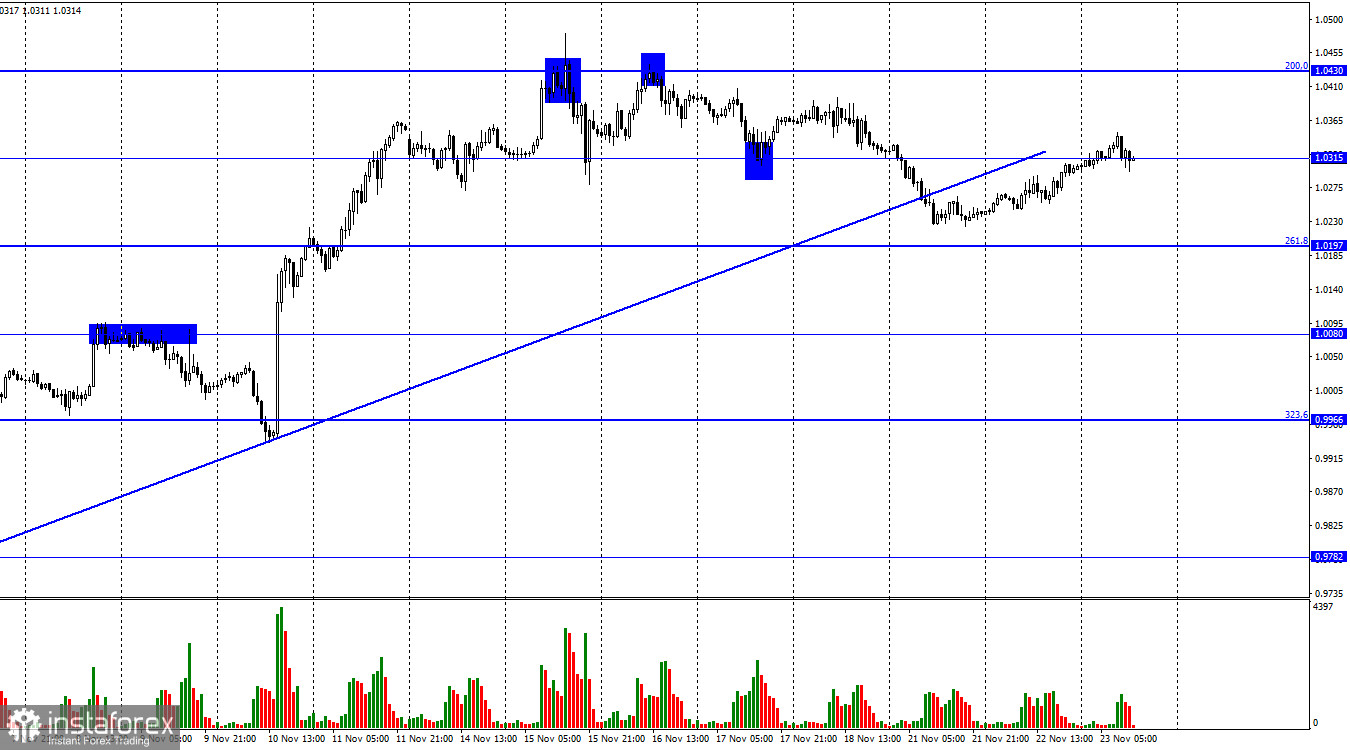

On Tuesday, EUR/USD continued its upward cycle initiated a day earlier. The pair closed above 1.0315 which makes it possible for the euro to rise towards the next Fibonacci retracement level of 200.0% at 1.0430. What is more important is that the price consolidated below the ascending trendline. This makes the further decline of the pair more likely. So, the current uptrend does not mean that the pair won't start falling today or tomorrow.

Today, the PMI data published in the EU was absolutely neutral. In the services sector, the reading for November stayed the same at 48.6. Activity in the manufacturing sector increased to 47.3 from 46.4. The composite PMI went up to 47.8 from 47.3. Yet, these changes are unable to cause a rise in the euro because all three indicators are holding below 50.0. For your reference, the reading below this mark is considered a negative sign for the economy. Therefore, a slight increase in two out of three indicators is not a reason for the euro to strengthen. So, the information background today is similar to what we had on Monday and Tuesday: there are no important reports or events.

The most significant event of the past two days was the statements by FOMC officials who announced that the Fed's rate will continue to rise in December but at a slower pace. Traders count on this scenario and have probably priced it in the quotes. Therefore, traders currently have no drivers to follow or use to adjust their trading strategy.

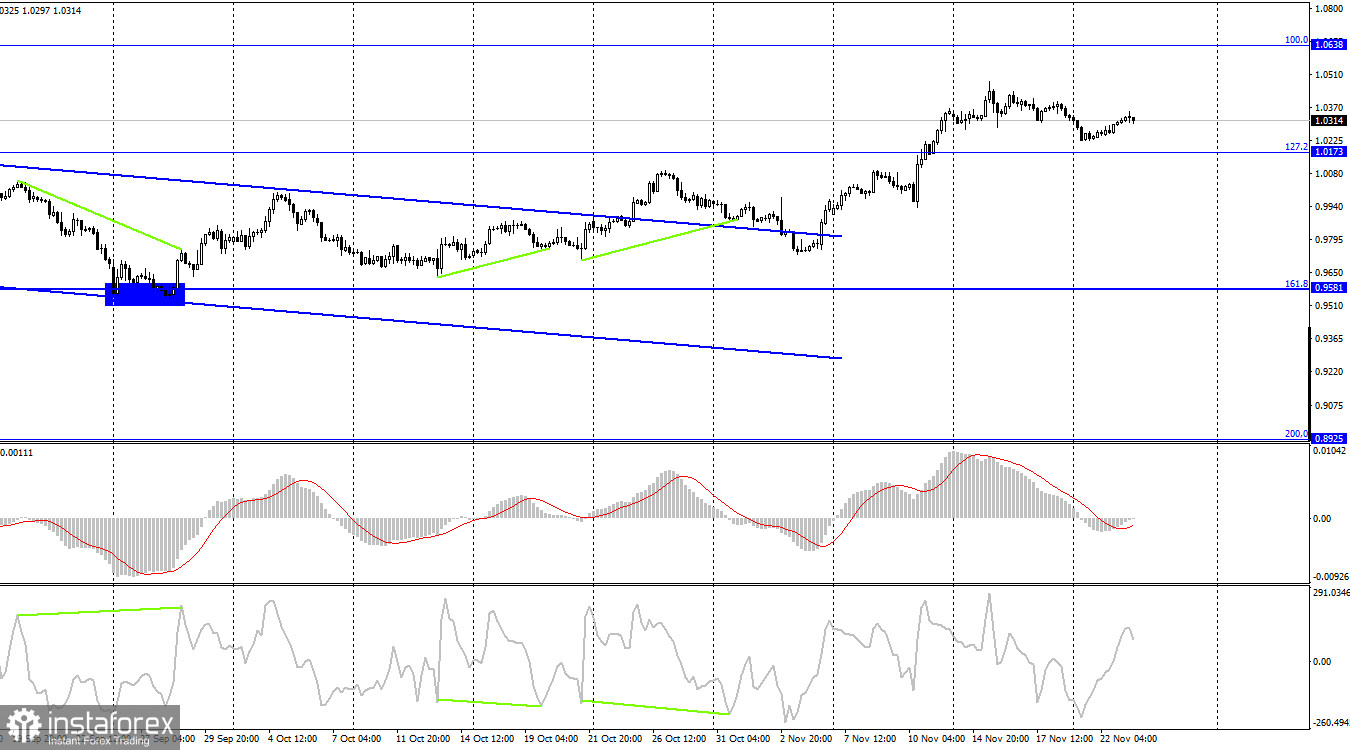

The pair settled firmly above the retracement level of 127.2% at 1.0173 on the 4-hour chart but is slowly pulling back to it. A rebound from this level will support the euro so that it could resume growth towards the retracement level of 100.0% at 1.0638. Consolidation below 1.0173 will make the further decline of the pair more likely and may bring it to the Fibonacci level of 161.8% at 0.9581.

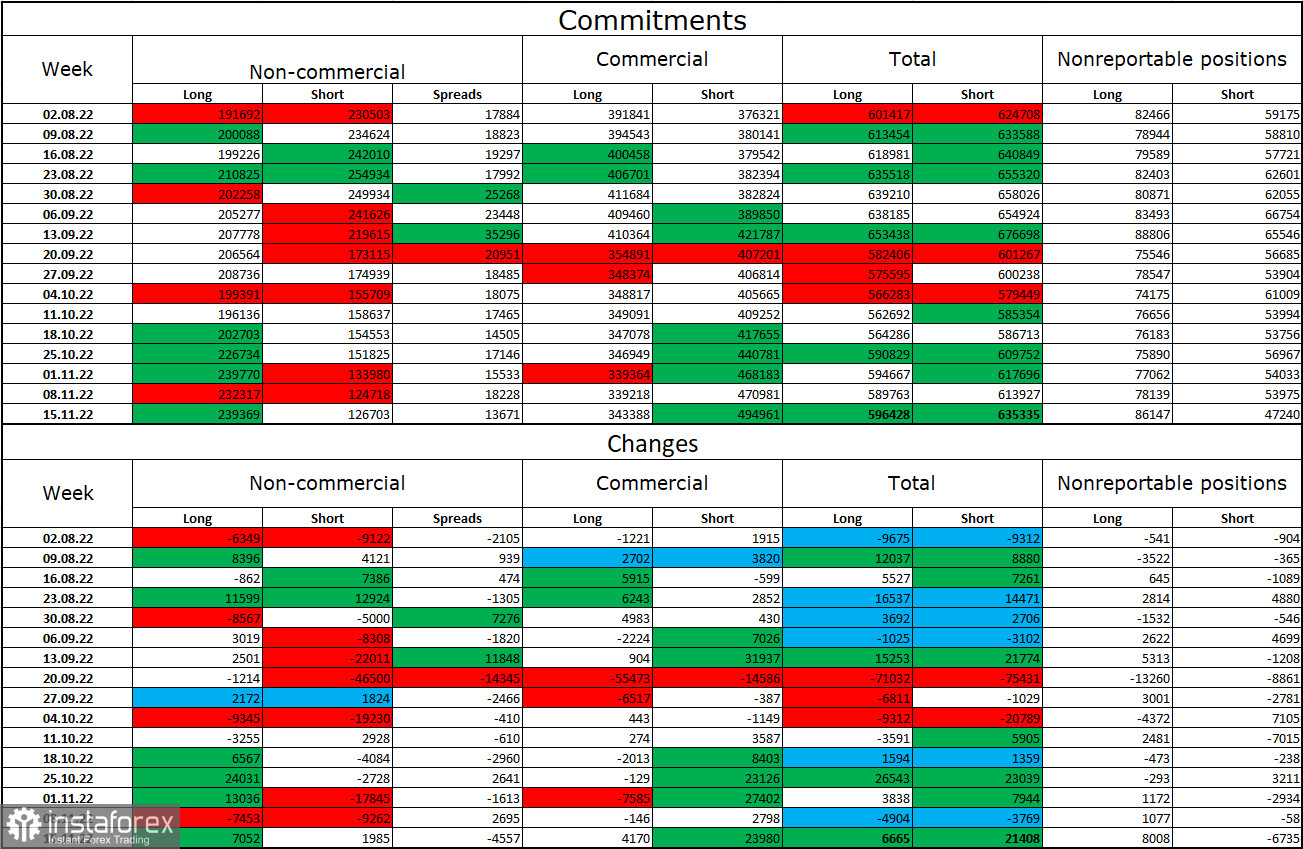

Commitments of Traders (COT) report:

Last week, traders opened 7,052 long contracts and 1,985 short contracts. This indicates that large market players became more bullish on the pair. The overall amount of long contracts opened by traders stands at 239,000 while the amount of short contracts is 126,000. I can finally admit that the European currency is rising which is confirmed by COT reports. In the past few weeks, the euro had a good chance to develop growth. Yet, traders were not ready to give up on the US dollar. Now we can see that the situation is changing in favor of the euro but this process may take a long time. Also, I would like to note the descending channel on the 4-hour chart as the pair has finally managed to close above it. Therefore, we may see a continued uptrend in the euro although it does not go in line with the current information background.

Economic calendar for EU and US:

EU – Services PMI (09-00 UTC).

EU – Manufacturing PMI (09-00 UTC).

US – Core Durable Goods Orders (13-30 UTC).

US – Initial Jobless Claims (13-30 UTC).

US – Manufacturing PMI (14-45 UTC).

US – Services PMI (14-45 UTC).

US – New Home Sales (15-00 UTC).

On November 23, economic calendars for both countries are full of important macroeconomic events. So, the influence of the information background on the market can be noticeable today.

EUR/USD forecast and trading tips:

I would recommend selling the pair as soon as the quotes settle firmly below the trendline on H1 with the targets at 1.0197 and 1.0080. These trades can be kept open for now. Buying the pair will be possible after a rebound from 1.0173 on the 4-hour chart with the targets at 1.0315 and 1.0430.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română