Over the past few days, the cryptocurrency market has been digesting the events of the first half of November, which may give the impression that the situation has stabilized. In fact, there are many processes going on inside the industry that will become apparent only after some time.

Consequences of updating the local bottom of BTC

The fall of Bitcoin below $17k provoked a series of events that could aggravate the current state of affairs. JPMorgan bank experts have repeatedly stated that following the results of the current bear market, the main cryptocurrency will not stop at $15k.

Analysts concluded that after the asset's quotes fell below $17k, Bitcoin became much closer to reaching the cost price level. If BTC tests or falls below the $11k–$13k area, the market may wait for a series of margin calls.

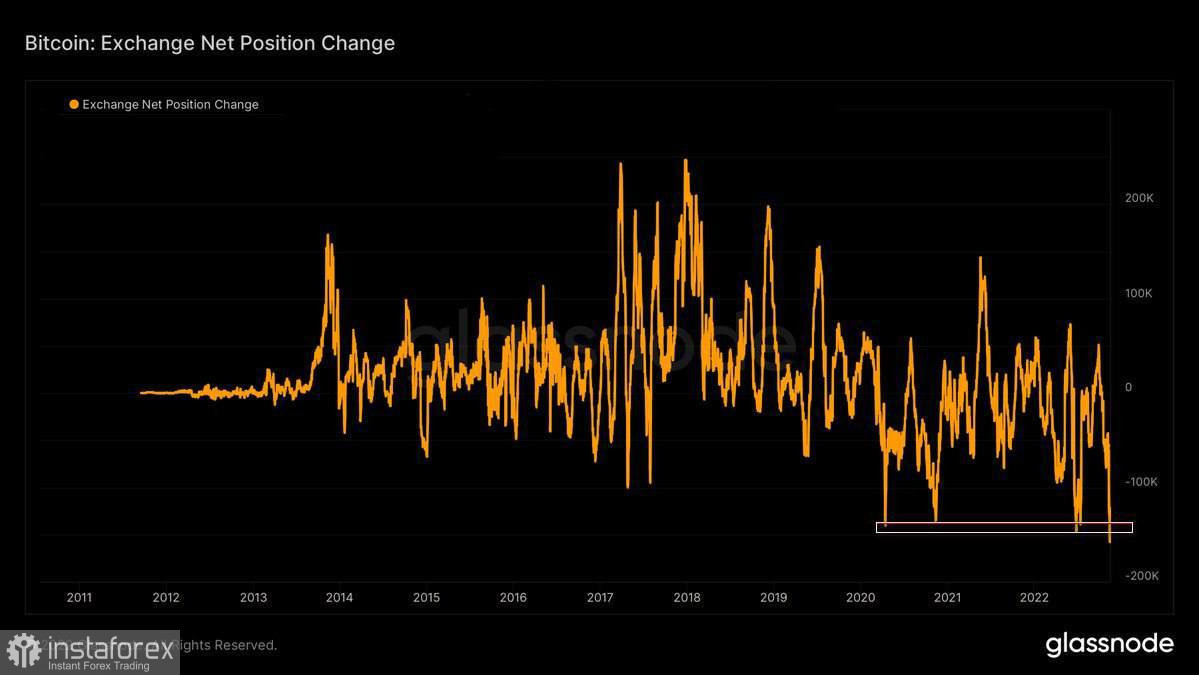

Despite the absence of resonant news and events, investors are starting to withdraw Bitcoin from centralized platforms. Glassnode records record BTC outflows from crypto exchanges. Over the past week, the volume of funds withdrawn reached 157,000 BTC.

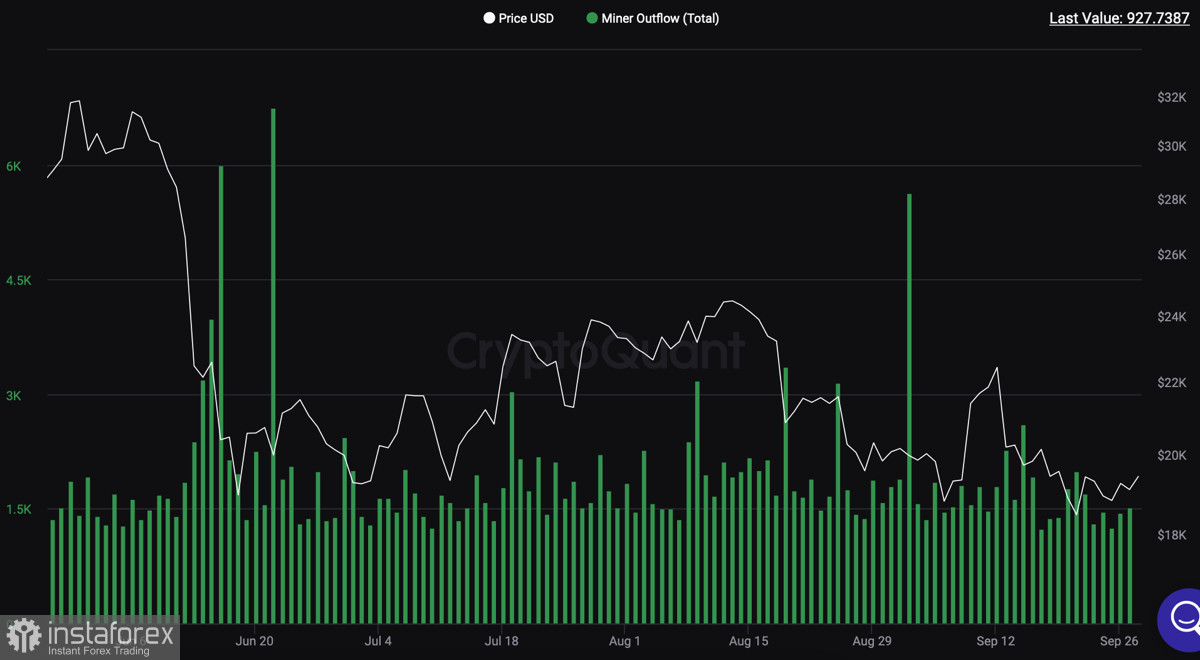

There is also a record capitulation of miners over the past five years against the backdrop of updating the local bottom with Bitcoin. According to on-chain data, mining companies sold about 7,760 BTC last week. The growing volumes of BTC coins sold indicate a significant deterioration in the state of affairs of miners.

Another worrying news was the possible bankruptcy of cryptocurrency lender BlockFi. Shortly before the news broke, the platform blocked the withdrawal of funds due to the bankruptcy of FTX. It is likely that BlockFi will be the first company to be hit by the FTX drop.

Is it not so bad in the medium term?

As for the longer run, there are positive signals that will help the market recover. Fed Vice Chairman Lael Brainard said that the latest inflation data will allow the regulator to slow down the key rate increase.

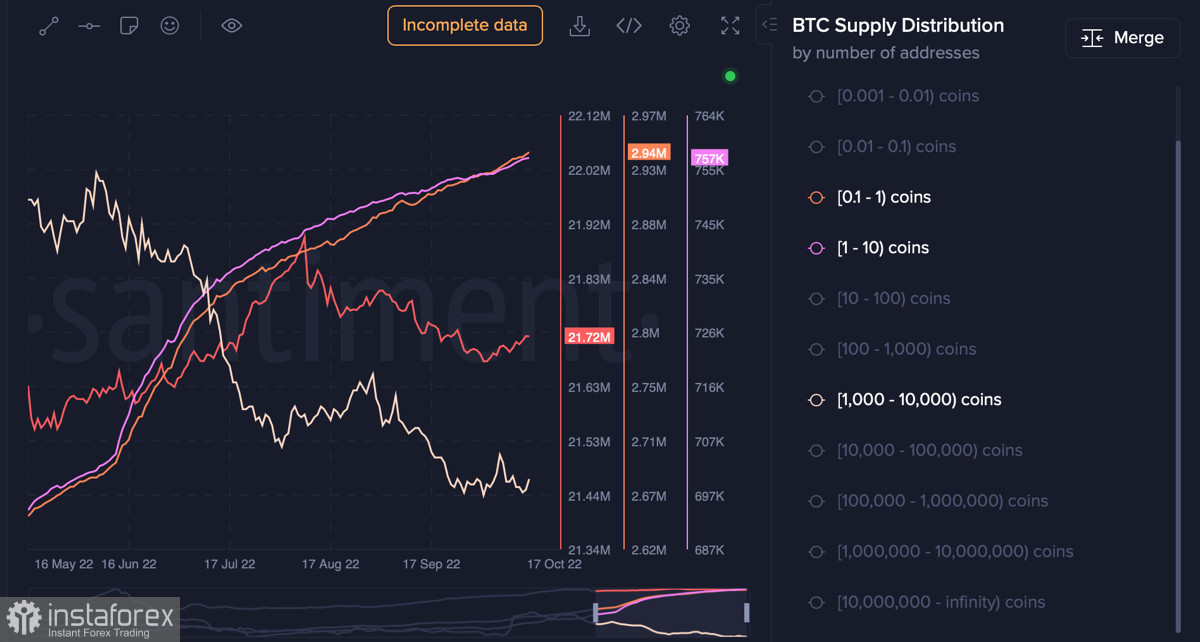

In addition, Santiment and Glassnode record the activation of long-term investors who are buying back the current market bottom. There is a significant increase in the number of addresses with balances from 0.1 to 100 BTC. Wallets with a balance of 100 to 1,000 BTC are also actively using the discount window on the crypto market.

BTC/USD technical analysis

Bitcoin continues to consolidate in a narrow range of $15.7k–$17.2k. The main support area of the cryptocurrency was the level of $16.7k. As long as the asset holds this milestone, buyers have a chance to gain a foothold above the key resistance zone at $17.2k.

As expected, trading volumes dropped significantly after updating the local bottom. It is worth adding that the outflow of users also provoked the collapse of FTX, and the reputation of centralized platforms was seriously shaken. Despite all these factors, buyers are trying to recover above $17k.

The technical metrics of the asset do not show signals for a serious change in the situation in the next few days . RSI and stochastic are moving flat near the lower border of the bullish zone. At the same time, MACD turned sideways, which may be the first signal to end the dominance of sellers.

At the same time, it is not worth counting on a serious recovery movement since the cryptocurrency has completely broken the correlation with stock indices. The stock market has shown good growth over the past two weeks, while the crypto market has updated the local bottom.

Results

In the near future, we should expect a lull in the crypto market and a decrease in trading activity. The main catalysts for significant changes will be fundamental news about the collapse of another crypto company or mining company.

Given JPMorgan's forecast for BTC falling to $13k and this indicator corresponding to an 85% drop from the absolute high, there is a possibility of a further decline in BTC/USD. At the same time, this is most likely to happen before mid-December since, subsequently, the market is waiting for a positively saturated period.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română