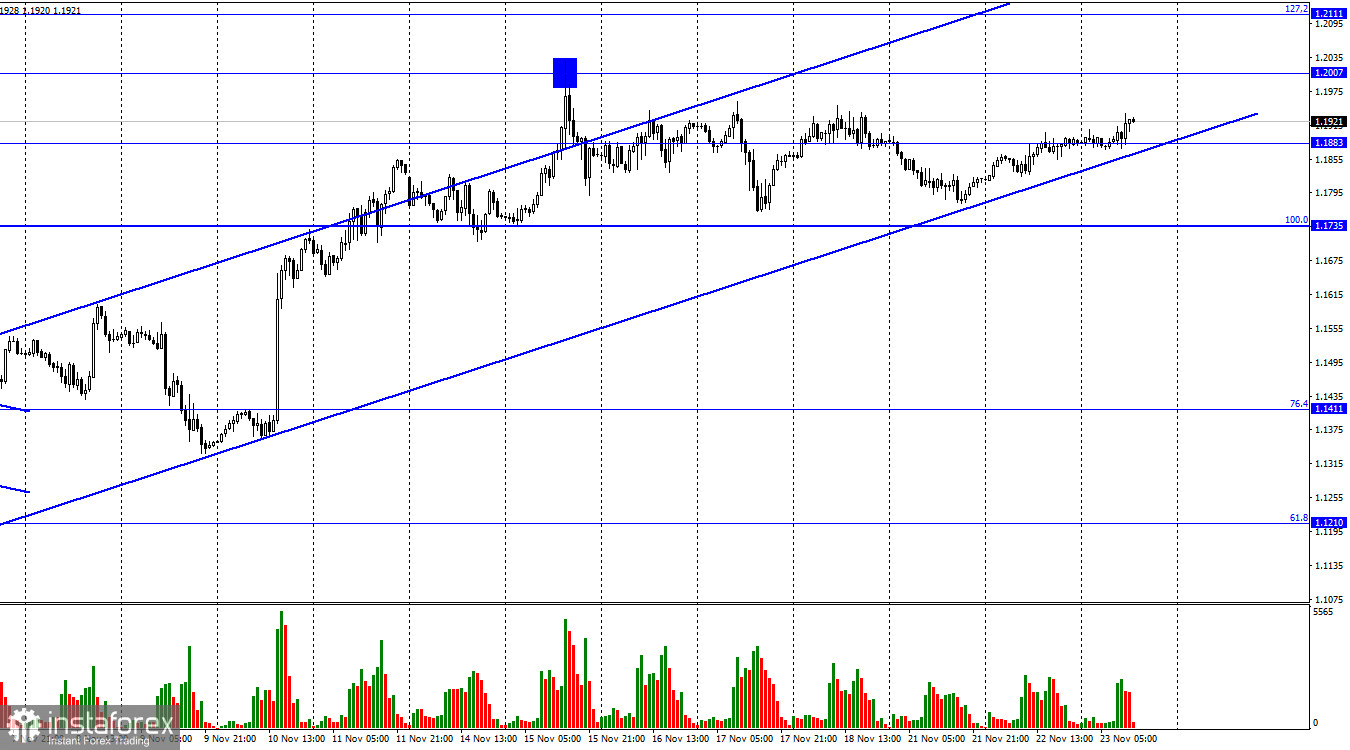

Hi, dear traders! According to the H1 chart, GBP/USD began to grow late on Monday night and continued to rise on Tuesday. It closed above the level of 1.1883, and the quote remains inside the upward trend channel, which shows that traders are bullish on the pound sterling. The pair may continue to advance towards 1.2007 and 1.2111 before settling below the corridor. Then it might fall towards the 100.0% Fibo level at 1.1735.

Today, UK PMI data were released. They were the first reports of the week. Since GBP went up in the first half of the day, one would assume that the PMIs exceeded traders' expectations. However, that was not the case. Two of the three indexes were unchanged from a month ago. The PMI composite edged up by 0.1. Therefore, these indexes were not very important on their own, and traders became even more passive afterwards.

US PMIs are coming up, as well as some US other data releases. In the evening the Fed will publish the minutes of the most recent FOMC meeting, at which the regulator may have raised the interest rate by 0.75% for the last time. The meeting minutes will not be particularly significant for traders – usually they are rather formal. However, other US reports could push the dollar in any direction simply because there will be quite a few of them. They all are listed below. Since the pair has not closed the trend corridor yet, it may continue to climb. However, today's data from the US may give some support to the US dollar. Then the pair will close below the corridor and the chart patterns of the euro and the pound will start to overlap, as they often do.

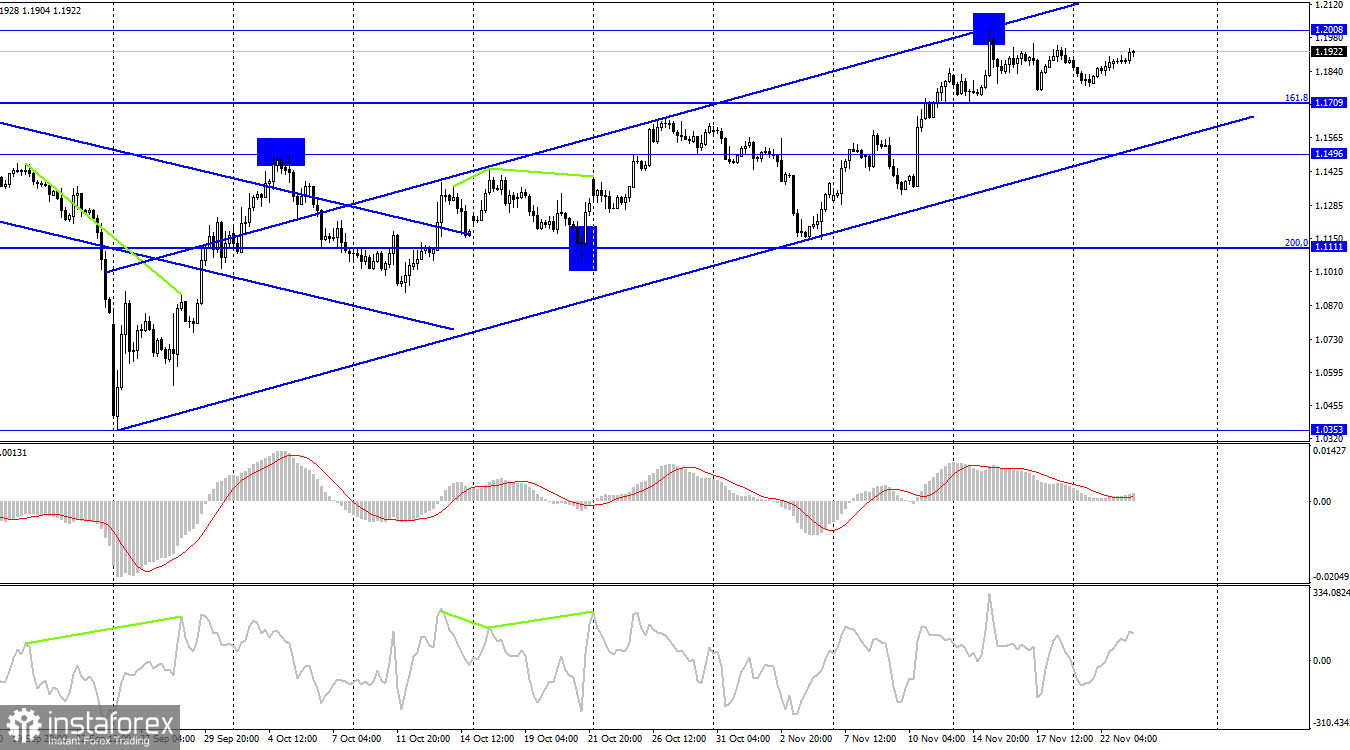

According to the H4 chart, the pair has been moving sideways in a range between 1,1709 and 1,2008 without testing either of them. Currently, the pair is rising towards 1.2008. A rebound from this level will send GBP/USD downwards towards 1.1709. If it consolidates under the ascending channel, the pair's decline towards the 200.0% Fibo level at 1.1111 will be more likely.

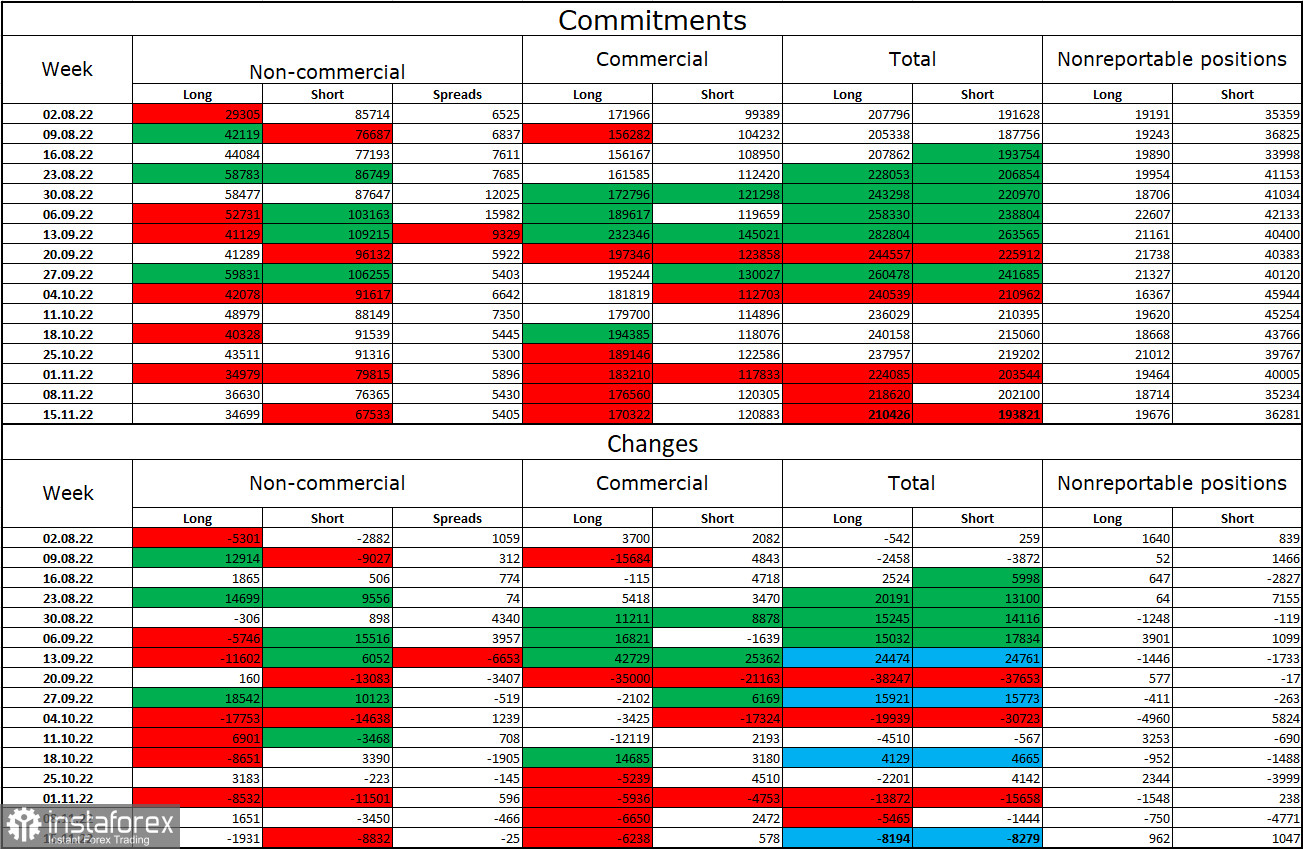

Commitments of Traders (COT) report:

The mood of Non-commercial traders last week became less bearish than the week before. The number of Long contracts in the hands of speculators decreased by 1,931, while the number of Short positions fell by 8,832. However, major players continue to be bearish on GBP/USD, and the number of Short positions still exceeds the number of Long positions greatly. Major traders continue to sell the pound sterling for the most part. While their mood have gradually become more bullish over the past few months, the shift has been very slow. It has already been going on for several months. The pound might continue to advance, because chart analysis, especially trend channels, shows that it is possible. The latest data releases do not give support to GBP, making the situation quite ambiguous. Nevertheless, we are now seeing an increase, which has been awaited for many months, but which is very difficult to explain.

US and UK economic calendar:

UK – Services PMI (09-00 UTC).

UK – Manufacturing PMI (09-00 UTC).

US - Durable goods orders (13-30 UTC).

US - Unemployment claims (13-30 UTC).

US - Manufacturing PMI (14-45 UTC).

US - Services PMI (14-45 UTC).

US – New house sales data (15-00 UTC).

There are a lot of events on the economic calendar in both the US and the UK. They can have a moderate influence on traders today.

Outlook for GBP/USD:

Short positions can be opened if the pair settles below the trend channel on the H1 chart with 1.1735 being the target. Earlier, traders were recommended to go long on GBP/USD if it bounced off the lower boundary of the trend channel on the H1 chart, with 1.2007 being the target. However, no such signal emerged.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română