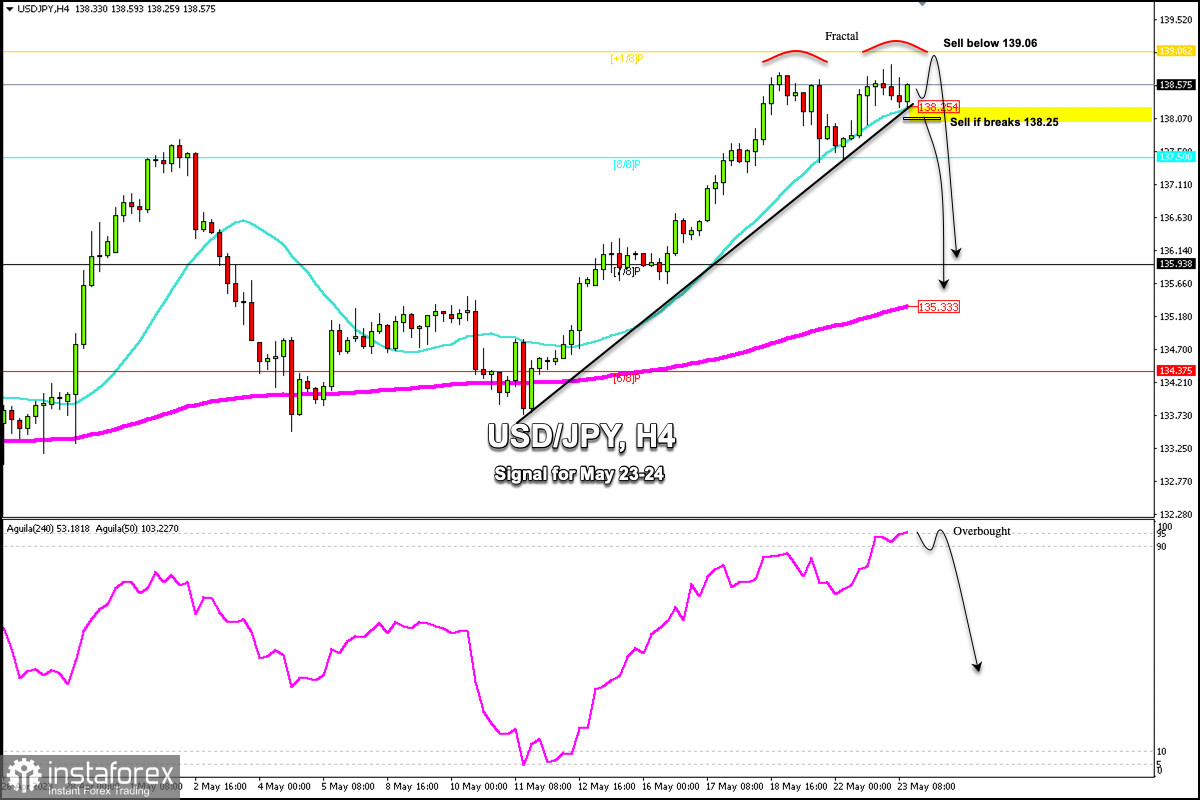

Early in the American session, the Japanese Yen is trading around 138.57, forming a fractal at around the 138.70 zone. During the European session, USD/JPY printed a high of 138.90, an area that coincides with the +1/8 Murray level, which represents strongly overbought levels and a probable change in trend.

In the event there is a break below the 21 SMA located at 138.25 in the next few hours, this could be a clear signal to sell because a break of the uptrend channel could be confirmed and USD/JPY could fall and reach 8/8 Murray located at 137.50 and finally could drop to 7/8 Murray at 135.93.

On the other hand, in case the bullish movement continues, it is expected that there will be a strong rejection around 139.06 (+1/8 Murray). This level could also be seen as an opportunity to sell because according to the Eagle indicator it is in an extremely overbought zone and a technical correction is imminent in the next few hours.

Since May 22, the Eagle indicator has been producing an extremely overbought signal. Thus, a technical correction is expected to occur in the next few hours, but for this, we should wait for a close below 138.25 on the 4-hour chart.

Our trading plan for the next few hours is to sell the Japanese Yen in case there is a pullback towards 139.06 or in case there is a break below 138.25 (21 SMA) with targets at 135.93 (7/8) and 135.33 (200 EMA).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română