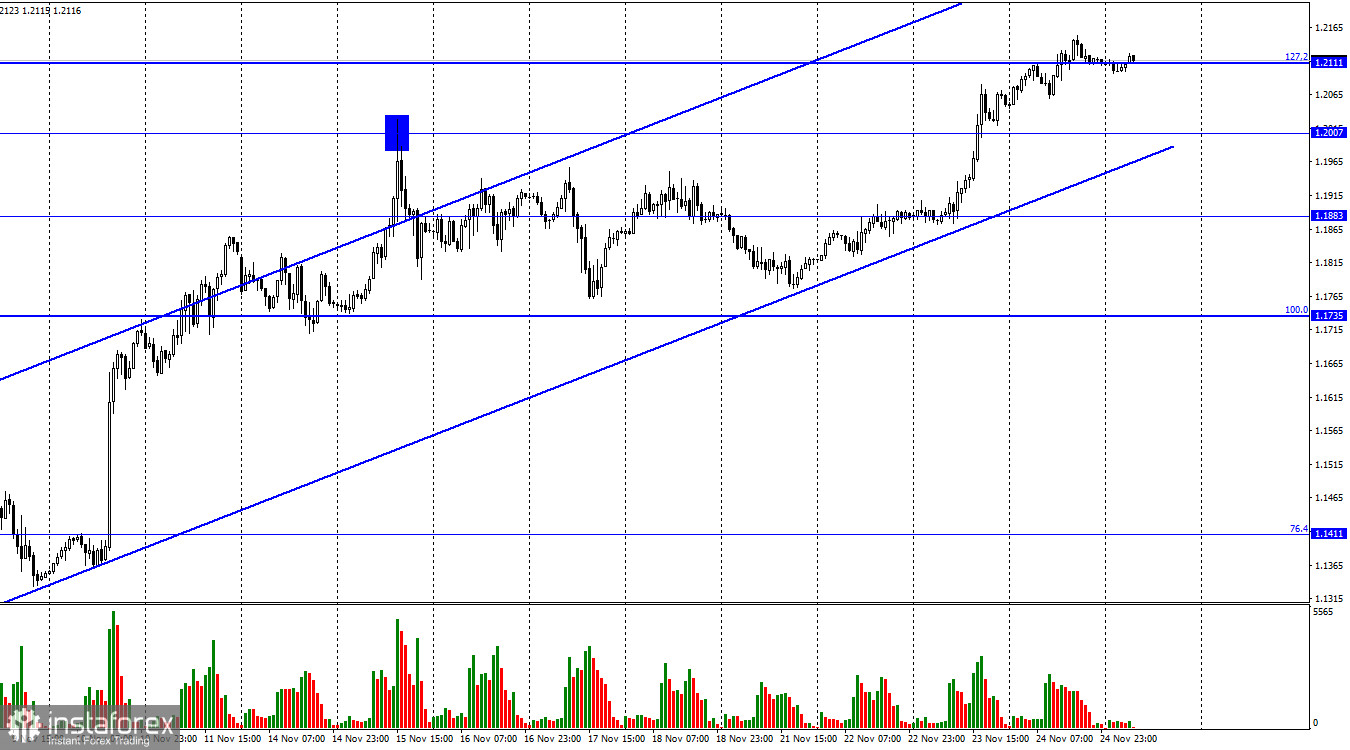

Hi, dear traders! In the 1-hour chart, GBP/USD completed a leg higher to 1.2111, the 127.2% correction level. If the currency pair settles above this level, it will open the door to a higher level at 1.2238. If the price kicks out of this level, it will benefit the US dollar and the price will decline to 1.2007. The overall upward trend channel defined the market sentiment as bullish.

This week, there is nothing noteworthy in the economic calendar for the UK, except for business activity indexes. However, this time they came out tepid and boring. They logged minor changes and the growth of the sterling is unlikely to be associated with these reports. The same can be said about the American statistics, which also did not contain important reports. I think that the message about the negative verdict of the UK Supreme Court in response to the Scottish request to allow holding a referendum on independence made a much more impression on traders than all the economic reports of the week put together. Let me remind you that in the case of the Scottish referendum, there is a danger that its result would show the readiness of the Scottish people to separate from Great Britain. Of course, this option does not appeal to anyone in London, and the Supreme Court quite logically refused, since the Constitution states that any referendum can be held only with the consent of the British authorities.

Hence, this issue can be considered suspended for a while, although the government of Nicola Sturgeon will probably return to it more than once and will send official requests to London. She will slam the British authorities and new Prime Minister Rishi Sunak. However, at this time, the sterling could spike because the court ruling gave it a helping hand. The British pound is expected to fall if the price closes below the rising trend corridor.

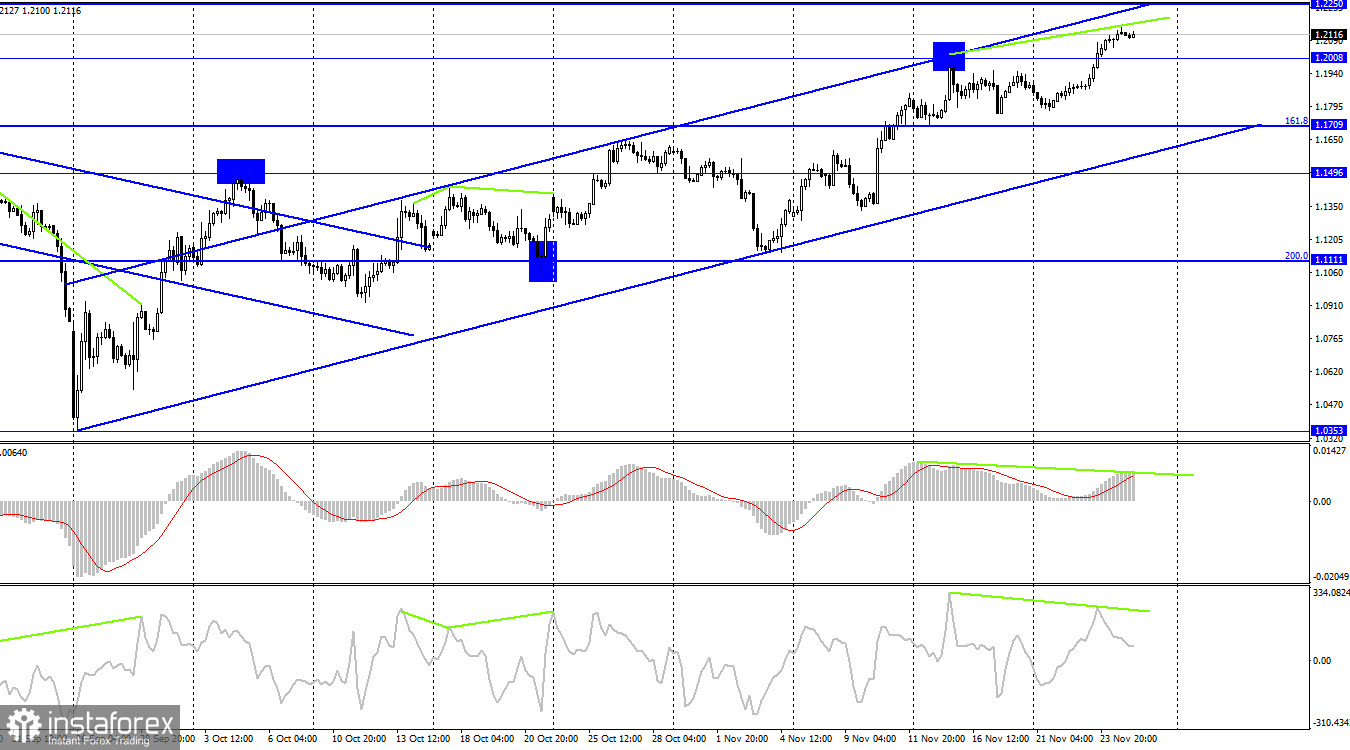

On the 4-hour chart, GBP/USD resumed the upward move, heading for 1.2250. A dip from this level will be in favor of the US currency, thus pushing the price down to 1.1709. If the instrument settles below the upward channel, this will increase the likelihood of a steep fall towards 1.1111 which coincides with the 200.0% Fibonacci level. Both CCI and MACD indicators signal bearish divergences.

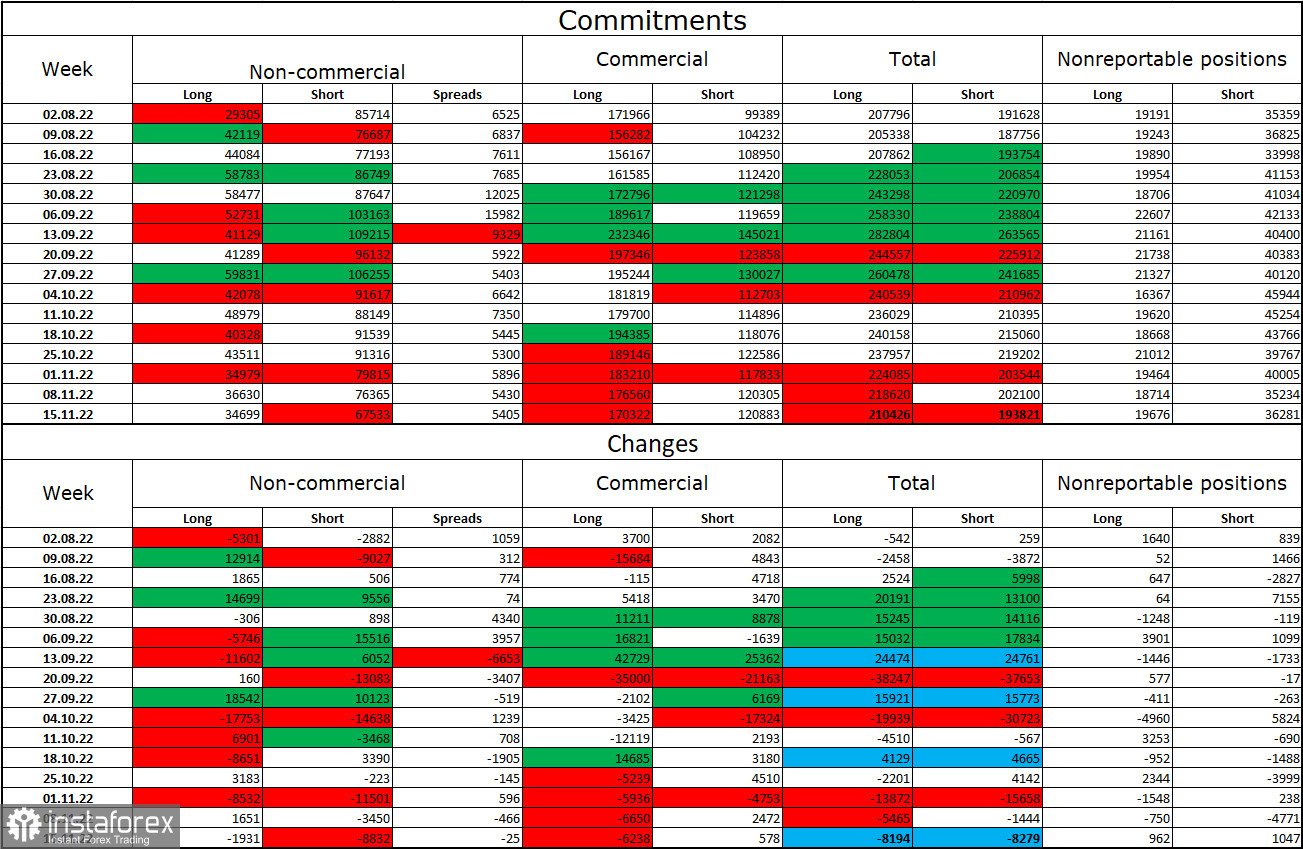

Commitments of Traders report (COT):

The overall sentiment in the category of non-commercial traders turned less bearish last week compared to the week ago. The number of long contracts held by speculators dropped by 1,931 whereas the number of short contracts declined by 8,832. All in all, short contracts remain way above the number of long contracts. Therefore, large market players are still poised to sell the currency pair but their sentiment has been changing slowly but surely to bullish in recent months. The process is too painstaking, lasting already for a few months. The pound sterling is likely to extend its strength which is proven by technical analysis, in particular trend channels. On the other hand, the information background is dubious because fresh economic data doesn't support the sterling. Nevertheless, GBP/USD has been trading higher. This rally, which has been anticipated for a few months, is hard to explain.

Economic calendar for US and UK

The economic calendar is absolutely empty on Friday both for the US and the UK. So, the information background makes no impact on market sentiment today.

Outlook for GBP/USD and trading tips

I would recommend selling GBP/USD in case the instrument settles below the trend channel on the 1-hour chart with a downward target at 1.1735. Alternatively, it makes sense to buy the pair if it closes above 1.2111 on the 1-hour chart with an upward target of 1.2238.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română