks at event, Friday

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română