Markets responded to the second tectonic shift in Britain's fiscal policy in the last few months quieter than to the first one. GBP/USD hit rock bottom after the government headed by Liz Truss announced a fiscal package worth 45 billion pounds. This time, New Chancellor of the Exchequer Jeremy Hunt unveiled plans for tax increases and budget spending cuts of 55 billion. This plan aroused a muted response. The sterling weakened a bit but regained its footing shortly after.

London realizes that it should act cautiously when investors' trust is at stake. The government of Rishi Sunak indents to raise taxes and cut budget spending proportionally by 55 billion pounds in order to fill the fiscal gap. The program is due to start in 5 years. In essence, the UK will go ahead with bond purchases in the amount of 300 billion pounds until 2027. Coupled with higher bond service costs, it will entail a dramatic effect. In 2020 alone, loan spending will total 120 billion pounds which equals 5% of GDP and 12% of the budget revenue. Such figures had not been seen since 1956. No wonder, the Office for Budget Responsibility predicts a recession in 2023.

UK GDP forecast

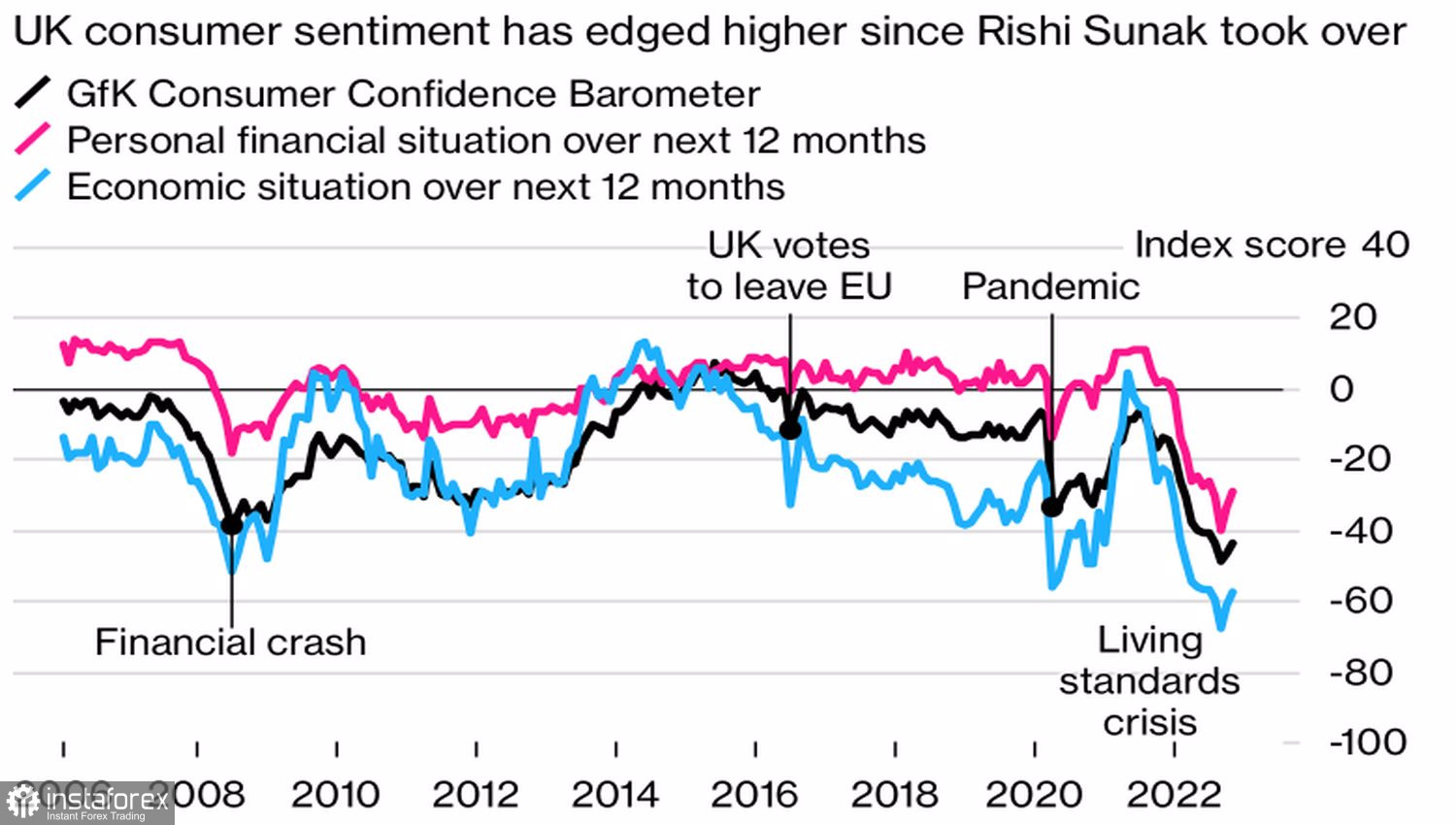

However, global investors have been already speculating on the theme of an economic slowdown in the UK. A few months ago, the Bank of England warned of a recession for five quarters straight. Such prospects have already been priced in market quotes of the pound sterling. Besides, a muted response to the tightening of fiscal policy means that the government managed to win back investors' trust. The same conclusion can be made on the grounds of the consumer confidence index which has been recorded in the GfK survey for the second month in a row.

Consumer Sentiment in UK

Importantly, it is not enough that Rishi Sunak and his team in tandem will develop efficient fiscal and monetary policies. The pound sterling needs other catalysts to reinforce its rally. The sterling is propped up in November by a recovery in global stock indices and a rising appetite for risk in consequence.

Investors cheer the Federal Reserve's intention to ease the pace of monetary tightening, rumors of removing COVID restrictions in China, and a decline in gas prices in Europe. These factors will make a recession in the eurozone less protracted and less profound. On the other hand, some factors sustain traders' interest in the US dollar such as the hawkish rhetoric of the FOMC policymakers, expectations of another jumbo rate hike, an increase in coronavirus cases in China, and the pending cold winter in Europe. Amid such fundamentals, there is a fifty-fifty chance of GBP/USD developing both an uptrend and a downtrend.

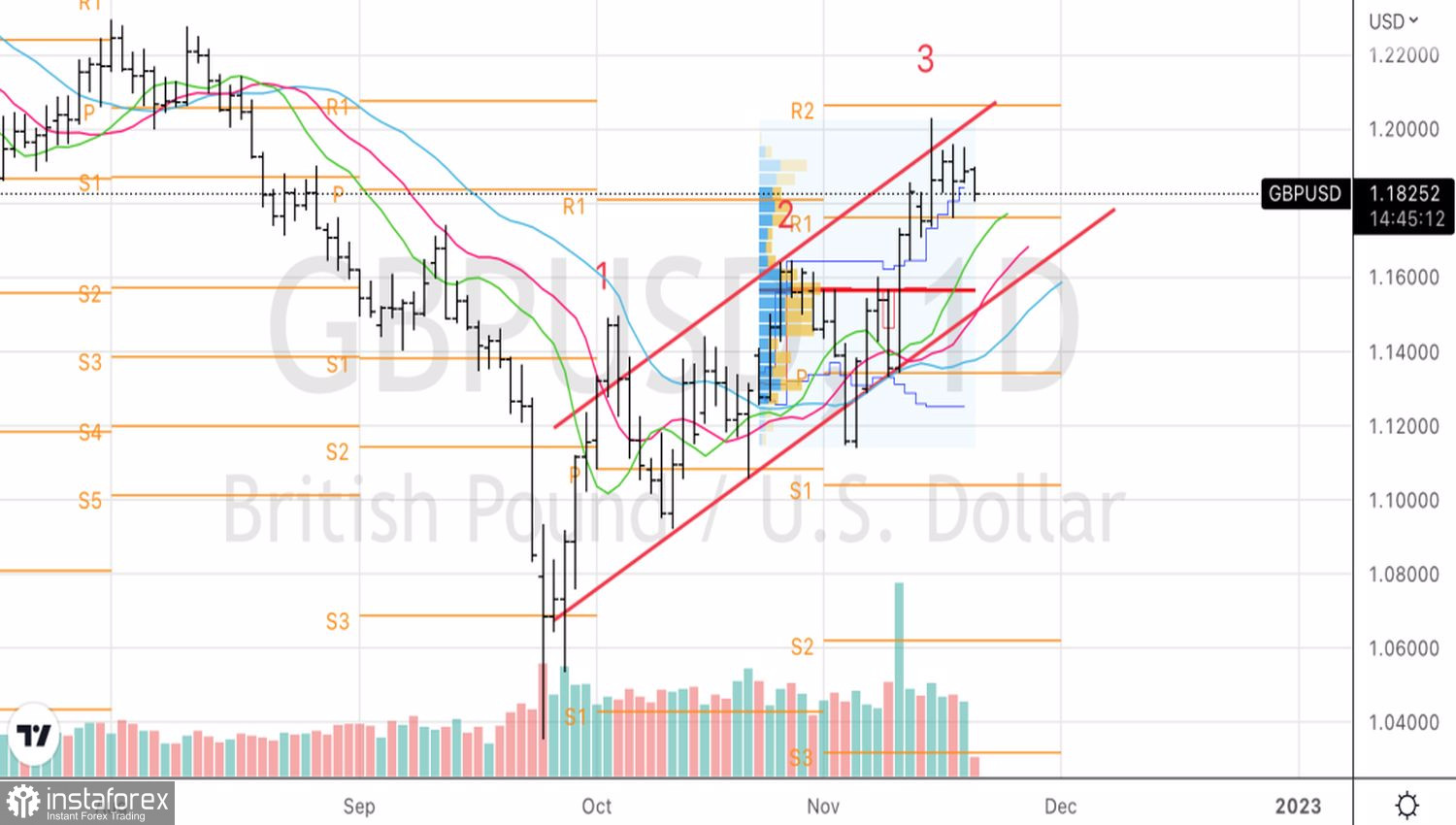

From the technical viewpoint, a Three Indians pattern is in progress on the daily chart of GBP/USD. The previous strategy of buying GBP/USD during a rebound at the support of 1.175 has worked out efficiently. The currency pair climbed above 1.2 but then, the bears entered the market. If support levels of 1.181 and 1.176 are broken, traders will find an excuse to sell GBP towards 1.166 and 1.156. Then, the bulls will take the lead.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română