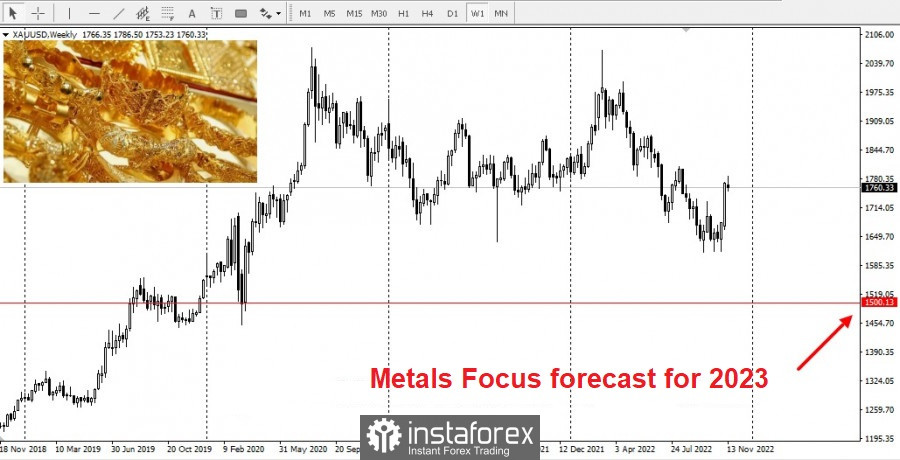

Although gold and silver showed strong gains in November, they are still likely to face challenges in 2023 as US monetary policy is expected to remain extremely tight. Metals Focus, in their price forecast for 2023, said gold prices could fall 10% next year, hitting a four-year low of about $1,500 an ounce in the fourth quarter.

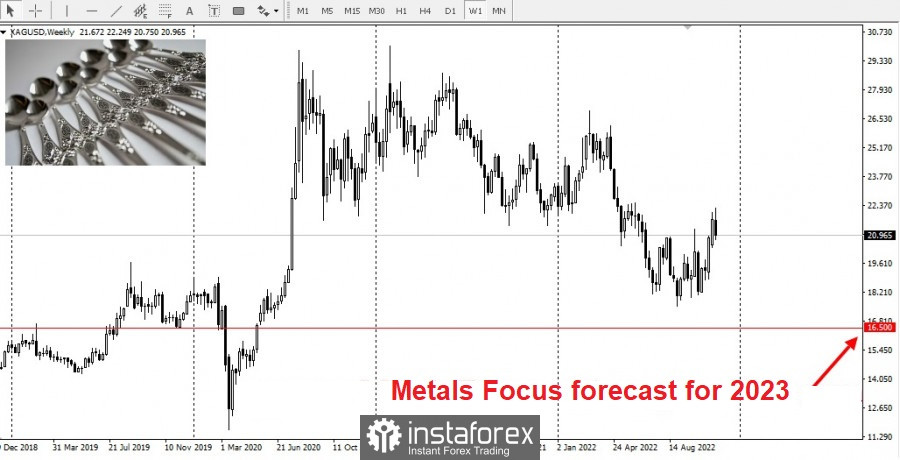

They have an even bleaker outlook for silver, that is, a 17% drop in 2023. They said prices could fall to about $16.50 an ounce in the fourth quarter.

Silver is expected to suffer from a financial spillover despite strong fundamentals. This is because the Fed's monetary policy and its impact on dollar and bond yields will continue to be the biggest headwinds for gold and silver.

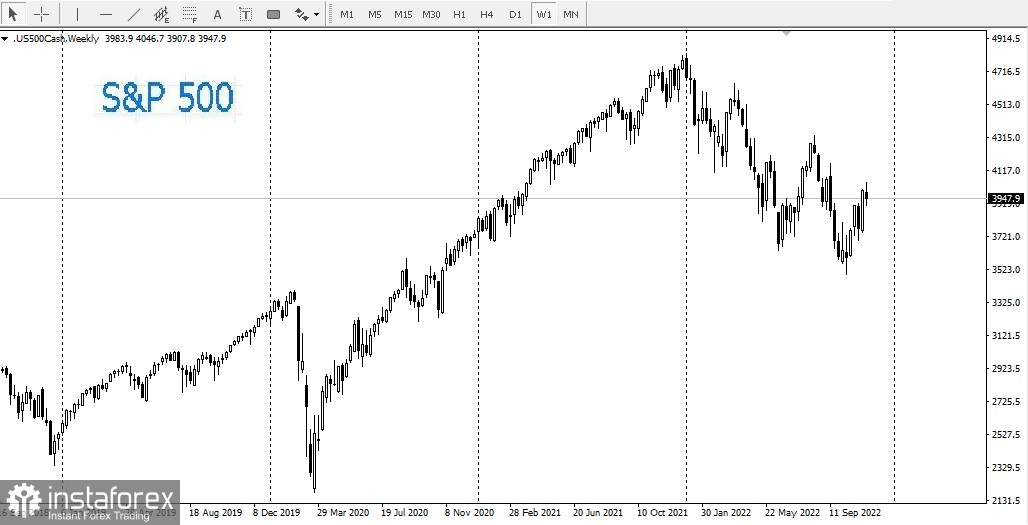

But even though prices are expected to decline through 2023, the two precious metals play an important role in investors' portfolios. Analysts expect both gold and silver to outperform equity and bond markets. After all, even at its lowest point this year, when gold prices fell to a two-year low of $1,618, it outperformed the S&P 500. And even now, with stock markets approaching 4,000 points, the index is still down more than 17%.

Metals Focus also expects lower gold prices to continue to support physical demand, which should keep prices stable through 2023. Meanwhile, silver is lagging behind as weak industrial demand weighs on the metal. Industrial use accounts for more than 50% of silver demand.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română