Overview of trading and tips on EUR/USD

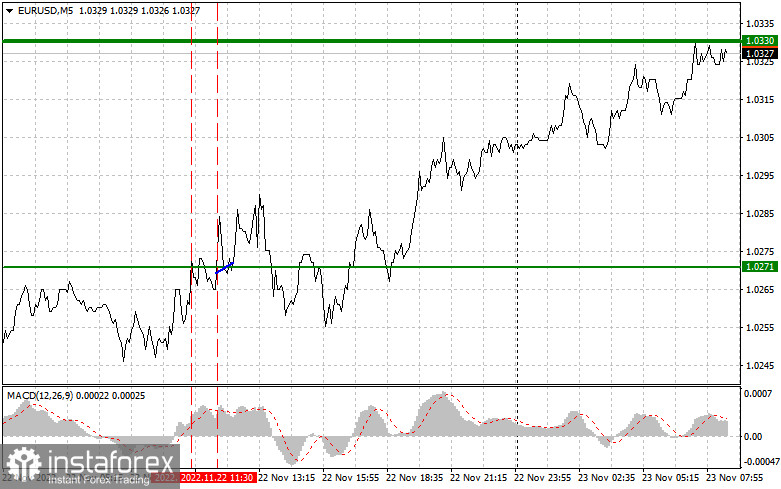

The level of 1.0271 was tested at the moment when the MACD indicator had passed a long way from the zero mark which caps the upward potential of the pair. For this reason, I didn't buy EUR/USD awaiting a sell signal. In a short while, the level of 1.0371 was tested for the second time. In my opinion, MACD has entered the overbought zone which confirms a sell signal. Nevertheless, the pair didn't actually move downwards, thus activating stop losses. The instrument didn't create other market entry points.

The data on the eurozone's current account balance and consumer confidence gave the euro a helping hand because the readings were decent. The market took no notice of a speech by Johannes Beerman from Bundesbank. Today, the economic calendar is more interesting. The eurozone's manufacturing PMI, the services PMI, and the composite PMI are on tap in the first half of the day. The euro could fall in case all readings are worse than expected. In the second half of the day, the same PMIs are due in the US as well as a weekly update on US unemployment claims and new home sales. If market participants detect negative changes in the US housing market, the US dollar will extend its weakness. Above all else, traders are alert to the Fed minutes of the last policy meeting. If traders discover hints about the moderation in monetary tightening, EUR/USD might update one-month highs.

Buy signal

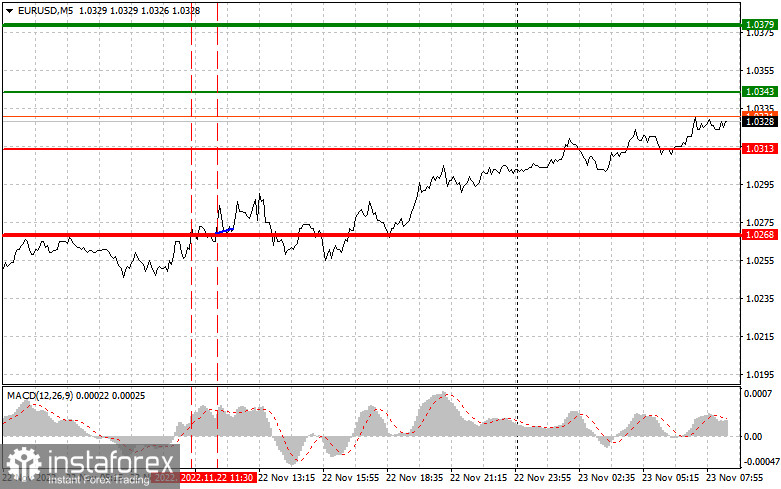

Scenario. We could buy EUR/USD today after the price reaches 1.0343 plotted by the green line on the chart with the upward target at 1.0379. I would recommend leaving the market at 1.0379 and opening short positions in the opposite direction, bearing in mind a 30-35-pips downward from the entry point. The currency pair could grow only on the condition of good statistics on the Eurozone. Importantly, before going long, make sure that MACD stays above the zero mark and is going to begin its climb from it.

Scenario 2. We could buy the euro today also in case the price reaches 1.0313, but at that moment MACD should be in the oversold zone. Such conditions will limit the downward potential of the instrument and reverse the trajectory upwards. We could expect the price growth to the levels of 1.0343 and 1.0379.

Sell signal

Scenario 1. We could go short on the euro once the price reaches 1.0313 plotted by the red line on the chart. The downward target is 1.0268 where I recommend leaving the market and immediately opening long positions in the opposite direction, bearing in mind a 30-35-pips upward move from the entry point. Importantly, before selling the pair, make sure that the MACD indicator is below the zero mark and is ready to begin its decline.

Scenario 2. Sell positions could be opened today in case the instrument reaches 1.0343, but at that moment MACD should stay in the overbought zone which will limit the upward potential of the pair and cause the market reversal. The price might drop lower to 1.0313 and 1.0268.

What's on the chart

The thin green line is the key level at which you can place long positions in the GBP/USD pair.

The thick green line is the target price, since the price is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the GBP/USD pair.

The thick red line is the target price, since the price is unlikely to move below this level.

MACD line. When entering the market, it is important to adjust trading decisions to the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid trading during sharp fluctuations in market quotes. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation will inevitably lead to losses for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română