Analysis of EUR/USD, 5-minute chart

The euro/dollar pair continued its corrective movement on Tuesday as part of an uptrend, which after three days of falling still persists. However, yesterday the price overcame the Senkou Span B line and now there is only one support from below in the form of a trend line. If the price settles below it, then the long-term downward trend may resume, and the euro will again rush to its 20-year lows. And today, the price may overcome this line, as the results of the Federal Reserve meeting will be announced in the evening. The market has no doubts that the rate will rise for the fourth time by 0.75%, and this is a weighty argument for further strengthening of the US currency. Over the past 2-3 days, traders could already work out the rate hike "in advance", so today we can see the pair rise. However, a further fall cannot be completely ruled out either. Recall that the market can react to such important events in an unpredictable way.

In regards to Tuesday's trading signals, the situation was quite interesting. At the very beginning of the European trading session, quotes bounced from the Senkou Span B line, afterwards they rose to the level of 0.9945. It was necessary to open a long position on this signal, and the profit was about 20 points. There were two bounces from the 0.9945 level, two sell signals. The first one was closed by Stop Loss at breakeven, and after the second one, the price overcame the Senkou Span B and almost reached the level of 0.9844, making it possible to earn another 60 points. This position should have been closed manually in the late afternoon.

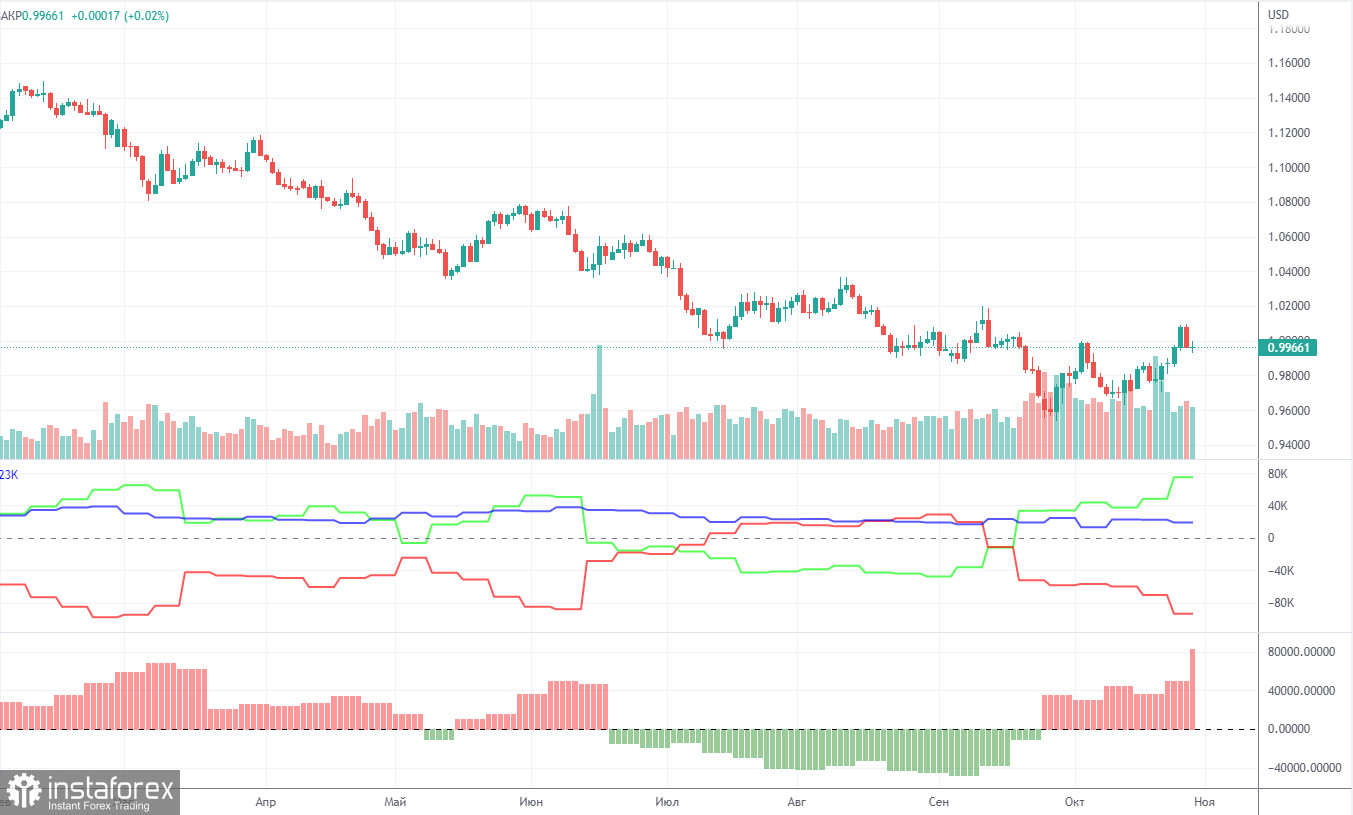

COT report

In 2022, the Commitment of Traders (COT) report for the euro is becoming more and more interesting. In the first part of the year, the reports were pointing to the bullish sentiment among professional traders. However, the euro was confidently losing value. Then, for several months, reports were reflecting bearish sentiment and the euro was also falling. Now, the net position of non-commercial traders is bullish again. The euro managed to rise above its 20-year low, adding 500 pips. This could be explained by the high demand for the US dollar amid the difficult geopolitical situation in the world. Even if demand for the euro is rising, high demand for the greenback prevents the euro from growing. In the given period, the number of short orders initiated by non-commercial traders increased by 24,000, whereas the number of long orders declined by 2,700. As a result, the net position increased by 26,700 contracts. However, this could hardly affect the situation since the euro is still at the bottom. At the moment, professional traders still prefer the greenback to the euro. The number of buy orders exceeds the number of sell orders by 75,000. However, the euro cannot benefit from the situation. Thus, the net position of non-commercial traders may go on rising without changing the market situation. Among all categories of traders, the number of long positions exceeds the number of short positions by 19,000 (609,000 against 590,000).

Analysis of EUR/USD, 1-hour chart

The pair is moving upwards on the one-hour chart, however, it may change its direction today. The price is around 70 points from the trend line, so it will not be difficult to overcome it. Especially when there is such a strong fundamental background, like what we have for tonight. On Wednesday, the pair may trade at the following levels: 0.9635, 0.9747, 0.9844, 0.9945, 1.0019, 1.0072, 1.0124, 1.0195, 1.0269, as well as the Senkou Span B (0.9900) and Kijun-sen (0.9977). Lines of the Ichimoku indicator may move during the day, which should be taken into account when determining trading signals. There are also support and resistance levels, but signals are not formed near these levels. Bounces and breakouts of the extreme levels and lines could act as signals. Don't forget about stop-loss orders, if the price covers 15 pips in the right direction. This will prevent you from losses in case of a false signal. The European Union is set to publish an index of business activity in the manufacturing sector. Not the most important report or indicator. In the US we have the ADP report and in the evening - the results of the Fed meeting. The macroeconomic background will be quite weak during the day, but the market may trade actively ahead of the meeting. You need to be ready for any development of events.

What we see on the trading charts:

Price levels of support and resistance are thick red lines, near which the movement may end. They do not provide trading signals.

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, moved to the one-hour chart from the 4-hour one. They are strong lines.

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals.

Yellow lines are trend lines, trend channels, and any other technical patterns.

Indicator 1 on the COT charts reflects the net position size of each category of traders.

Indicator 2 on the COT charts reflects the net position size for the non-commercial group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română