Bitcoin has fallen from grace. Back in April, 42% of hedge funds surveyed by PWC predicted that BTC would cost between $75,000 and $100,000 by the end of 2022. In 2021, JP Morgan didn't rule out the possibility of BTC/USD rising to $146,000 in the long term due to the token supplanting gold. Now, the company expects the leading cryptocurrency to fall to $13,000 amid turmoil related to the FTX bankruptcy. Investors have a reasonable question: what comes next? With that, they are getting rid of toxic assets.

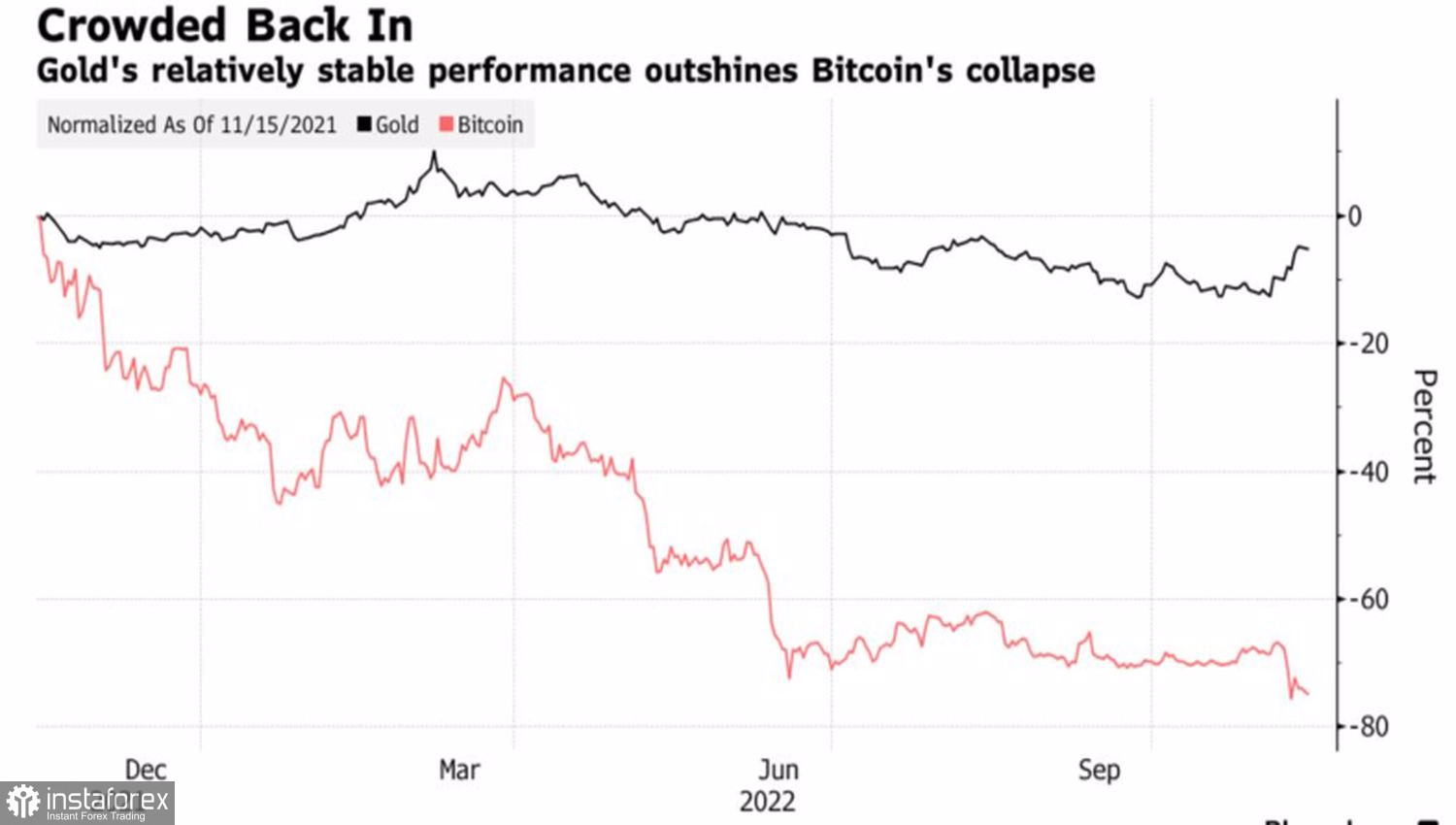

Performance of BTC and gold

Unlike bank deposits, funds held by customers on crypto platforms such as FTX are not protected by insurance companies or the government. Depositors have to rely solely on bankruptcy proceedings. And the courts have to figure out who owns the money – the customers or the platform itself? Although some companies are already starting to buy back claims for 3-5 cents per dollar, the impact has been very painful for Bitcoin.

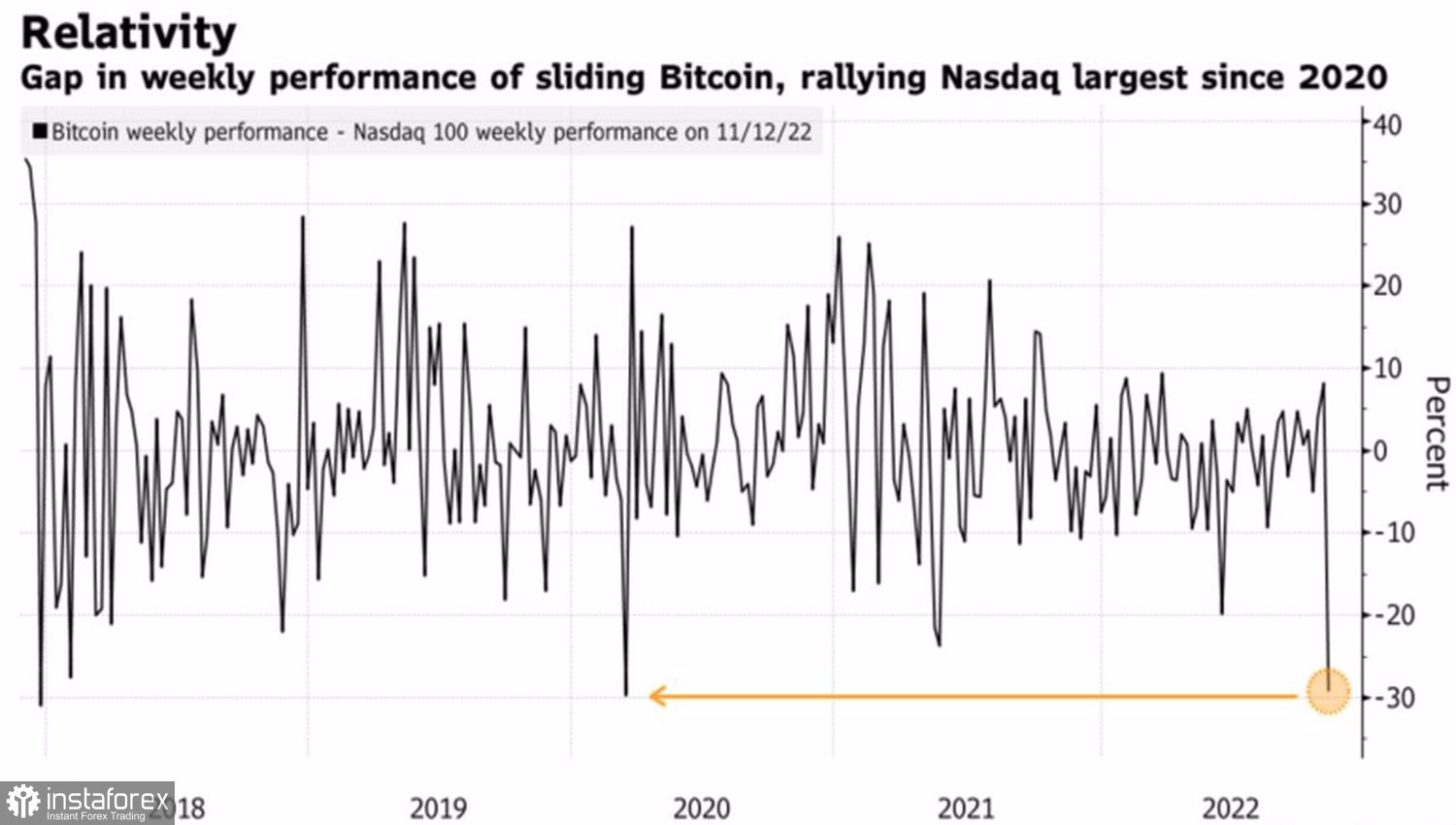

In the week to November 11, BTC was down by 23%, its worst performance since June. Back then the entire risky asset class was in decline, however. Now the S&P 500 rose by 5.9% over the five-day period thanks to decelerating US inflation and hopes that the Federal Reserve will soon slow the pace of monetary tightening as well. As a result, the correlation between the U.S. stock indices and the BTC/USD hit its lowest point in 2022. For the Nasdaq Composite, it has fallen to its lowest level since 2020.

Weekly performance of BTC

Bitcoin lately has found strong support in the capital inflows from institutional investors. They owned about 5% of the total volume of issued tokens. The crypto market cap fell from a record peak of $3 trillion in 2021 to its current level of $843 billion. Now, this asset class represents less than 1% of the global equity market.

The bankruptcy of FTX showed investors the idea that Bitcoin can become a full-fledged asset in an investment portfolio was incorrect. Why buy BTC when you can find a more reliable alternative? It is better to bet on BTC/USD declining or to hedge risks by selling futures contracts. That's exactly what institutional investors are doing. As a result, the market has entered backwardation, when the spot price is higher than the futures price. This was not the case during previous massive sell-offs.

Despite the serious pain caused by the bankruptcy of FTX, Bitcoin is trying to recoup some of its losses. Historical data suggests that during six previous collapses by 20% or more during the week, BTC/USD subsequently rose by 9% on average over the course of the month.

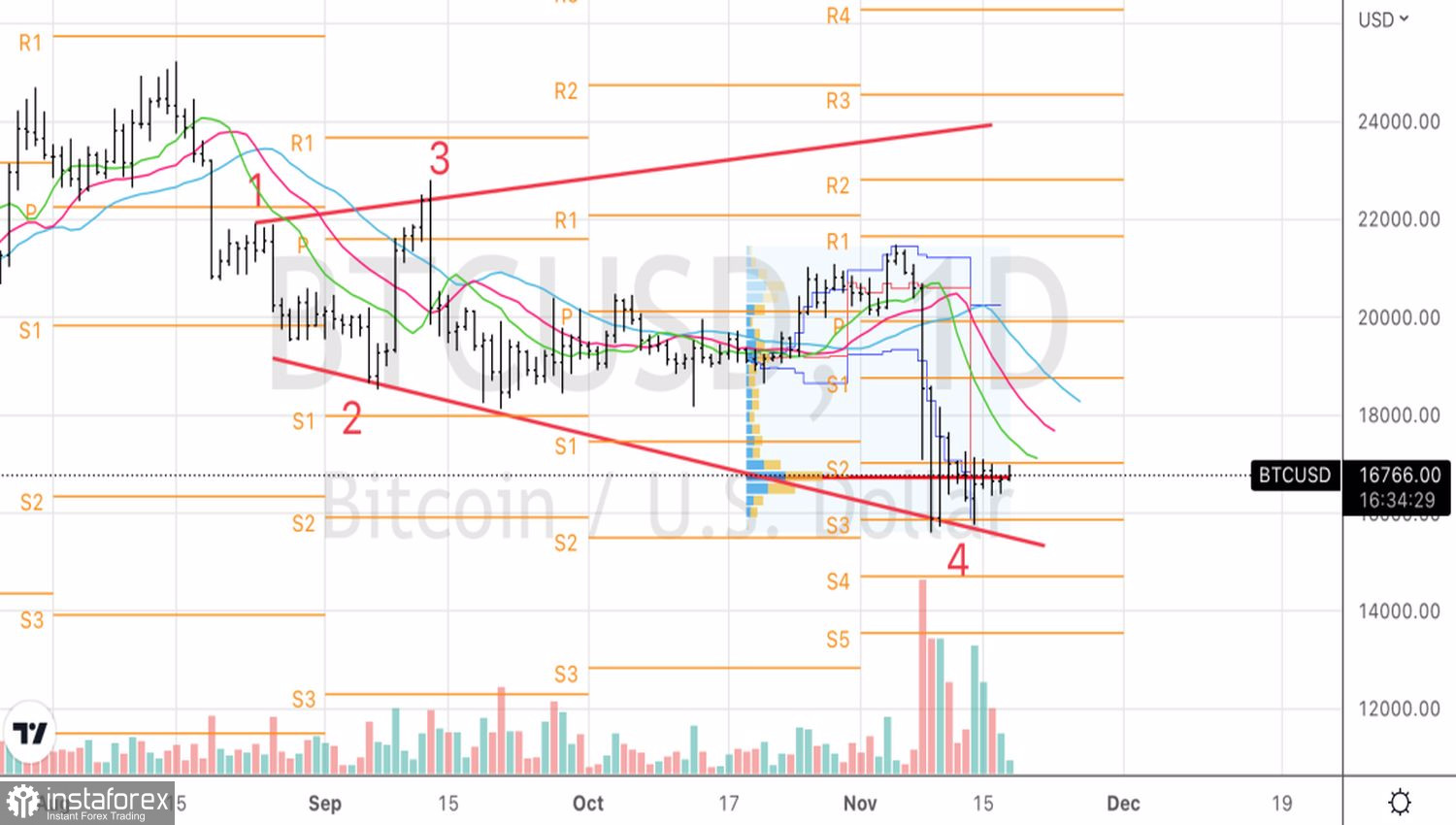

From a technical standpoint, there is a steady downtrend on the Bitcoin's daily chart. BTC is moving away from moving averages. Its rebound from dynamic resistance levels of $17,200, $17,500 and $18,000 should be used to open short positions. The same applies to successful breakouts below the support at $16,340 and $15,870. Initial targets are $14,700 and $13,600.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română