On Wednesday, futures on US stock indices rose despite concerns that the Fed may signal at the end of its meeting tomorrow that it would maintain its aggressive policy next year. As for the good news, investors are counting on the fact that China will start to phase out its strict Covid Zero policy, which will smooth out supply chain problems. US-listed Chinese stocks rose sharply in the premarket. An unconfirmed social media post sparked rumors that Beijing is seeking to phase out the restrictions, even though the country's foreign ministry said it was unaware of such a plan.

The US dollar index and Treasury yields fell slightly. The S&P 500 index futures rose by 0.3%, while the Dow Jones Industrial Average index added about 0.2%. The NASDAQ index jumped by 0.4%. Treasury yields fell to 3.95% despite expectations that the Fed's most aggressive campaign in four decades will continue.

Mining companies' stocks rose in Europe amid signs of a rebound in copper prices due to an expected global supply shortage. Iron ore prices jumped after a six-day decline. Gold and oil also rose.

JPMorgan Chase & Co. strategists believe that the Fed's aggressive actions are coming to an end, which is likely to calm the markets down. Economists say the US is likely to raise rates by 50 basis points in December and suspend its rate hike program after another 25 basis point increase in the first quarter. The details of this kind of policy change will be revealed tomorrow after the results of the committee meeting and Fed Chairman Jerome Powell's comments are released. If the Fed does hint that there will be policy changes, risky assets may gain considerably.

Meanwhile, the British government said that all citizens, especially the wealthiest, would have to pay more taxes to restore the stability of public finances. At the same time, the Bank of England should launch a program to reduce the balance of bonds accumulated during the crisis.

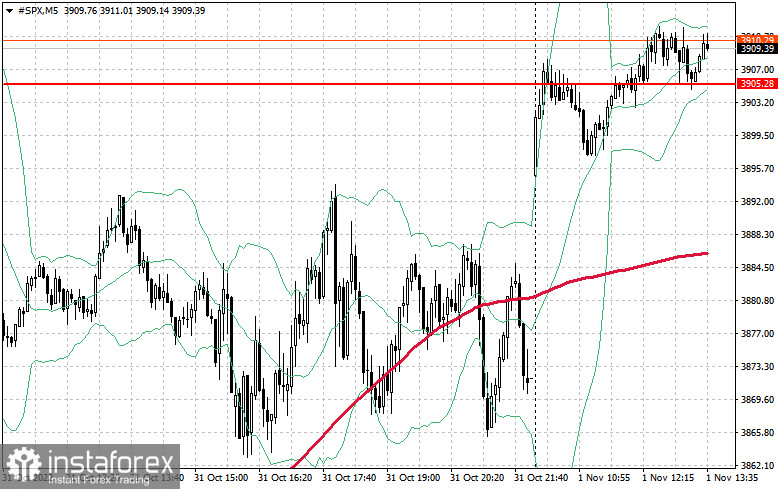

As for the technical picture of the S&P 500 index, after yesterday's slight decline, the demand for the index returned. Bulls need to protect the support levels of $3,861 and $3,835. As long as the instrument is trading above these levels, we can expect the demand for risky assets to persist. It may also strengthen the trading instrument and take control over the level of $3,905, just above which the level of $3,942 is located. This scenario is likely to strengthen an upward correction with the target at the resistance of $3,968. The next target is located in the area of $4,000. If the index declines, bulls will have to be active near $3,861. If this level is pierced, it may push the trading instrument down to $3,835 and $3,808. It will also open the way to a new support of $3,773.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română