On Monday, the EUR/USD currency pair surpassed the moving average line, so now we have our first sell signals. Remember that the euro has been growing logically and sensibly over the past few weeks and that we have anticipated a significant downward correction for more than a week. There are specific technical reasons for this to happen after the pair is fixed below the moving average. The dollar is unlikely to have good reasons to keep falling in the upcoming weeks or months, as we have stated numerous times. The Fed rate is still higher than those of the BA and ECB. The Fed rate will undoubtedly continue to increase for the next four months, even at a slower rate than before. Relations between the West and the Russian Federation are getting worse, and the geopolitical landscape is still extremely complicated. Furthermore, Finland and Sweden might formally join NATO in the upcoming months, and I don't even want to consider what might happen. Therefore, many factors still support the dollar's elevated position compared to the euro or the pound.

Remember that the pair may grow despite the fundamental and geopolitical backgrounds if there are technical reasons for doing so. They might even be sufficient. However, this cannot go on for very long because the "technique" reflects current market behavior. What are we seeing? The euro/dollar pair has been rising in recent months after two years of decline. Assuming that the market will now quickly close short positions after setting profits is simple. We come to a technical correction that is very challenging to understand from a macroeconomic or foundational standpoint. However, this "profit-taking" process will eventually end, and the euro currency will require specific justifications for an upward trend.

How can the situation with the Fed rates affect the market mood?

The current state of the Fed's interest rate situation is as straightforward and clear as possible. In the absence of an unexpected event, the rate will rise once by 0.5% and twice by 0.25%. Many of the Fed's monetary committee members have been discussing this lately. Since inflation has begun to decline and has been doing so for four consecutive months, slowing tightening is already necessary. However, it would help if you also considered the economy, as each new rate increase will impede its expansion. The American economy is experiencing a recession, but experts are divided over when it will begin and what qualifies as a "recession" and what does not. Recall that the Fed predicts a small recession rather than a full-blown downturn, which would make sense given the economy's swift recovery from the pandemic. According to official projections, the US economy will slow down but not contract over the next two years. If this is the case, there will be less of a reason for the dollar to fall.

The future of the economy in the European Union is also partially clear. Moreover, a few months ago, many experts and journalists publicly dissipated the panic caused by the gas shortage. Following the "Northern Streams sabotage," this subject has gained increased relevance. Later, it was learned that there might not be enough gas and that it would be wise to make savings, but there was no need to discuss a "gas crisis." The severity of the upcoming winter will have a major impact. However, given the constant discussion of global warming, it can get quite warm. The demand for gas will then decline, and as of a few weeks ago, according to Ursula von der Leyen, the European Union was able to replace roughly 75% of the Russian gas being used at the time. So, it needs to be clarified how much the European economy will suffer due to the gas shortage and the increased ECB rate. We believe neither the dollar nor the euro shows signs of strong or long-term growth.

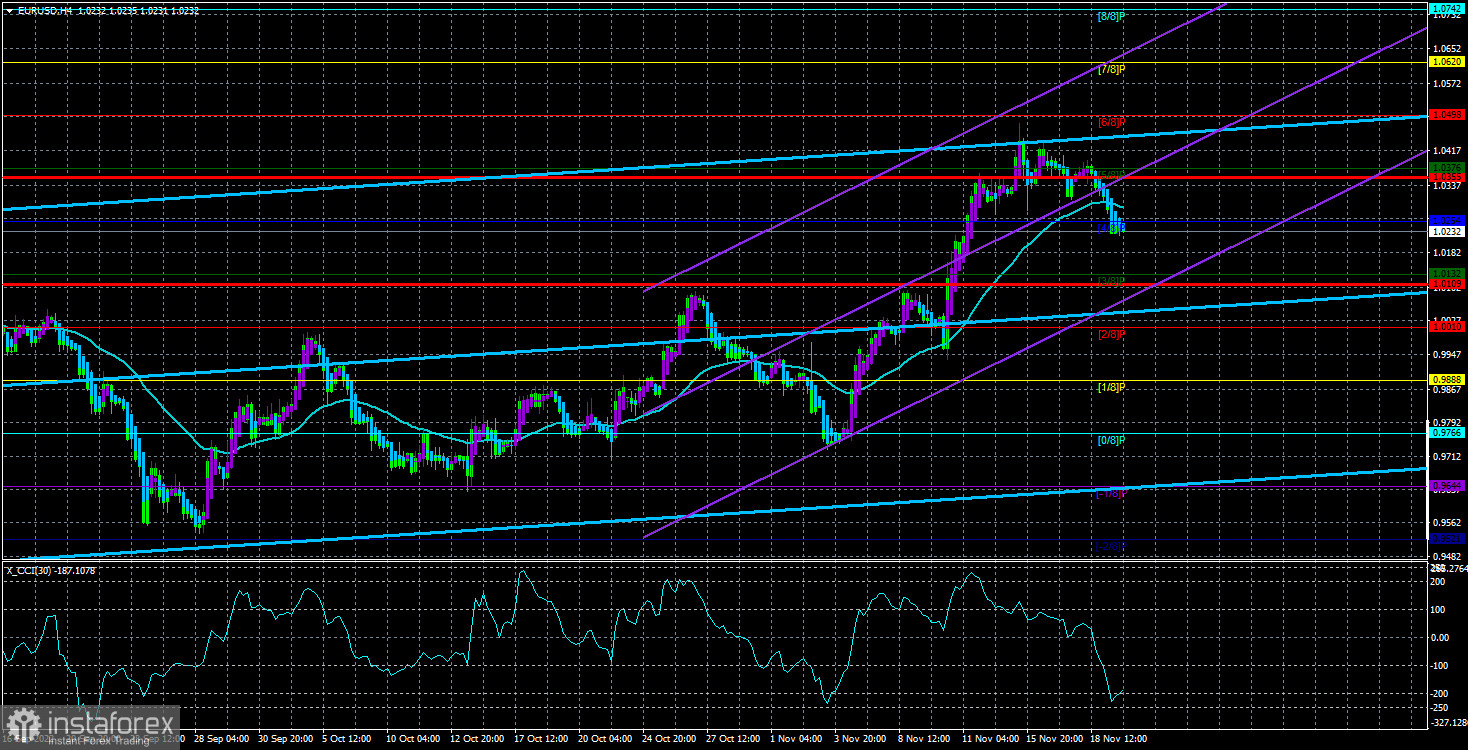

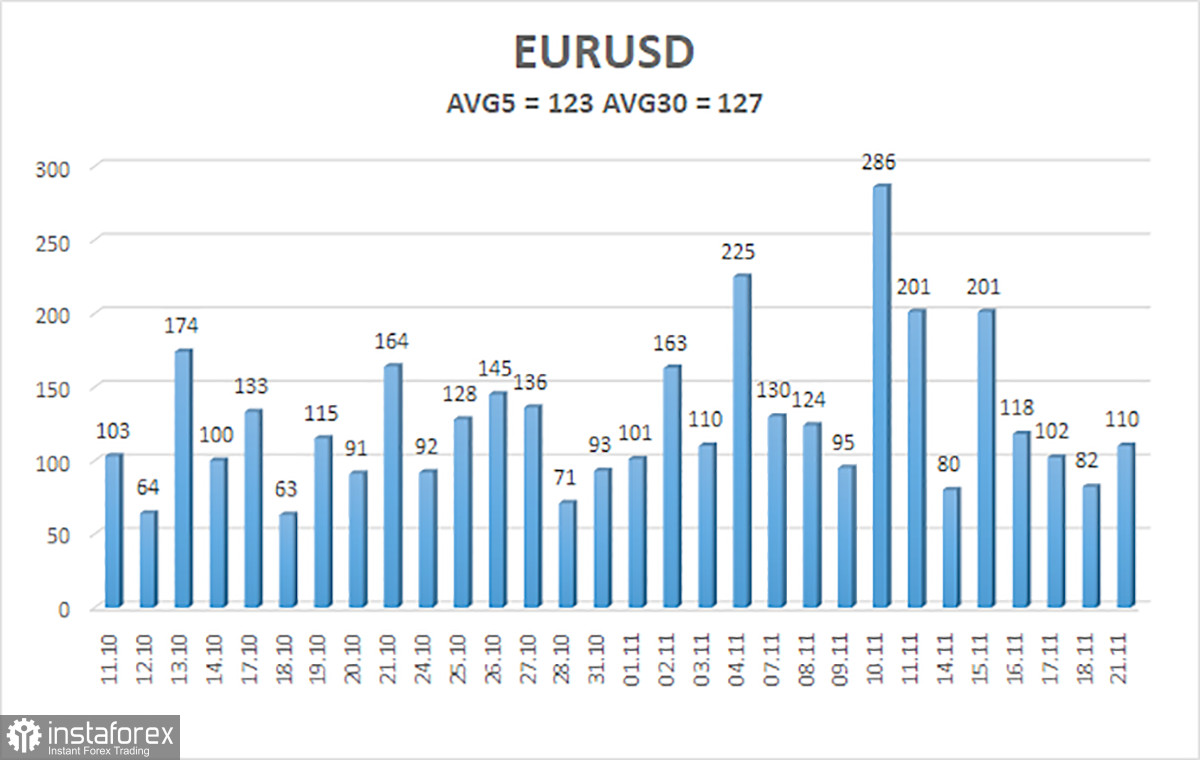

As of November 21, the euro/dollar currency pair's average volatility over the previous five trading days was 123 points, which is considered "high." As a result, we anticipate that the pair will fluctuate on Monday between levels 1.0109 and 1.0355. An upward turn of the Heiken Ashi indicator will indicate a potential continuation of the upward movement.

Nearest levels of support

S1 – 1.0132

S2 – 1.0010

S3 – 0.9888

Nearest levels of resistance::

R1 – 1.0254

R2 – 1.0376

R3 – 1.0498

Trading Suggestions:

Below the moving average, the EUR/USD pair has been consolidating. Thus, until the Heiken Ashi indicator turns up, you should hold short positions with targets of 1.0132 and 1.0109. With targets of 1.0376 and 1.0498, purchases will only be relevant after the price fixes above the moving average line.

Explanations of the illustrations:

Linear regression channels – help to determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels – target levels for movements and corrections.

Volatility levels (red lines) – the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română