Respect is formed over the years and can be lost in a few minutes. Similarly, in the market, investors have been raising bets to hedge against stagflation for a long period of time, but when US consumer prices slowed in October, they were reversed in a few moments. The EURUSD pair soared to its highest levels since the beginning of July, and no matter how US dollar fans explain the rally by closing speculative shorts, there is certainly a foundation for the euro rally.

In contrast to the Fed, which at the end of 2021 continued to adhere to the mantra of the temporary nature of high inflation and got down to business too late, investors bought the US dollar. This currency proved to be an excellent safe-haven asset and, in the face of the highest prices in 40 years and anemia in economic growth, seemed like an ideal option to save your own money. The American exceptionalism and the Fed's most aggressive monetary restriction in decades added to the demand for safe havens.

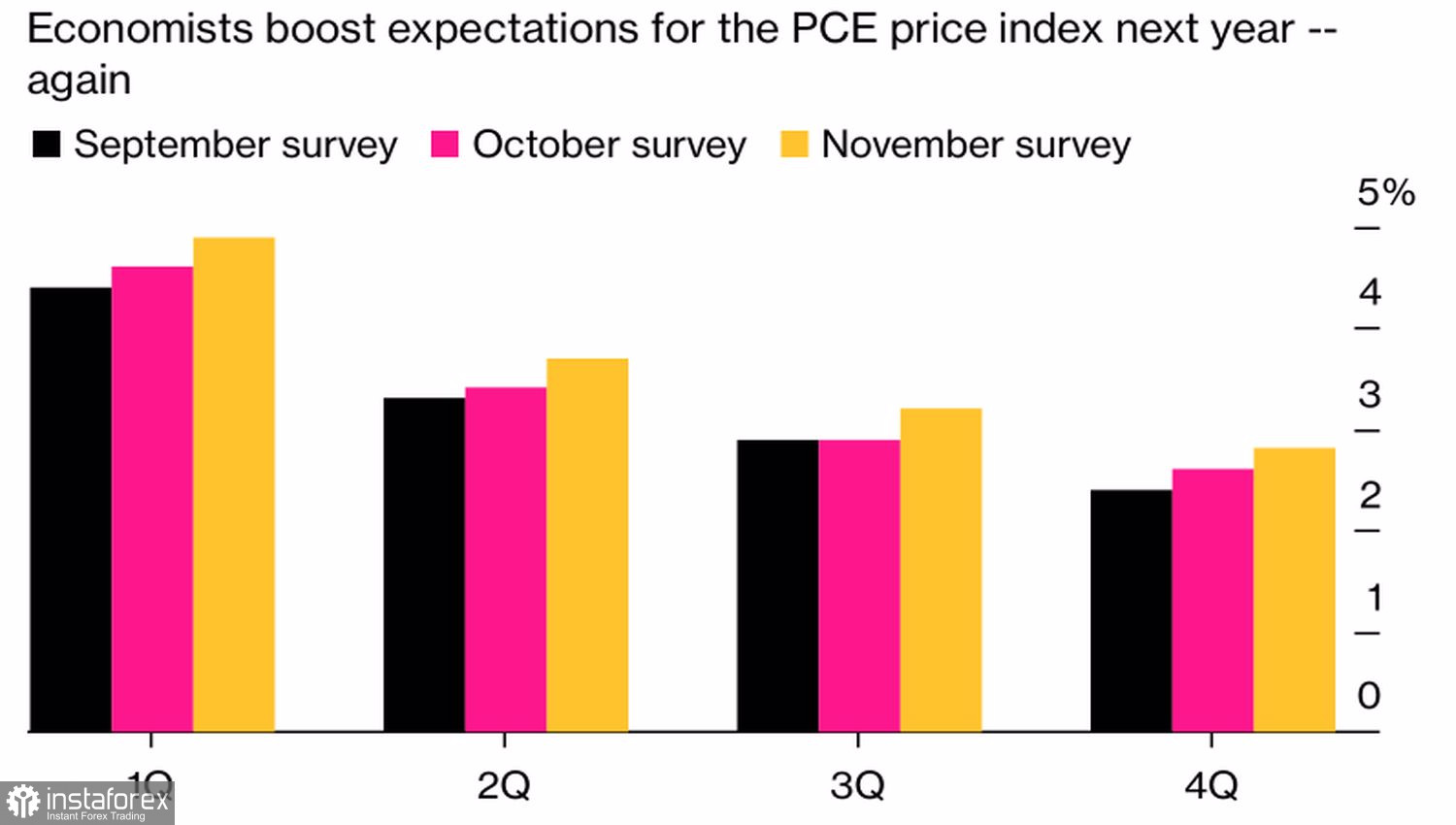

The situation changed radically in November, when Jerome Powell announced the Central Bank's intention to slow down the rate hike. Despite the fact that the US dollar reacted to that message with growth, it was its swan song. Neither the strong employment report for October nor the forecasts of Bloomberg experts, which recorded higher PCE figures than in previous estimates, saved the dollar.

American PCE Forecasts

In fact, the macro environment has changed. Inflation has passed its peak and is slowing down. A strong labor market raises the chances that the Fed will be able to achieve a soft landing for the US economy. Hedging bets against stagflation are no longer relevant, and their folding leads to a sharp increase in EURUSD.

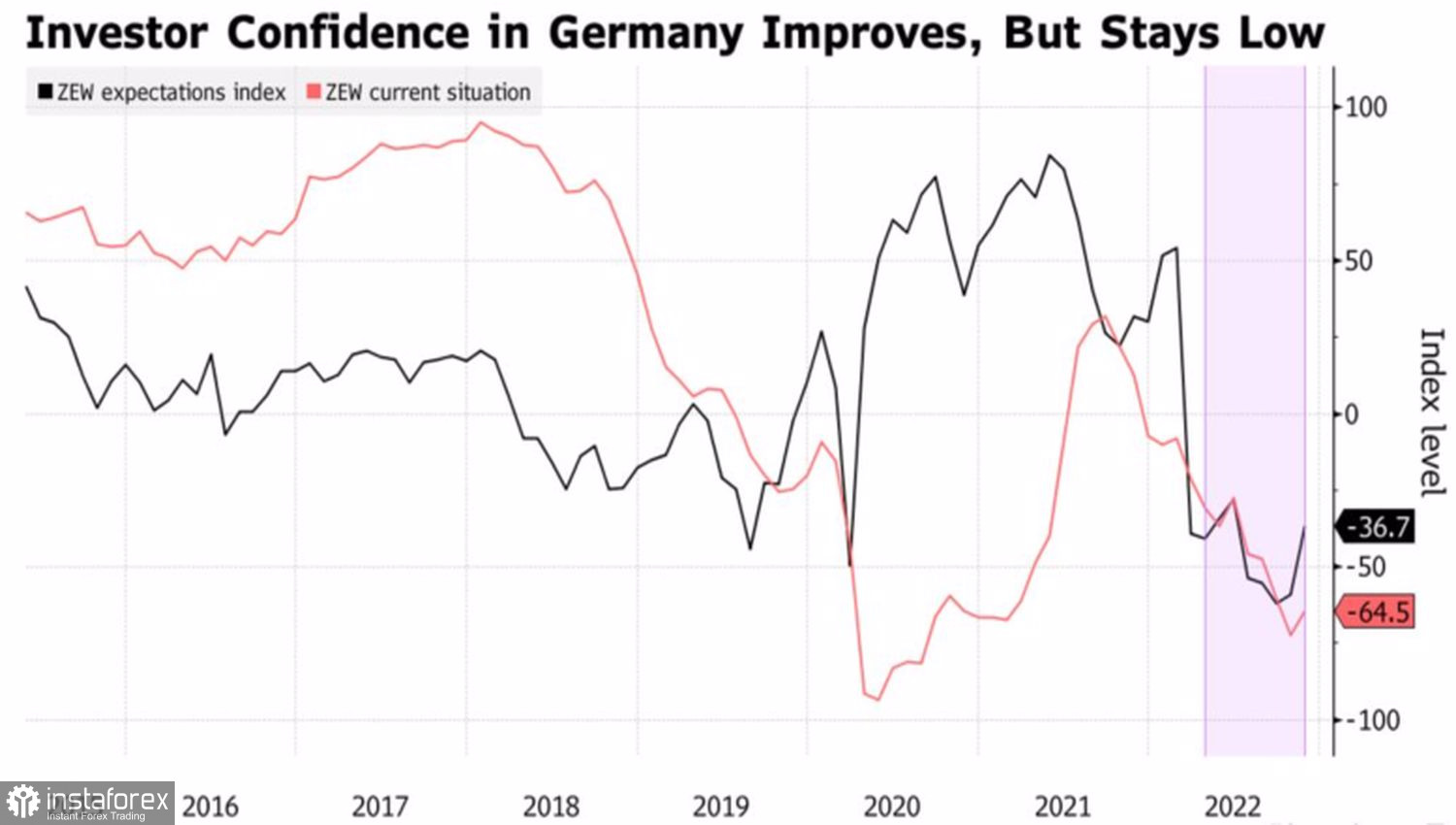

Moreover, due to warm weather in Europe the risks of a deep and prolonged recession are reduced, and the ECB is doing what the Fed did a few months ago. It talks about the need to defeat inflation, even with the help of the sacrifice of his own economy. Belief that CPI has also peaked in the euro area is fueling investor confidence in Germany's economic outlook to its highest level since June.

Dynamics of expectations and current business conditions in Germany

Add to this the improvement in relations between the United States and China after the meeting of the heads of the two countries on the sidelines of the G20 summit, which will have a positive impact on international trade, and the EURUSD rally will no longer look surprising.

In the global economy, the glass is already half full, and the euro is the currency of the optimists, unlike the dollar, which is usually bought when things are bad.

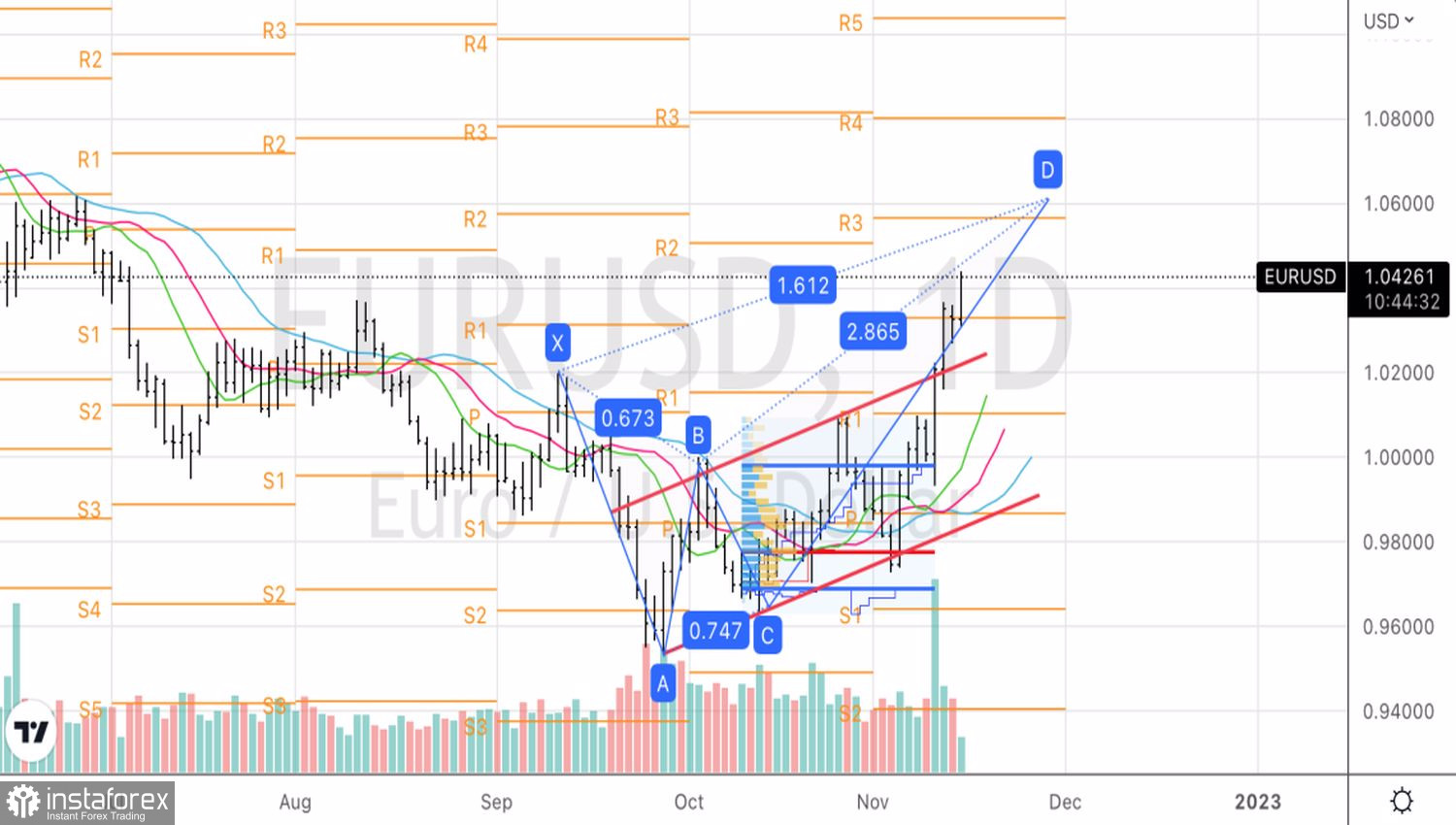

Technically, on the EURUSD daily chart, the exit of quotes beyond the limits of the corrective ascending channel and overcoming the important pivot point at 1.0335 increase the risks of reaching the target by 161.8% according to the Bat pattern. It is located near the 1.061 mark. We continue to adhere to the previous strategy of buying the euro on pullbacks.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română