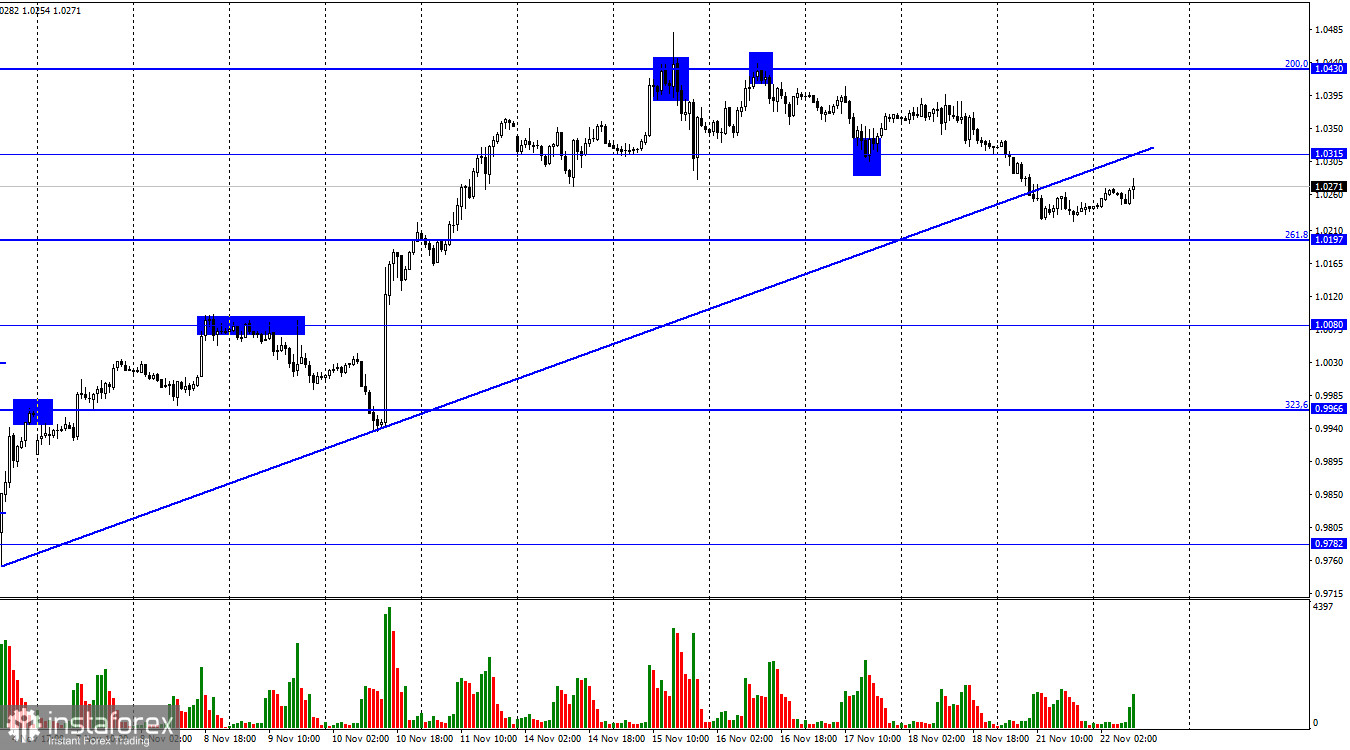

Hello, dear traders! The EUR/USD pair went down on Monday and consolidated below the trend line. According to the hourly chart, bearish sentiment mounted and the pair fell to the 261.8% retracement level of 1.0197.

Yesterday, the pair traded horizontally despite the empty macroeconomic calendar. Meanwhile, the San Francisco Fed president said the central bank should consider reducing the pace of interest rate hikes. Thus, most members of the Committee now advocate for it. In other words, the Fed may raise the interest rate by 0.50% in December. In fact, such a possibility has long been priced in by traders.

In my view, the fact that the greenback has been on a losing streak over the past several weeks confirms that. If this is the case, it means that the dollar has no reason for extending the downtrend anymore. The pair's consolidation below the trend line indicates that bears may return to the market. This week, the euro may plunge by as many as 200-300 pips. On Tuesday, the pair is likely to show a sluggish movement. It may rise to 1.0315, pull back, and drop to 1.0197 or even lower.

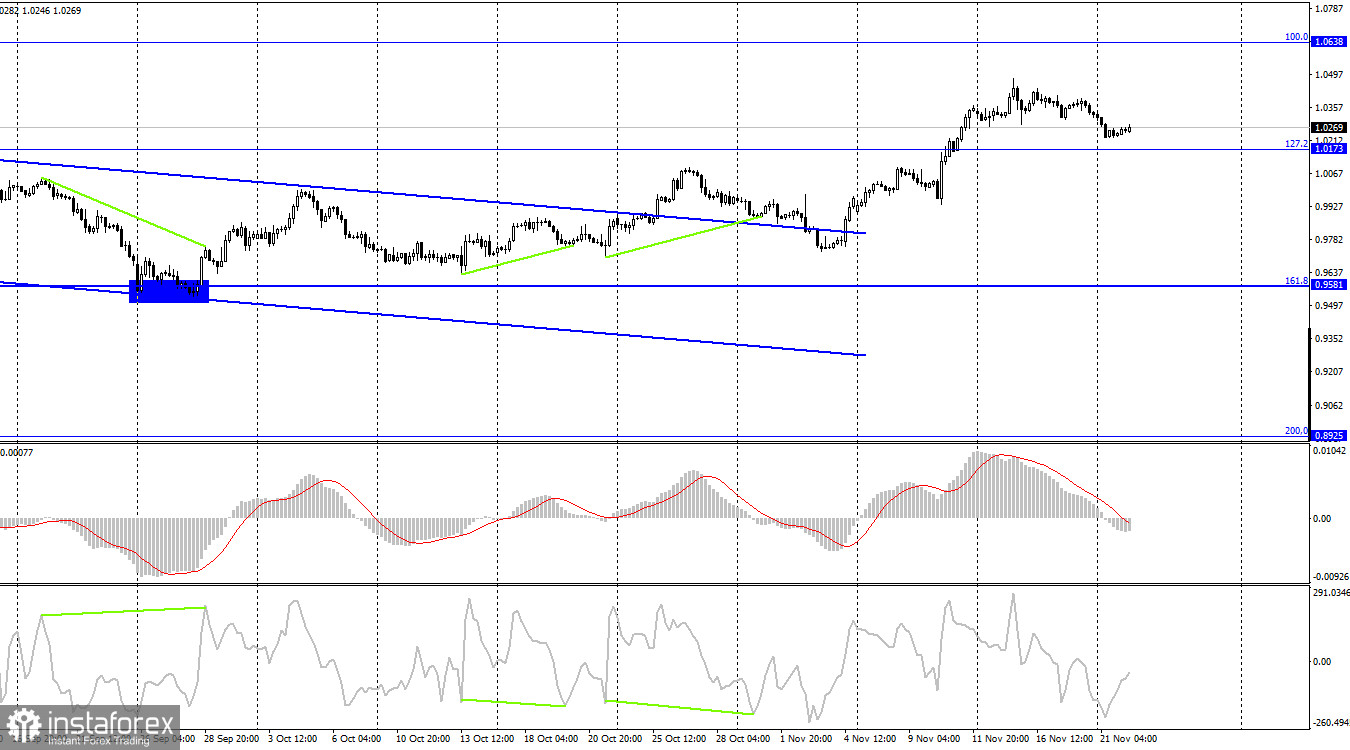

On the 4-hour chart, the pair closed above the 127.2% retracement level of 1.0173. The price is now gradually moving back to this mark. In case of a rebound, growth may extend to the 100.0% retracement level of 1.0638. Should the pair settle below 1.0173, the euro may tumble to the 161.8% Fibonacci retracement of 1.9581.

Commitments of Traders:

Last week, speculators opened 7,052 long positions and 1,985 short positions, reflecting an increase in bullish sentiment among major players. The number of longs and shorts held by speculators totals 239,000 and 126,000 respectively. The COT report illustrates an increase in the euro. Although the currency has shown more growth potential over the past several weeks, traders are still not ready to give up USD purchases. Therefore, I think it is now wiser to focus on the descending corridor on the H4 chart, above which the price managed to close. Consequently, we may see the extension of the uptrend.

Scheduled macro events in the United States and the eurozone:

On November 22, the macroeconomic calendar is empty both in the eurozone and the United States. Therefore, fundamental factors will have no influence on the market today.

Outlook for EUR/USD:

It will become possible to open short positions after consolidation below the trend line on the hourly chart, with targets at 1.0197 and 1.0080. Long positions could be considered after a rebound from 1.0173 on the 4-hour chart, with targets at 1.0315 and 1.0430.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română