The three pillars of the upward trend in the USD index were American exceptionalism, an aggressive increase in the federal funds rate, and high demand for the dollar as a safe-haven currency. The US economy looked more resilient than others. The Fed ran ahead of the rest of the central banks like the leader of the pack on the road of tightening monetary policy, and numerous shocks in the global economy and politics forced investors to hide in safe-haven assets. In November, everything turned upside down. So, should we be surprised at the EURUSD trend reversal?

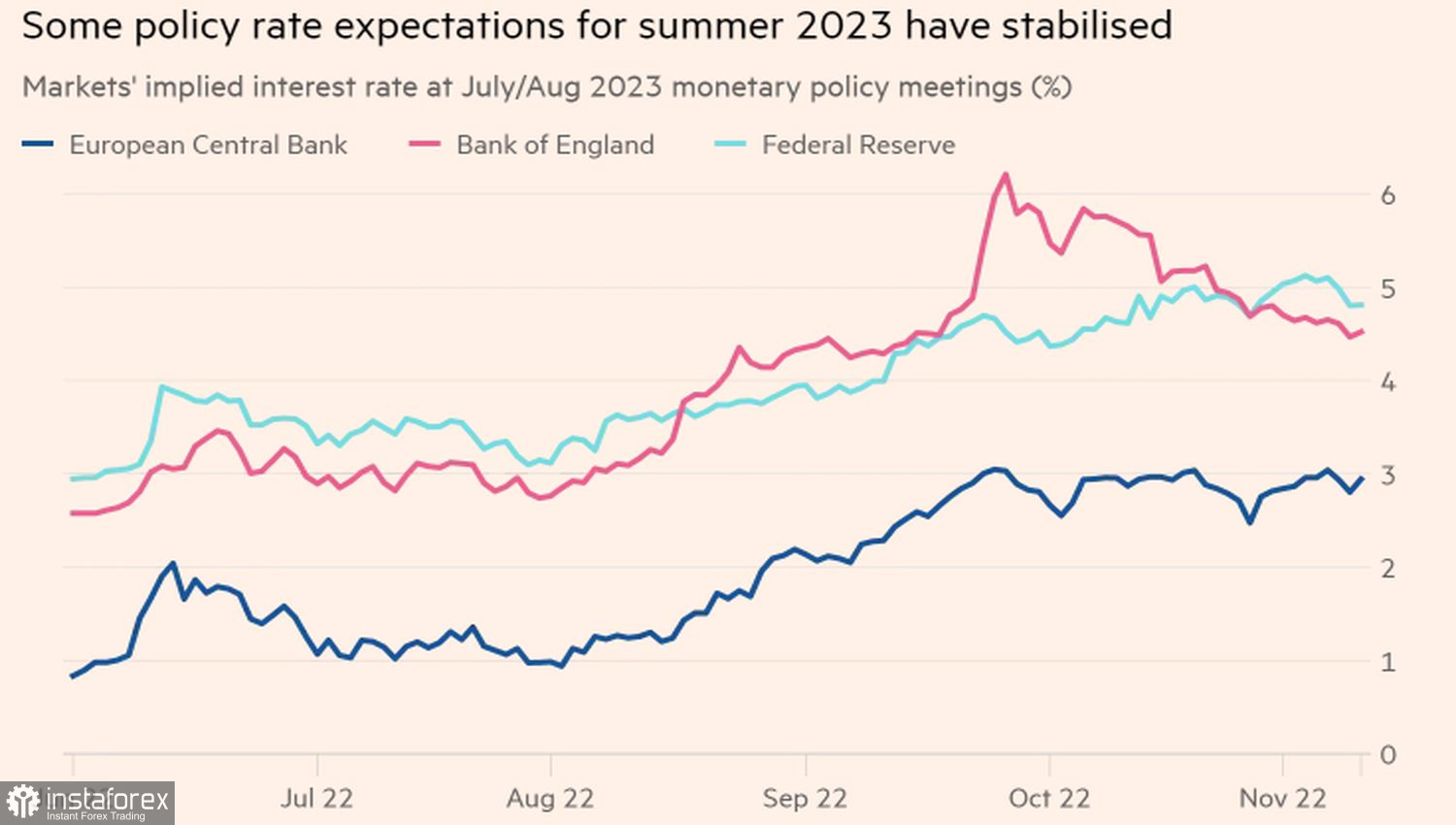

When the Fed began the process of monetary restriction in March, the ceiling of the federal funds rate was estimated by the futures market at 2.8%. The FOMC's September forecast raised it to 4.6%, and Jerome Powell's words that the peak will be even higher – up to 5%. Before the release of the US inflation data for October, rumors about 6% even circulated on the market, but the slowdown in consumer prices forced investors to lower the bar. As a result, the cost of borrowing may not reach 5%.

At the same time, inflation in the eurozone has not yet reached its maximum, which forces the market to maintain high expectations for the ECB deposit rate. The difference between the supposed extreme rates in the US and the eurozone is shrinking, which plays into the hands of the EURUSD bulls.

Dynamics of expected extreme rates of central banks

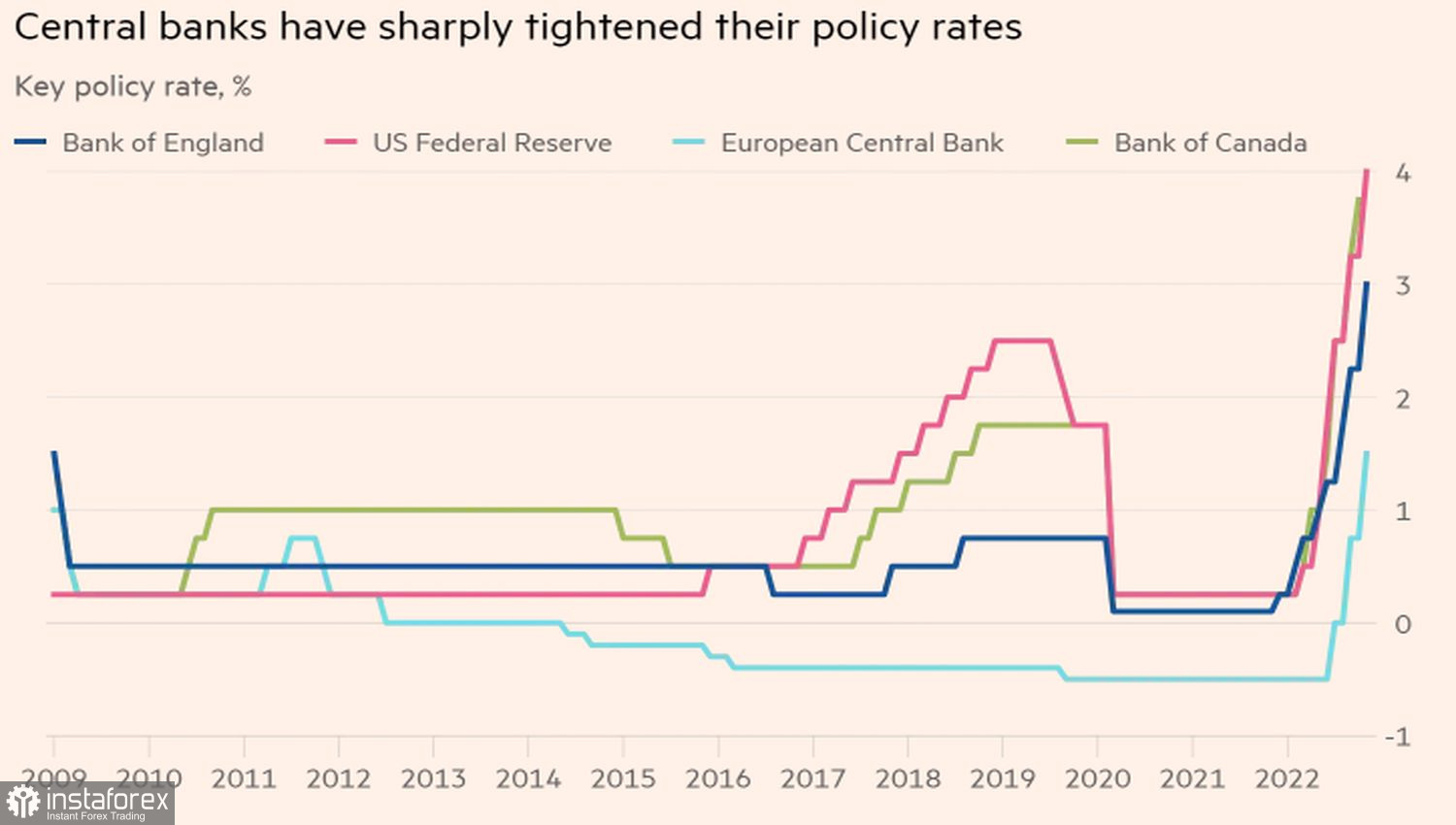

The more aggressively the Fed and other central banks tightened monetary policy, the higher were the risks that the global economy would plunge into recession. Regulators were focused on beating inflation and were often willing to sacrifice economic growth. Over time, their position has changed. First, the Reserve Bank of Australia and the Bank of Canada slowed down the rate of monetary restriction, then the Fed and the Bank of England made hints about this. Even ECB hawk Robert Holzmann noted that the Governing Council should be mindful of too drastic actions that could drive the eurozone into stagflation or recession.

Dynamics of Central Bank Rates

As a result, the idea of a soft landing for the US economy has been revived, suggesting a growing chance that it will still avoid a recession. In such conditions, the demand for safe-haven assets decreases, and the USD index falls.

Finally, warm weather in the euro area, an increase in the filling of gas reserves to 95% instead of the usual 80–85%, and a fall in prices for blue fuel gave rise to talk that the eurozone economy is not so bad compared to the United States. It is also able to avoid recession. If so, then American exceptionalism can be forgotten, which gives strength to fans of the euro.

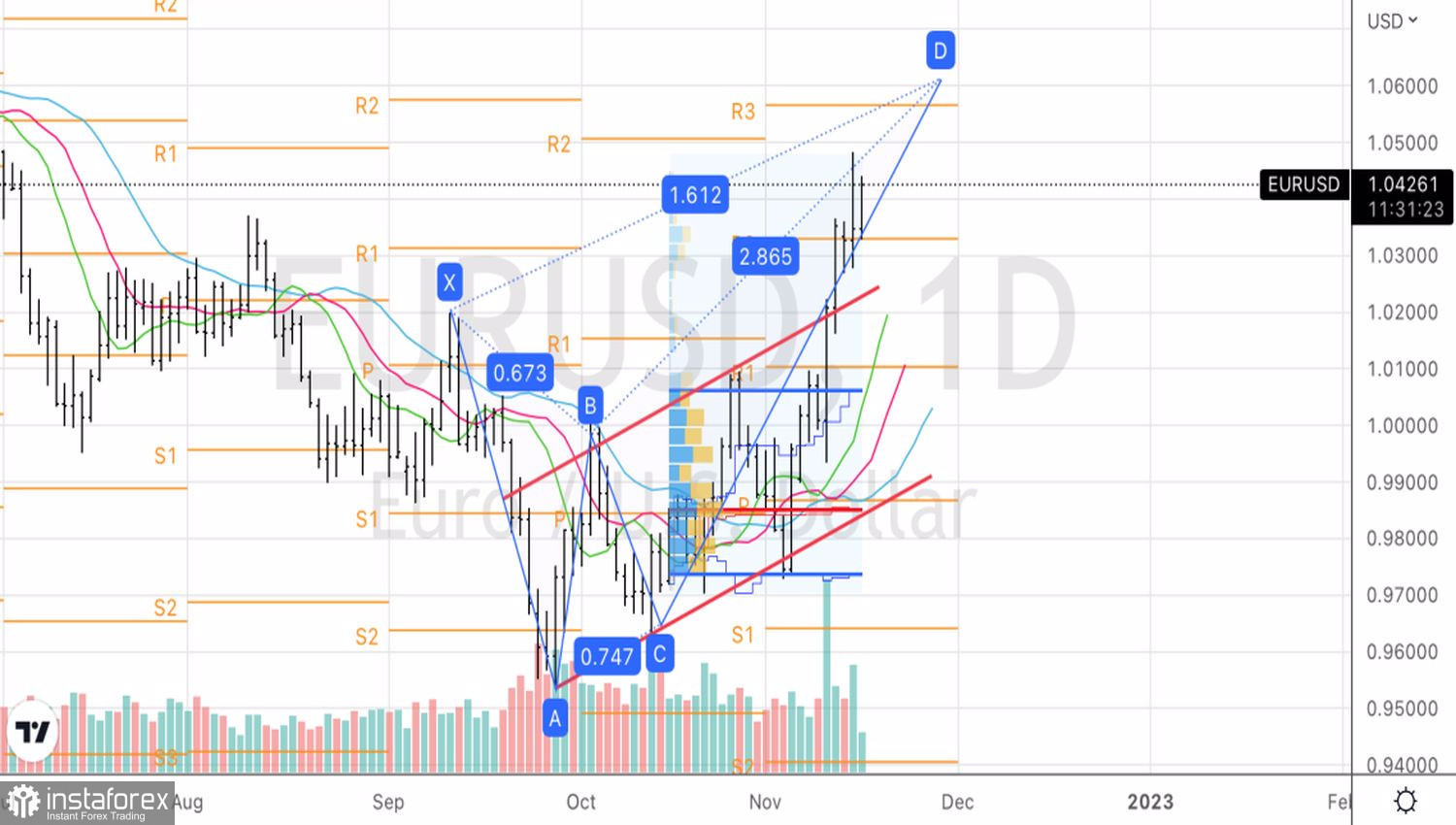

Technically, on the EURUSD daily chart, the bulls are making their second attack in the hope of breaking both to the psychologically important level of 1.05 and to the 161.8% target according to the AB=CD pattern. Note that it is located near 1.061. The strategies for buying the euro on pullbacks, voiced in the previous two materials, continue to work like clockwork. Why give them up?

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română