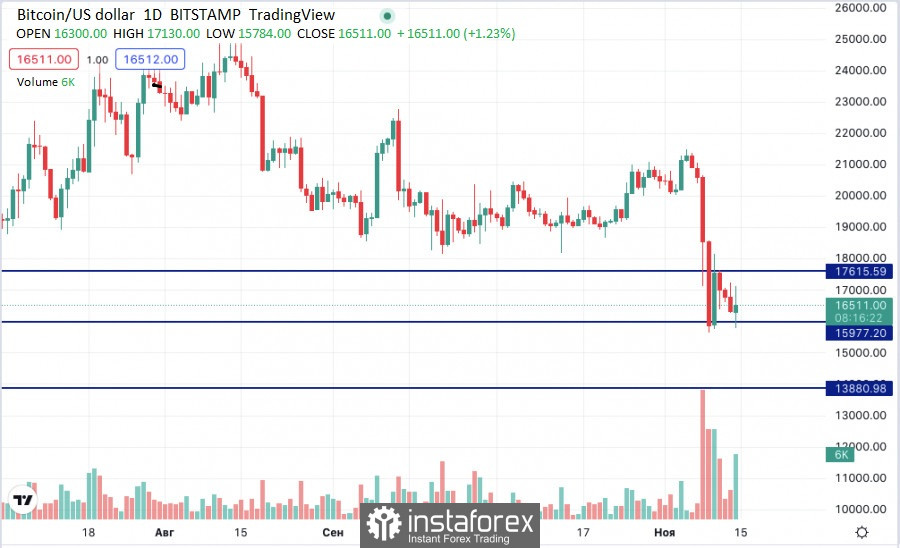

The FTX crash and the cascade of news it generated sent bitcoin below $16,000 last week. During the local recovery, mainly amid the fall of the US dollar, the level of July lows was confirmed as resistance.

BTCUSD quotes remain within the range of $15,977 - $17,615, between these limits. Technically, here the main cryptocurrency can move horizontally. But if the support fails, there is every chance of catching bitcoin in the $13,000 area. Everything will depend on further developments.

The crypto industry is in a gloomy mood

Bitcoin remains under heavy pressure on Monday as concerns about the crypto industry persist.

As a result of the FTX crash, many crypto investors decided to leave the industry entirely. In addition, other well-known and reputable companies, such as Voyager Digital and Celius, went bankrupt. Thus, with the departure of FTX, the question arises of which company will be next.

The latest data shows that investors have withdrawn their cryptocurrencies from crypto exchanges such as Binance and OKX. In addition, the outflow of Tether funds has increased dramatically over the past few days.

But on the other hand

They say that failure is luck, the meaning of which is not yet understood. Probably, this whole story also has some positive side. In the evolution of all industries, such searches are common. For example, in the early 1900s, dozens of banks failed each year. This ended after the creation of the US Federal Reserve.

The same thing happened in the early 2000s when everyone was investing in dot-com companies. It ended tragically after the dot-com bubble burst, costing investors billions of dollars. Since then, giants such as Google, Cisco, and Amazon have grown.

So the positive side of the FTX crash is that regulators may finally take control of the sector and put up barriers to protect investors. While more companies may fail, it is a necessary process to weed out the bad guys.

Changpeng Zhao: Industry transparency is essential

Binance CEO Changpeng Zhao reaffirmed the importance of transparency in the cryptocurrency industry after the FTX crash.

He also confirmed that Vitalik Buterin will create a "proof of reserve" protocol that will be initially tested by Binance.

Zhao explained that Binance operates differently from FTX, but acknowledged that cryptocurrency exchanges are "inherently a pretty risky business."

In a Twitter Spaces discussion hosted by Binance on Monday, Zhao spoke out about the industry-shaking FTX bankruptcy. On Friday, FTX filed for Chapter 11 bankruptcy after the firm was found to be insolvent.

Binance had previously expressed interest in buying the exchange, but withdrew from the deal, citing due diligence. It was later revealed that former CEO Sam Bankman-Fried secretly transferred $10 billion in customer funds to save his trading firm Alameda Research after Terra's collapse.

Commenting on these developments, Zhao reaffirmed the need for more transparency in the industry.

Binance disclosed its crypto assets in a blog post following the FTX crash. The exchange also announced plans to provide proof of funds held on its balance sheet. In a call to Spaces, Zhao said Ethereum creator Vitalik Buterin had agreed to create a "proof of reserve" protocol that would use Binance as a "guinea pig."

Zhao mentioned some of the questionable actions of FTX and Alameda prior to last week's crash, reassuring listeners that Binance is taking a more conservative approach to its operations.

Crypto Recovery Fund

In addition to the news of its readiness to prove reserves, cryptocurrency exchange Binance said that it is forming an industry recovery fund to "mitigate further cascading negative impact of FTX."

"As an industry, we need to increase transparency. We need to work very closely with regulators around the world to make this industry more reliable."

A recovery fund for the crypto industry is also being set up to help projects that are otherwise strong but are experiencing a liquidity crunch.

"Other players in the industry with cash who want to jointly invest are also welcome," the head of Binance added. "Cryptocurrency will not disappear. We are still here. Let's restore the market."

At a fintech conference in Indonesia on Friday, Zhao spoke about regulation and his firm's efforts to set global standards for cryptocurrencies in collaboration with other industry players.

He compared the FTX debacle to the 2008 financial crisis, warning of cascading consequences. Zhao believes that we need to work very closely with regulators around the world to make this industry more reliable.

The crypto industry is "still growing" and "we are still building," he stressed.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română