The situation on Forex is changing rapidly. As soon as the Fed began to consider slowing down the pace of interest rate hikes and US inflation showed signs of cooling, the dollar posted a wave of sell-offs. However, after ECB officials began to follow the Fed's rhetoric and investors expressed doubts that it would be easy to combat high prices, the EUR/USD pair collapsed from the 5-month highs, casting doubt on whether the long-term downtrend had been broken.

ECB chief economist Philip Lane said that the December increase in the deposit rate would not be the last one. He also added that the regulator would probably continue to raise borrowing costs in 2023, albeit at a slower pace. According to him, monetary policy moves filter through to the economy with a delay and the European Central Bank should take this into account. This somewhat resembles the accompanying policy statement made by the FOMC in November on the cumulative impacts of rate increases and the need to be aware of them. It seems that both the Fed and the ECB are going to temper the pace of coming interest rate hikes, which deprives euro bulls of an important advantage.

The euro's rally in early November was also caused by hopes for a soft landing due to the Fed's more resilient attitude. According to BofA, this is fundamentally wrong. The longer the US economy remains stable, the more difficult it is for the Fed to fight inflation, and the higher the risks that inflation expectations will start to rise again. The central bank needs to act more aggressively to break this vicious circle. It seems too early to expect that Jerome Powell and his colleagues will pause, which supports euro bears.

Besides, the euro is coming under pressure from the gloomy outlook for US stock indices. Goldman Sachs notes that stocks do not typically recover from troughs until the rate of deterioration in economic and earnings growth slows down. The strategists estimate that the S&P 500 will end 2023 at around the 4,000 mark, which is not far from current levels.

S&P 500 recap and outlook

This opinion echoes that of Morgan Stanley, which also sees the major US stock index trading at around 4,000 by the end of next year. At the same time, the company predicts the S&P 500 could fall by 24% at the end of the first quarter and it would be extremely difficult for the stock market to recover. Experts attribute this drop to deteriorating global risk appetite, which fuels demand for safe-haven assets, including the US dollar.

Thus, the driving forces behind the dollar's bullish run are still relevant. This makes investors doubt that the long-term downtrend in the main currency pair has been broken.

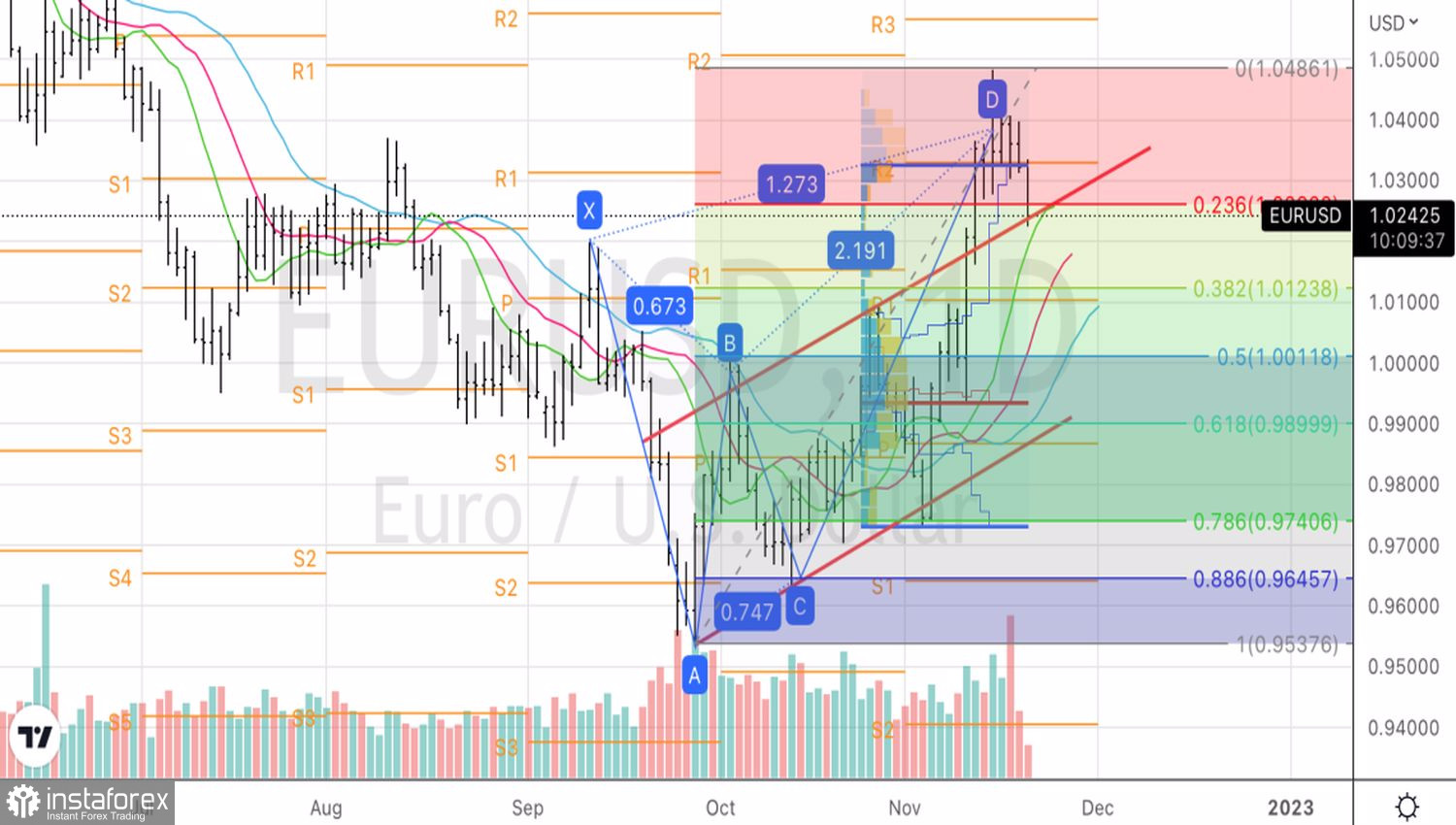

From a technical point of view, the daily chart shows that our strategy suggesting short positions amid a breakout of support at 1.033 presented in the previous article has proven effective. The quotes reached the target at the 127.2% level according to the Butterfly pattern and then entered a correction as expected. For now, the best way to make a profit is to keep short positions open. However, a rebound from 1.022 or 1.015 may lead to a reversal.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română