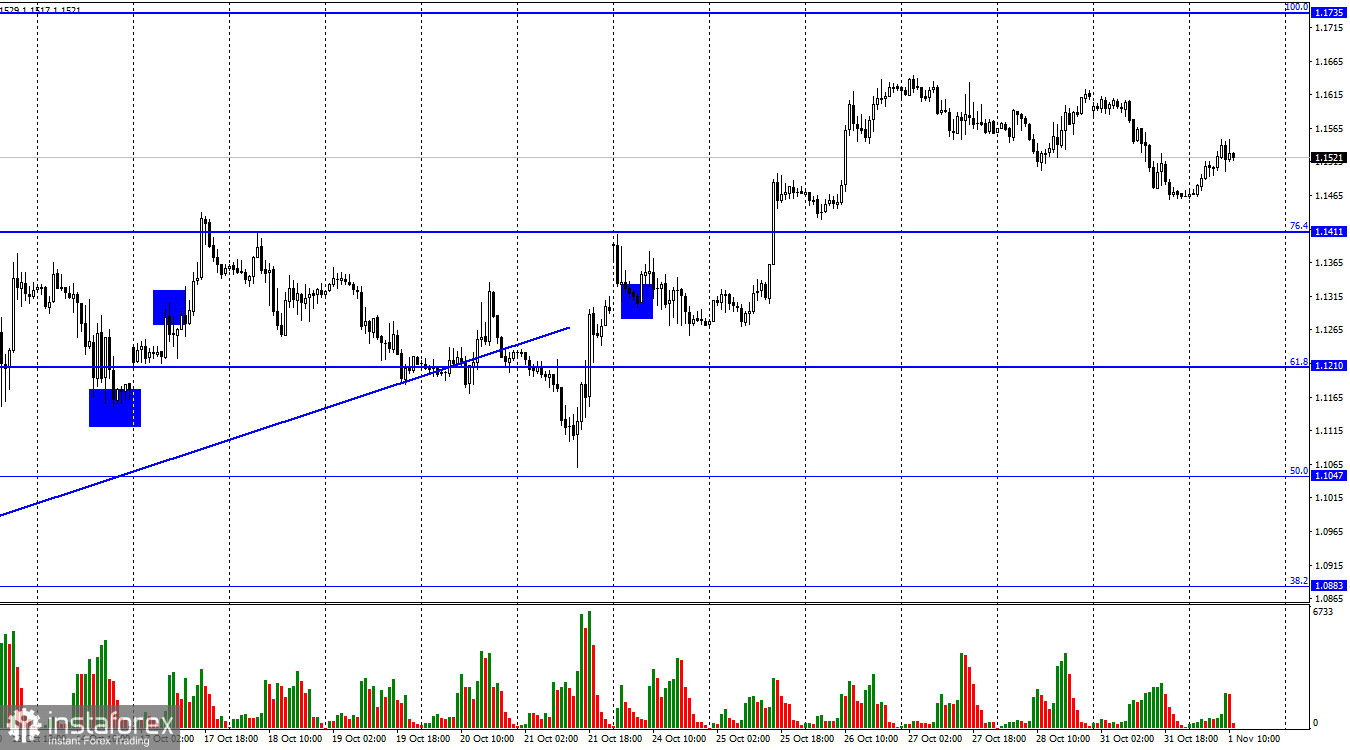

According to the hourly chart, the GBP/USD pair performed a new fall toward the corrective level of 76.4% (1.1411) on Monday. On Tuesday, a slight increase began. The British pound is still trading at high positions compared to the price observed a few weeks ago.

The Fed will summarize the results of the penultimate meeting this year. Since the US dollar, paired with the British pound, is in no hurry to grow, I believe it can show strong growth. But everything will depend on the accompanying statement of the American central bank. Traders do not doubt that the 0.75% rate hike will be the last in the current cycle of tightening the PEPP. Then there will be increases of 0.50% or 0.25%, and there will be few. Thus, the dollar may lose its key advantage in the near future.

But with the Bank of England meeting, everything is much more complicated. Traders doubt how much the British regulator will raise the rate on Thursday. By 0.75% or by 1.00%? The first and the second options imply a significant strengthening of the British currency. Thus, we can observe movements in different directions on Wednesday and Thursday. And very strong movements. If everything is more or less clear with the Fed rate, it will rise to 4.5-4.75% and continue to remain at this level until inflation drops to at least 3-4%; then everything is confusing with the Bank of England rate. First, it is unclear whether the Bank of England is ready to raise the rate to 5%. Inflation in the UK continues to rise even after seven rate hikes. Second, it is unclear at what pace the regulator will continue to raise the rate. Before that, although there were as many as seven increases, they were small, 0.25% mostly. The rate may grow for another year until it reaches 5%, which, according to many experts, may pressure the consumer price index.

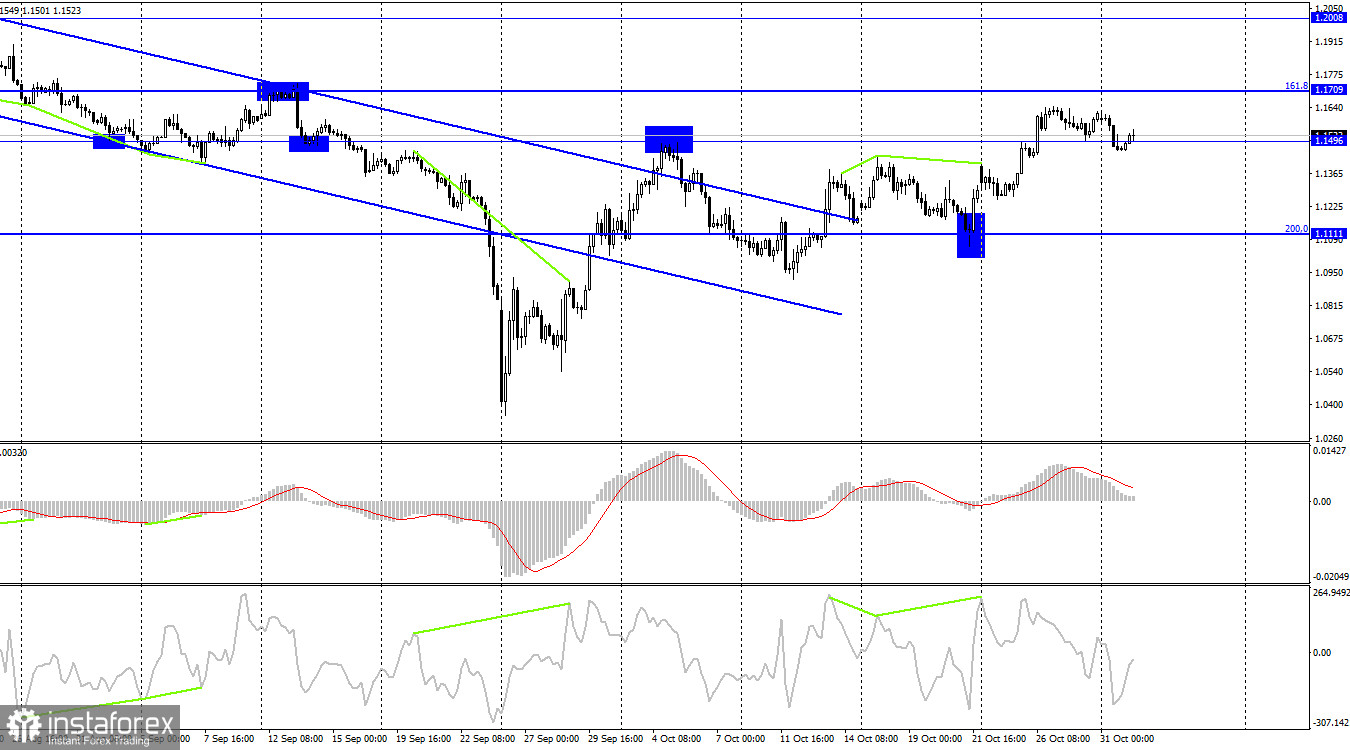

On the 4-hour chart, the pair secured above the level of 1.1496. Thus, the growth process can be resumed in the direction of the Fibo level of 161.8% 1,1709. Fixing the pair's exchange rate below the level of 1.1496 will favor the US dollar and begin a new fall in the direction of the Fibo level of 200.0% (1.1111). There are no emerging divergences today.

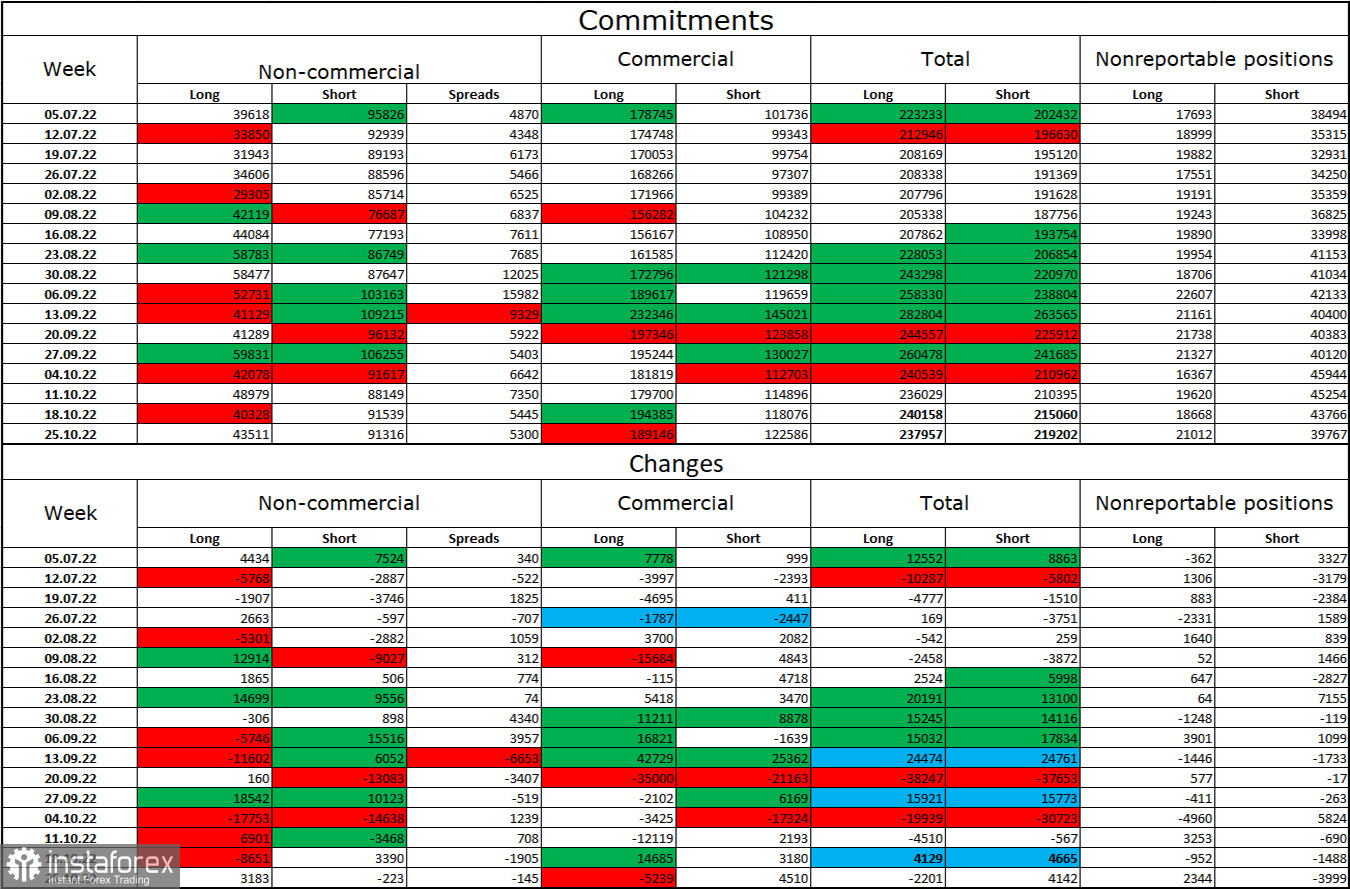

Commitments of Traders (COT) Report:

Over the past week, the mood of the "Non-commercial" category of traders has become slightly less "bearish" than a week earlier. The number of long contracts in the hands of speculators increased by 3,183 units, and the number of short contracts decreased by 223. But the general mood of the major players remains the same – "bearish," and the number of short contracts is still much higher than the number of long contracts. Thus, large traders remain mostly in the pound sales, and their mood is gradually changing towards "bullish" in recent months, but this process is too slow and long. The pound can continue to grow if there is a strong (for it) information background, with which problems have been observed in recent months. I draw attention to the fact that the mood of speculators on the euro has long been "bullish," but the European currency is still not popular among traders. And for the pound, even COT reports do not give grounds to buy it.

News calendar for the USA and the UK:

US - index of business activity in the manufacturing sector (PMI) (13:45 UTC).

US - index of business activity in the manufacturing sector (PMI) from ISM (14:00 UTC).

On Tuesday in the UK, the economic events calendar does not contain an interesting entry. In the USA, there are two reports on business activity. The influence of the information background on the mood of traders will be present today.

GBP/USD forecast and recommendations to traders:

I recommend selling the British in case of a rebound from the level of 1.1709 on the 4-hour chart with a target of 1.1496 or a close under 1.1496 with a target of 1.1111. You can buy the pound with a target of 1.1709 if a rebound from the level of 1.1496 is performed on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română