The Fed's decision on interest rates was the same as expected. The increase was 75 basis points, and there were hints that in the next months, there may be a slowdown in rate growth as inflation has been easing already. Because of this, the dollar gradually lost its strength, but then Jerome Powell came out and surprised the market with his statements. He said the central bank is not planning to end the cycle of interest rates increases in the near future, only at the end of next spring will there be a reduction in rate hike. Powell reasoned that inflation is still high, so there is a need to continue or take any measures to reduce it. He added that leaving inflation high for a long time will lead to devastating consequences for the economy.

So far, the labor market is already affected, showing signs of deterioratio. This is despite unemployment being at its lowest level in the last fifty years.

In other words, the Federal Reserve will have to ease the pace of rate hike if it wants to save the US economy. Perhaps it may start in December by increasing rates by only 50 basis points. Even so, the cycle will last until the end of next year, which means that it will be significantly higher than expected. This means that it is unlikely that interest rates in other regions, such as Europe, will be higher than in the United States. consequently, the long-term strengthening of the dollar will continue.

Interest rate (United States):

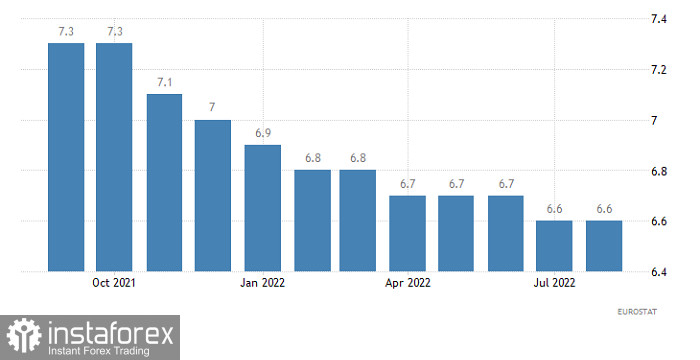

In Europe, the situation is aggravated by recent statistics, which clearly outperforms the others. For example, today's data on the unemployment rate is likely to rise from 6.6% to 6.7%, which means that the unemployment rate in the region is not only higher than in the United States, but it is also rising. Of course, there is no reason for optimism here.

Unemployment rate (Europe):

Despite this, the euro still has a chance to grow, similar to the pound, which could rise due to the decision of the Bank of England to raise the refinancing rate by 75 basis points. However, the market needs a reason for a local correction.

Interest rate (UK):

EUR/USD dropped below 0.9850. Although it is clearly oversold, the market is still in a downward trend. Further pressure below 0.9800 may lead to another decline, but a correction may occur any time.

GBP/USD fell below 1.1400. In this situation, much will depend on the upcoming economic events.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română