On Monday, EUR/USD reversed in favor of the euro and advanced to settle above the level of 0.9782. So, the pair may continue to rise towards the next Fibonacci retracement level of 323.6% at 0.9963. Last time, the upside movement stopped at his level. If the price closes below 0.9782, this will support the US dollar, and the pair may resume its fall to the Fibonacci level of 423.6% at 0.9585.

The information background is very weak at the start of this weekly session. Today, there will be only one report on industrial production in the US. The really important data on inflation in Europe will be published tomorrow. In the meantime, Goldman Sachs has revised its outlook for the European economy and the rate hike. Analysts are sure that the EU will inevitably face a recession due to soaring energy prices and energy deficit. The EU has filled its gas storage facilities in advance ahead of the heating season. Then, there was an explosion at Nord Stream pipelines. At the moment, there is only one gas supply route operating in Europe.

The European Union has long been talking about restructuring its energy system to wean itself off Russian gas supplies. So, gas supply cuts to Europe were only a matter of time. Some experts are worried that the existing gas storage volumes may not be enough to live through this winter. In this case, the EU will need to either find additional suppliers in other countries or stick to a tough energy-saving mode.

Analysts at Goldman Sachs also predict that the ECB will raise the rate by just 0.50% at its next meeting. Eventually, the rate should reach 2.75% next year. Meanwhile, interest rates in the US are set to rise higher which will serve as a strong driver for the US dollar in the coming months.

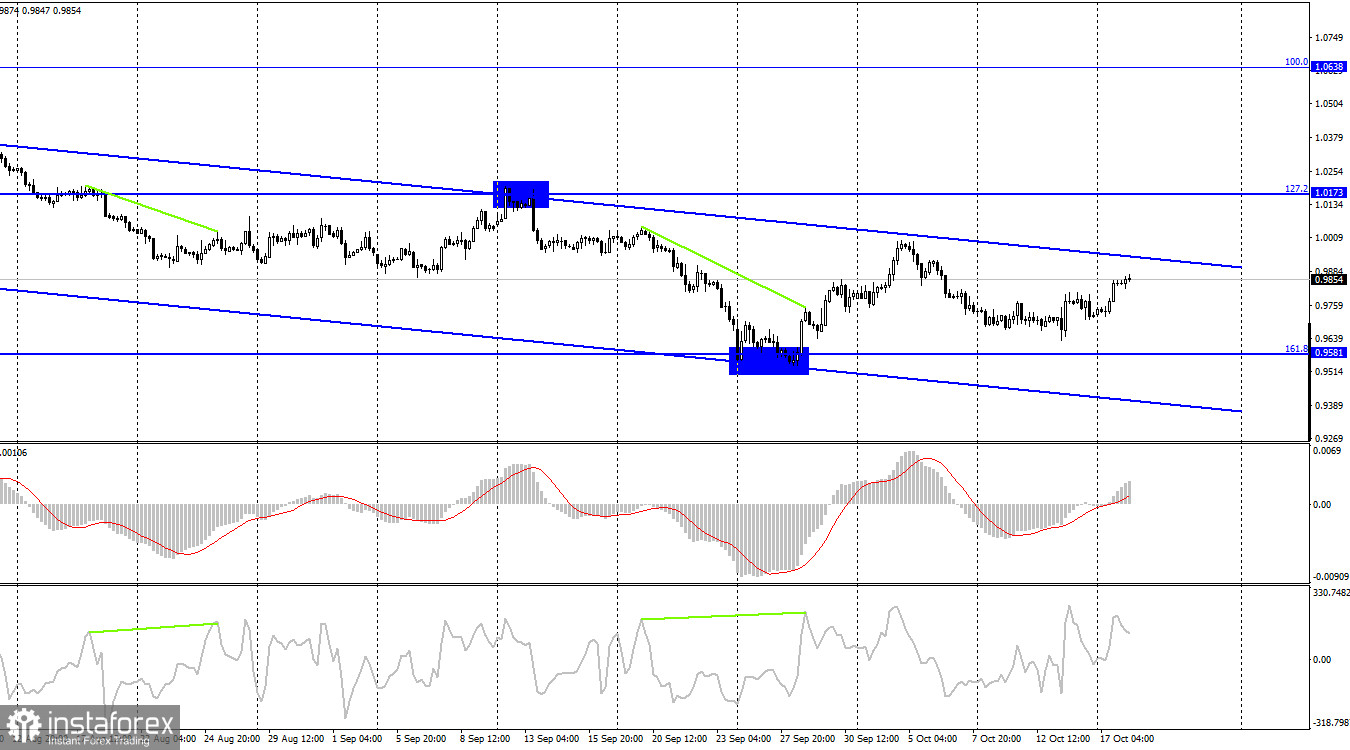

The EUR/USD pair continues to fall on the 4-hour chart towards the Fibonacci level of 161.8% at 0.9581. It is trading within the current descending channel. Therefore, the market is clearly bearish in this time frame. Only a firm hold above the descending channel will allow the euro to notably advance towards the retracement level of 127.2% at 1.0173.

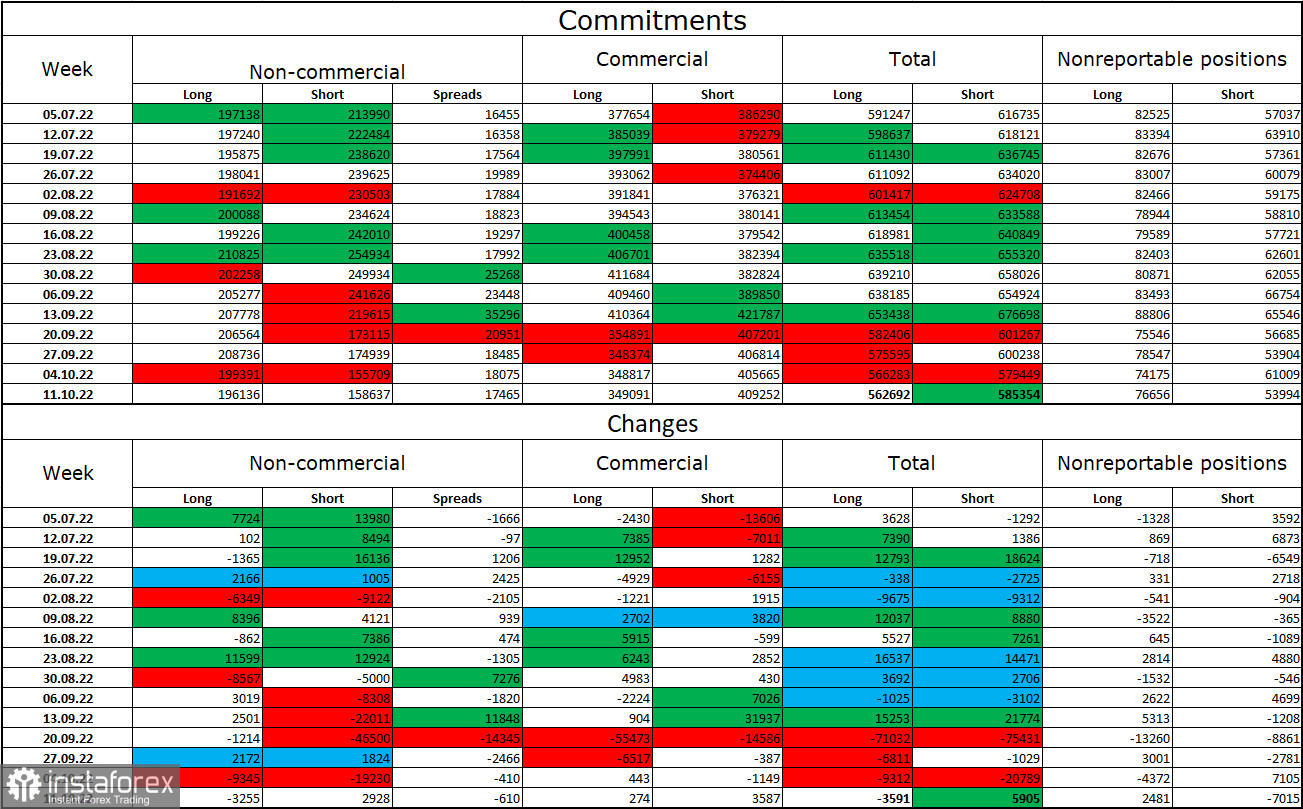

Commitments of Traders (COT) report:

Last week, traders closed 3,255 long contracts and opened 2,928 short contracts. This means that large market players became less bullish on the pair. The total number of long contracts opened by traders is 196,000 while the number of short contracts stands at 158,000. Yet, the euro is still struggling to develop a proper uptrend. In recent weeks, there were some chances for the euro to recover. However, traders are hesitant to buy it and prefer the US dollar instead. Therefore, I would advise you to focus on the main descending channel on the H4 chart although the price failed to close above it. It is also recommended to monitor geopolitical news as it tends to greatly affect the market sentiment. Eleven the bullish sentiment of larger market players does not allow the euro to develop growth.

Economic calendar for US and EU:

US - Industrial Production (13-15 UTC).

On October 18, there are almost no important events in the US and EU. There is only one report in the US that is of minor importance. So, the impact of the information background on the market sentiment will be very weak or even zero today.

EUR/USD forecast and trading tips:

I would recommend selling the pair if the price bounces off the upper line of the channel on the 4-hour chart. The target in this case should be the level of 0.9581. Buying the pair will be possible when the price holds firmly above the upper line of the channel on the H4 chart with the target at 1.0638.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română