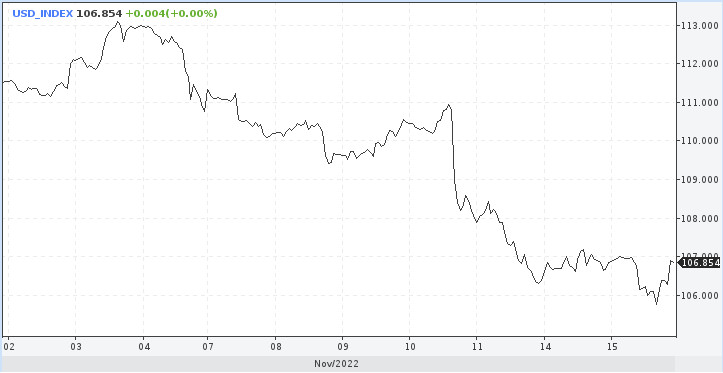

Judging by the weekly chart, the dollar is far from doing so well. It is extremely difficult to convince yourself that this does not mean the end of the rally. Even the pound may find it easier to hold on in the face of fiscal tightening and still rising inflation. Is it so?

The dollar makes you nervous. Signals for a reversal of movement only started to appear at the start of the week, the index began to recover, as on Tuesday it failed again. Intra-session losses reached 1%, the US currency fell under 106.00 for the first time since August 12.

It looks like there will be softer signals from the Federal Reserve. The day before, Fed Vice Chair Lael Brainard said the central bank had already done a great job of curbing inflation. Thus, she strengthened the case for a 50 bps rate hike in December. Another Fed spokesman Christopher Waller also acknowledged that the central bank may slow down the pace of rate hikes at upcoming meetings. At the same time, he stressed that officials are not planning a pause, the rate hike cycle is not over.

On Tuesday, the dollar index was quickly losing the bullish momentum of the previous session. There are fears that it may reorient itself to decline, although in the midst of the US session bulls tried to win back part of the losses.

Volatility is elevated due to uncertainty, investors are tossed from side to side as they cannot join any side. How dovish will the Fed become and will inflation pump up next month?

If the selling trend picks up momentum, the index is in danger of saying hello to 104.80.

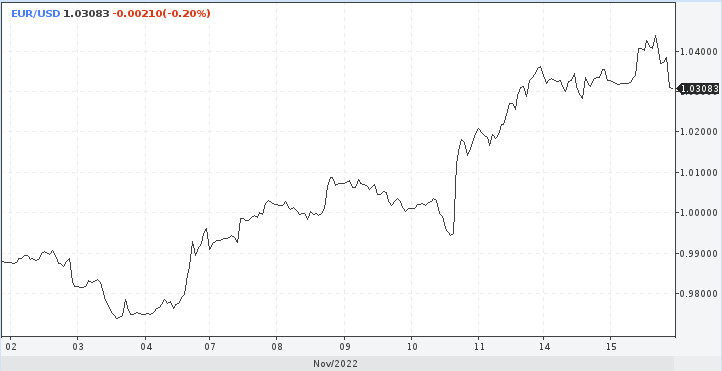

Euro revived

The euro also took advantage of the dollar's weakness, gaining at least 4% from last week's lows. The EUR/USD pair went above 1.0400 and this is an excellent result. However, it was not possible to settle. This level will remain a serious barrier for bulls on the euro. In order to settle higher, new strong drivers are needed.

Economic data for the bloc has improved in recent days, but that's no reason to celebrate just yet. Traders will prefer to wait a while.

In addition to the weak dollar, the strong position of the European Central Bank is positive for the euro. The ECB is expected to continue to tighten monetary policy despite fears of an economic slowdown. ECB board member Francois Villeroy de Galo said the central bank is likely to take rates above 2%. At the same time, large-scale tightening in the style of the Fed is not worth waiting for.

Another official, Fabio Panetta, said on Monday that the ECB should keep raising rates, but a norm or some middle ground is needed. Excessive tightening could lead to a permanent decline in output below the trend.

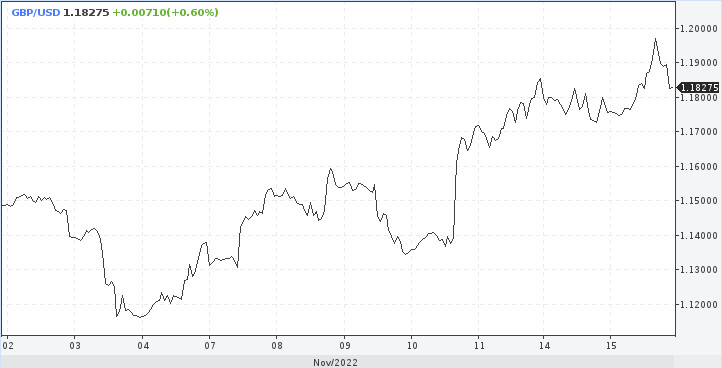

The pound surpassed everyone

The pound struck with its desire to return to its previous levels. On Tuesday, its rate updated multi-month lows. The GBP/USD pair broke through the level of 1.2000 at the moment.

In addition to the situation with the dollar, the British currency was helped by internal factors. Wages in the UK were higher than expected. At the same time, there were clear signs of cooling of the ore market. The unemployment rate rose to 3.6% from 3.5% in August.

The labor market is turning around, but as economists at Pantheon Macroeconomics noted, it will take "several months before the impact of a downturn in business confidence is fully reflected in the jobs data."

The Bank of England still has some work to do if it wants to reverse inflation to 2% given that wages have beaten expectations and point to rising domestic inflationary pressures. Therefore, the central bank is likely to raise interest rates by 50 bps in December. Further increases are likely to occur in early 2023 as well.

"We continue to believe that by the mid-March central bank meeting, there will be enough strong evidence of rising unemployment and slowing wage growth to stop the tightening cycle. At the same time, the bank rate will be about 4%," according to Pantheon Macroeconomics.

However, this scenario looks unconvincing. Further advances will be required to ensure continued support for the pound.

The data on the labor market is an important indicator in light of the increase in rates. However, the response to it was insufficient. Maybe this is due to the release of the consumer price index on Wednesday. Inflation will be a more relevant indicator for the British authorities and members of the BoE.

The overall CPI is forecast to be 10.6% y/y in October compared to 10.1% in September.

The core consumer price index will be 6.4%, well ahead of the BoE's target of 2% and consistent with further interest rate hikes.

The pound's reaction to these data is difficult to predict. Will it continue to rise if inflation eases? After all, this will mean that the BoE may soon complete the rate hike cycle.

This week the pound has another important event. On Thursday, Chancellor Jeremy Hunt will talk about his tax and spending plans for the coming months and even years. The official will try to regain market confidence and reassure investors that the UK's debt position remains strong.

Rumor has it that Hunt wants to fill the "black hole" with an amount of about 55 billion pounds. It will do so by cutting spending and raising taxes. There is a price to be paid here, and it will have to be paid by lower economic growth, which is a natural obstacle to the pound's strengthening potential.

MUFG believes that after the announcement of the budget on November 17, the pressure on the pound will increase.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română