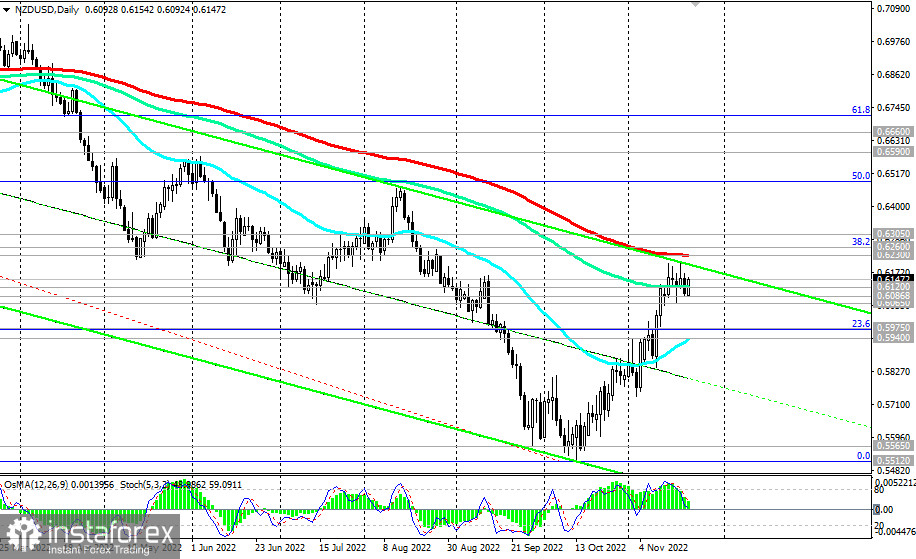

Today, NZD/USD continues to develop an upward correction, moving towards the key long-term resistance level of 0.6230 (200 EMA on the daily chart).

From a technical point of view, also taking into account the growth potential of the US dollar, a pullback is likely around this resistance level and some stabilization around the levels of 0.6200 and 0.6100.

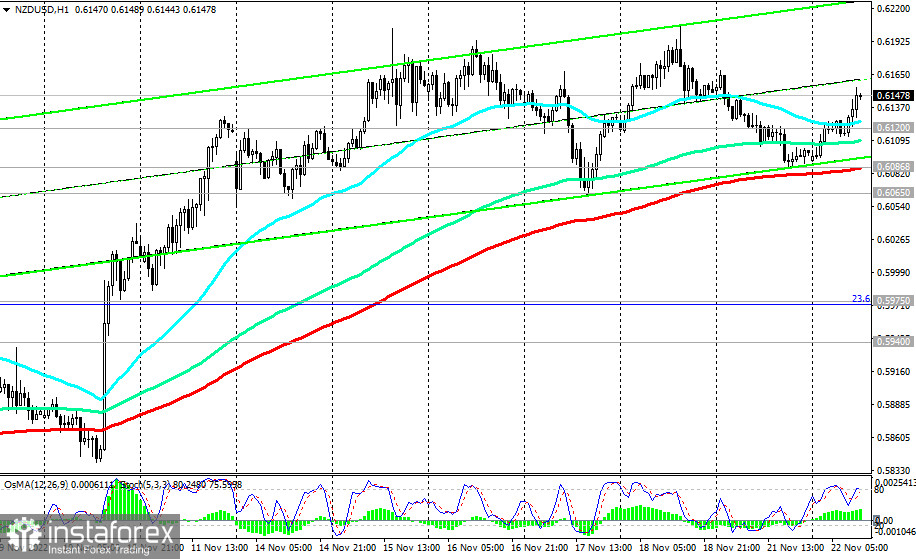

At the same time, below the resistance level of 0.6230, NZD/USD remains in a long-term bear market zone. The first signal for the resumption of short positions will be a breakdown of support levels 0.6086 (200 EMA on the 1-hour chart), 0.6065 (local support level).

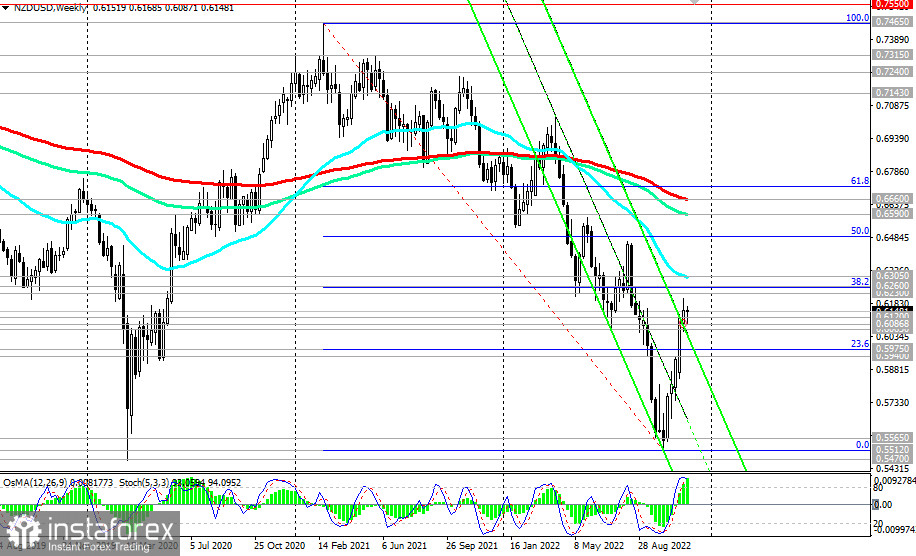

In the alternative scenario, NZD/USD will continue to rise towards the next long-term resistance level of 0.6305 (50 EMA on the weekly chart). Its breakdown, in turn, significantly increases the chances of NZD/USD returning to a long-term bullish trend.

Support levels: 0.6120, 0.6086, 0.6065, 0.5975, 0.5940, 0.5900, 0.5860, 0.5600, 0.5565, 0.5512, 0.5470

Resistance levels: 0.6200, 0.6235, 0.6260, 0.6305

Trading Tips

Sell Stop 0.6085. Stop-Loss 0.6175. Take-Profit 0.6065, 0.5975, 0.5940, 0.5900, 0.5860, 0.5600, 0.5565, 0.5512, 0.5470

Buy Stop 0.6175. Stop-Loss 0.6085. Take-Profit 0.6200, 0.6235, 0.6260, 0.6305

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română