Will the US economy be able to avoid a recession? The answer to this question depends on how quickly inflation will decline. This in turn depends on the pace of monetary policy tightening by the Fed. The central bank is making every effort to assess the cumulative effect of its previous moves and, if possible, steer the economy back from the brink. Whether it works or not, time will tell. In the meantime, traders are trying to figure out what the Fed thinks about it.

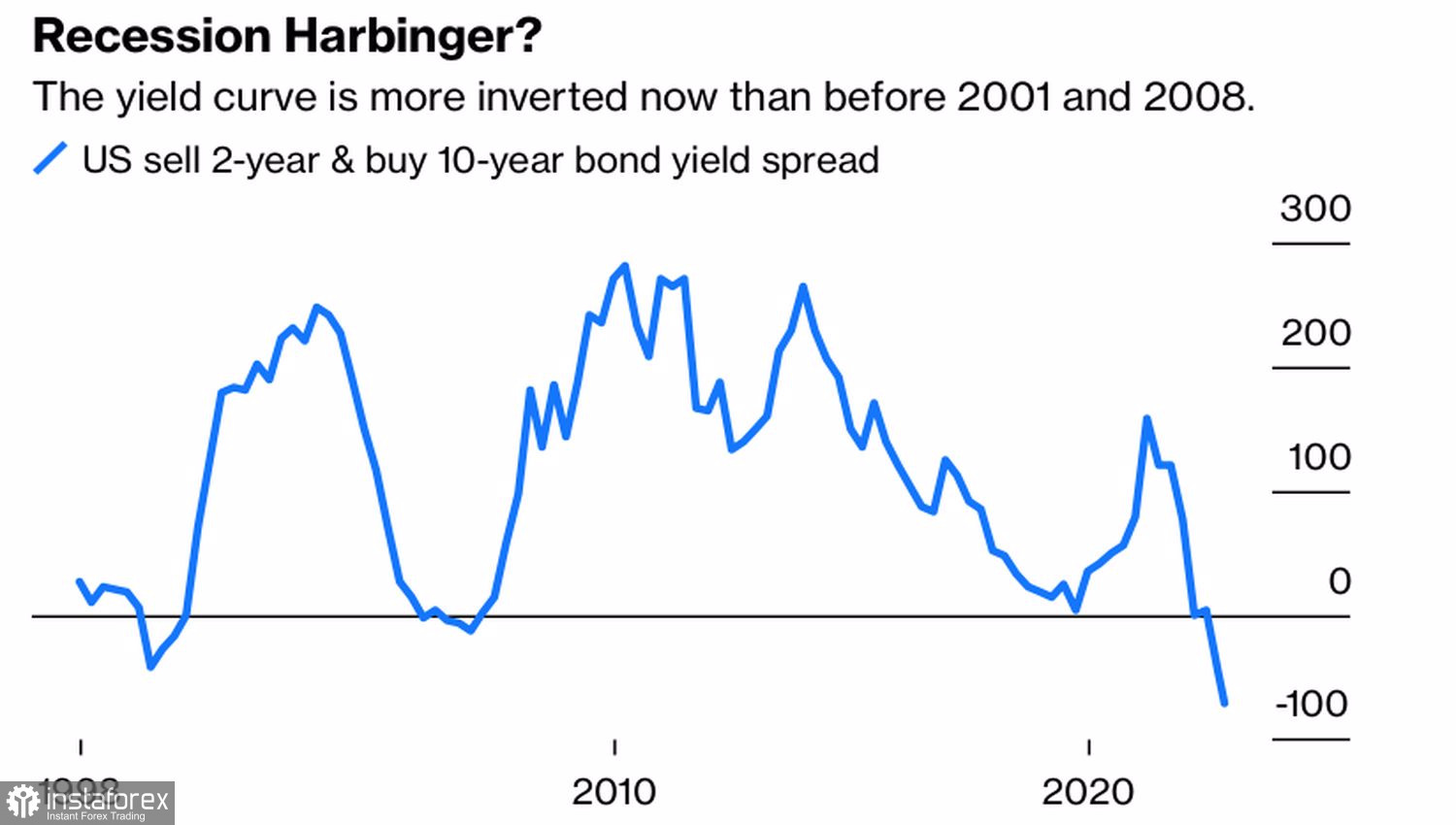

An inverted yield curve, the difference in rates between 2- and 10-year Treasury bonds, usually signals an approaching downturn. It shows that the Fed will most likely cut rates soon, which usually happens amid a recession. Now the yield curve is more inverted than before the economic downturns of 2001 and 2008, which cannot but worry investors.

US yield curve dynamics

They see Jerome Powell's signals of slower monetary restrictions as the first sign of a pause followed by a shift to a dovish stance, which is exerting pressure on the US dollar. While the head of the regulator tried to offset his hints by referring to a greater rate hike, market participants realized his true intentions. Moreover, the latest inflation data further convinced investors that the cycle of tightening monetary policy is coming to an end.

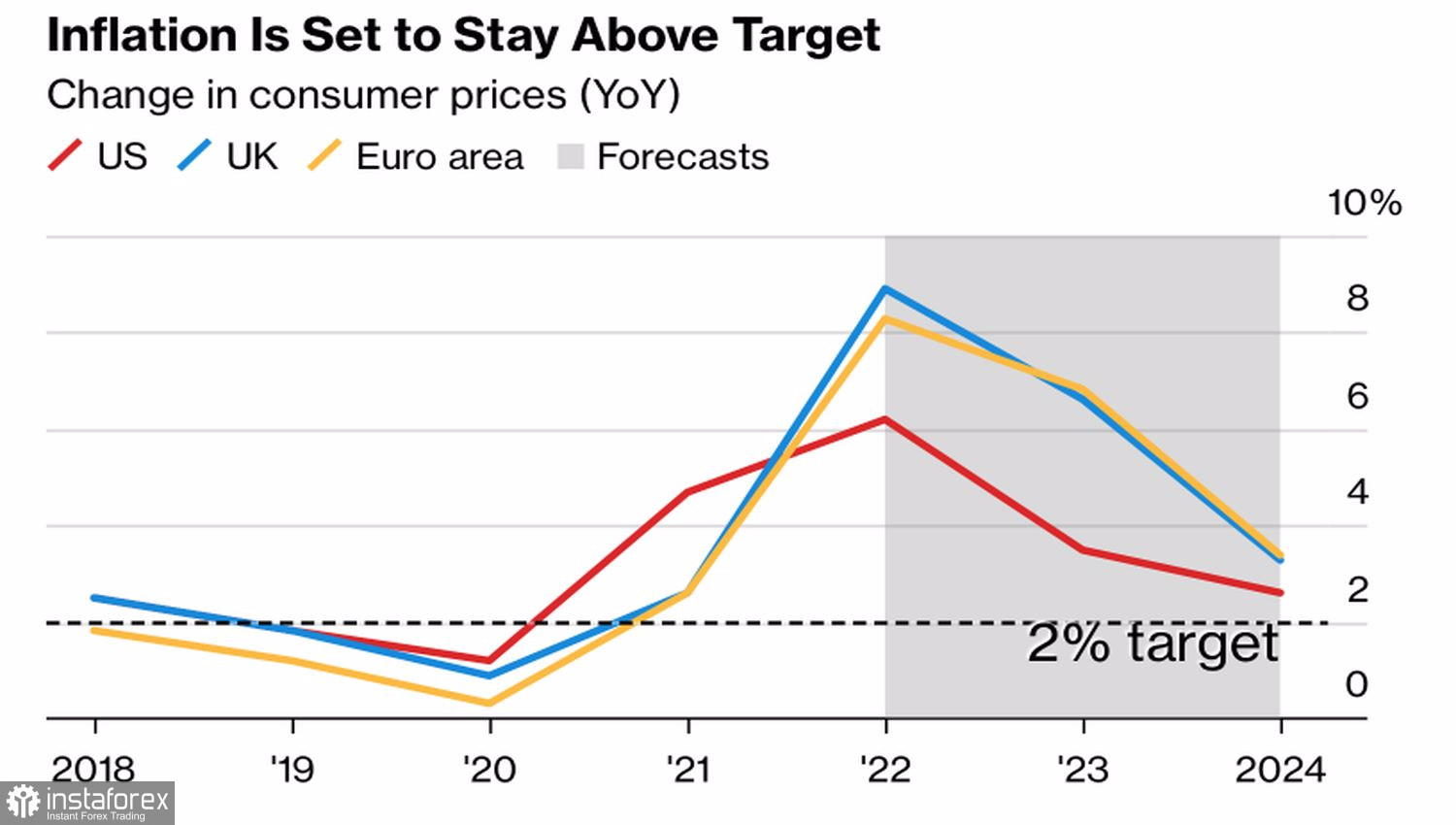

Alas, so far there are no signs of cooling inflation. The OECD urges central banks to keep raising interest rates. According to its forecasts, by the end of 2023, US inflation will fall to 2.6%, in the eurozone - to 3.4%, in Britain - to 3.3%. That is, the rates will not come back to their target levels.

OECD Inflation Forecast

Another thing is that the US dollar is not hopeless. After all, other major central banks follow the Fed and begin to talk about rate cuts. In particular, European Central Bank governing council member Mario Centeno said that the ECB could hike the deposit rate by less than 75 bp in December. ECB Chief Economist Philip Lane noted that the regulator would continue to tighten monetary policy, albeit at a slower pace.

This assumption is supported by the fact that German producer prices fell by 4.2% m/m for the first time in two years. The main reason is a sharp drop in wholesale power prices for businesses, which reflects easing fears regarding the situation with gas this winter.

Thus, the EUR/USD pair's rally will hardly be as strong as in early November. The market is likely to enter a sideways range, and its upward move will be challenging. Moreover, the slightest sign of turmoil may force investors to shift their focus to the US dollar again.

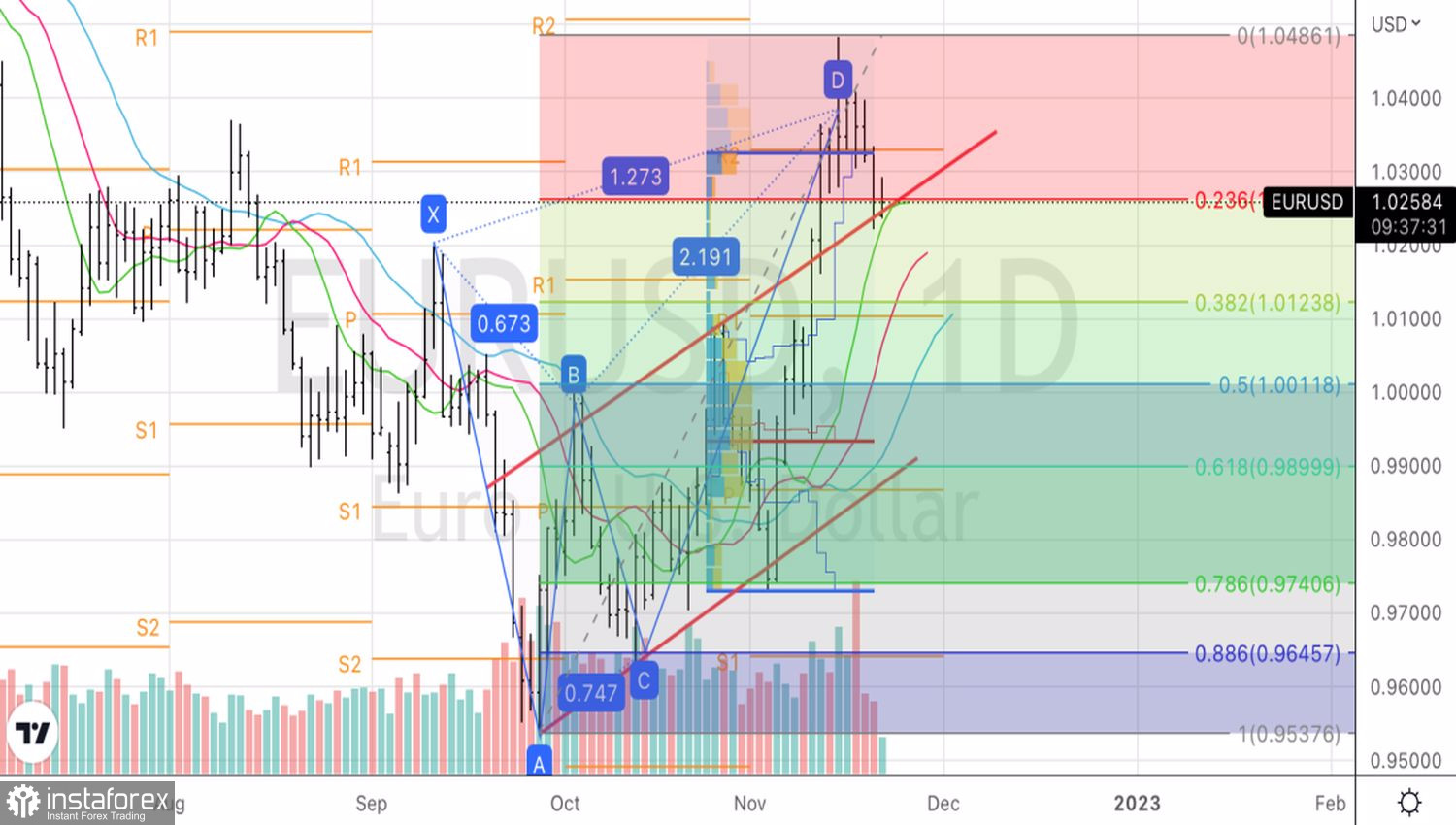

From a technical point of view, the 1-day EUR/USD chart shows that a rebound from the upper boundary of the ascending trading channel may inspire bulls for a new attack. If the price consolidates above the 23.6% Fibonacci level, it will most likely extend gains. Otherwise, a drop below 1.0265 will enable traders to add short positions opened from 1.033.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română