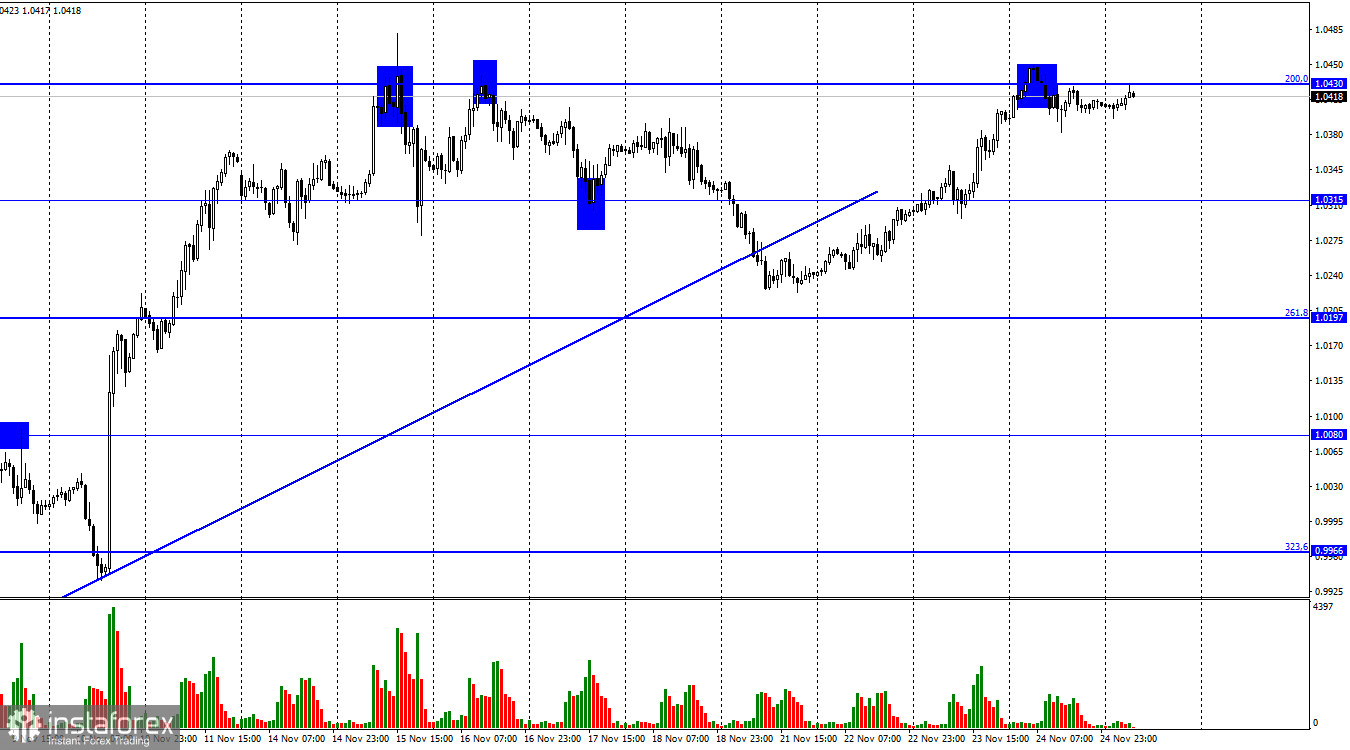

On Thursday, EUR/USD advanced to the retracement level of 200.0% at 1.0430. A rebound from this level will indicate the dominance of the US dollar and a decline toward the level of 1.0315. The pair has bounced off this level twice and a third time might be coming. Consolidation above the level of 1.0430 will make the rise to the Fibonacci level of 161.8% - 1.0574 more likely.

Traders have no more events to watch for this week. All key reports were released on Wednesday. Thursday was a quiet day, while Friday is lacking any events at all. The only event worth paying attention to is the speech by ECB Vice-President Luis de Guindos. He confirmed the intention of the regulator to continue the rate-hiking cycle. The official also stated that an economic slowdown alone would not halt inflation. Therefore, the EU countries have to pursue a reasonable monetary policy. On the one hand, these words could have caused a rise in the European currency. However, this is not the first time when the ECB members have mentioned a further rate increase. So, the euro is unlikely to grow after every such statement.

The euro has developed steady growth in the course of the week even though it closed below the trendline at one point. This technical signal is no longer relevant. Next week is expected to be more eventful in terms of fundamental news. Yet, it seems that bears have changed their mind and no longer wish to return to the market. This week, the US dollar had a chance to strengthen amid a favorable macroeconomic background but this didn't happen. If the fundamentals support the euro next week, we may witness a strong advance in the pair.

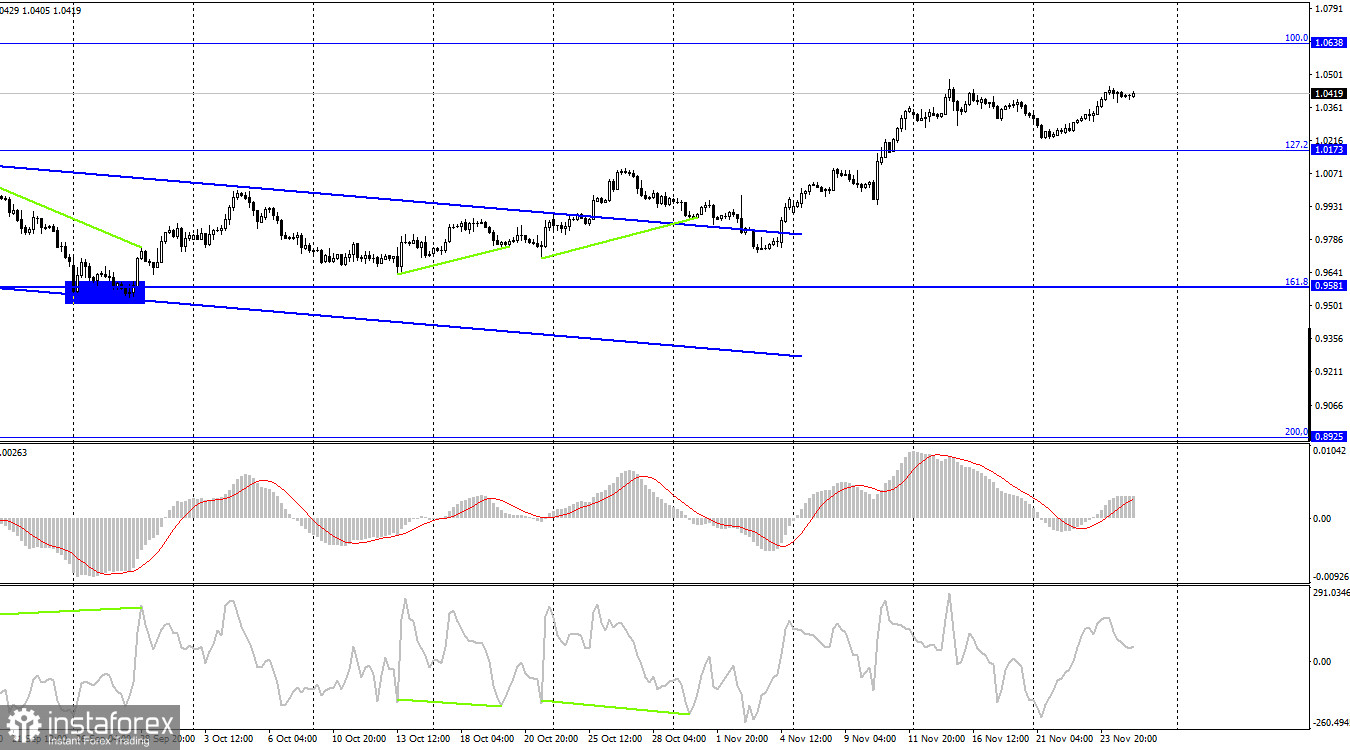

The pair settled firmly above the retracement level of 127.2% at 1.0173 on the 4-hour chart and resumed growth towards the next retracement level of 100.0% at 1.0638. Consolidation below 1.0173 will support the US dollar and may push the pair down to the Fibonacci level of 161.8% at 0.9581. None of the indicators is showing a divergence coming.

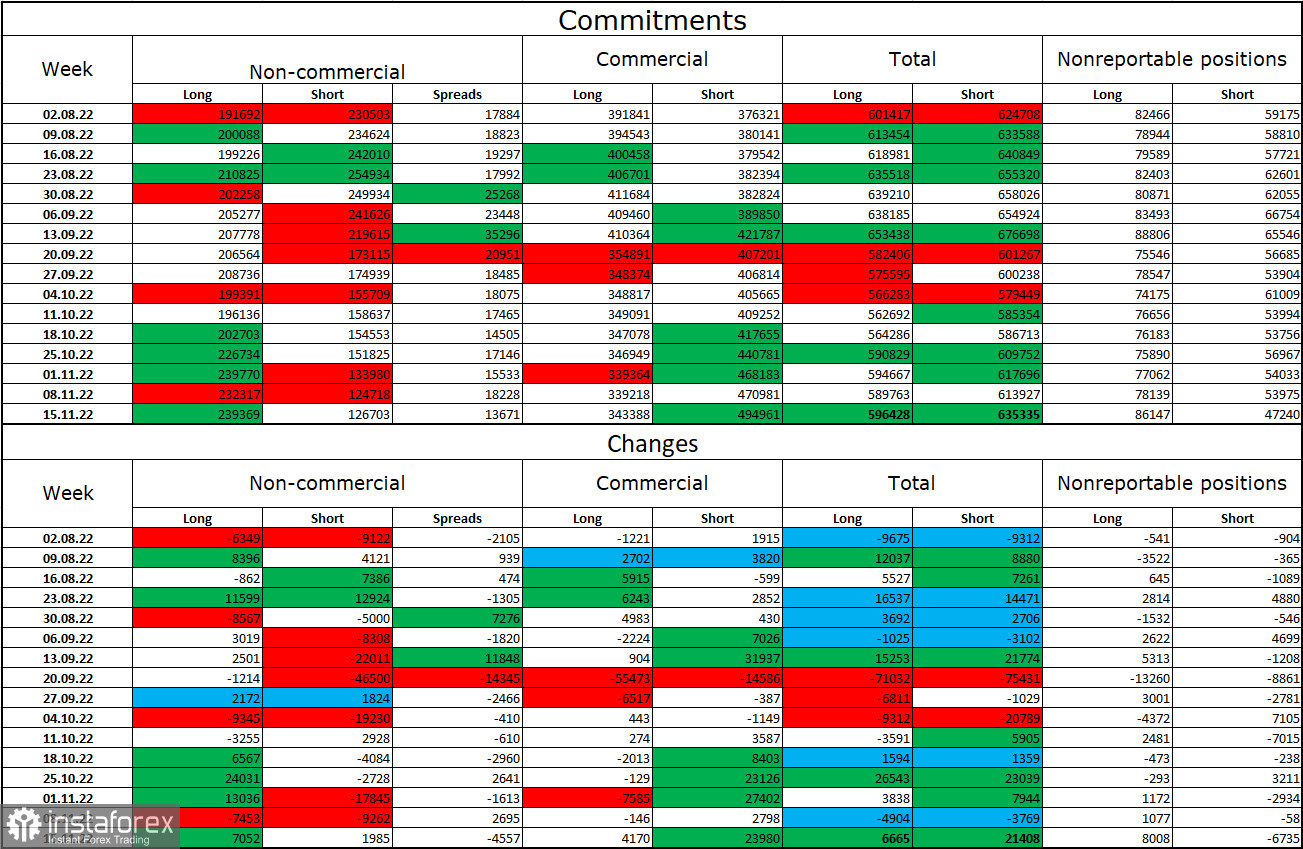

Commitments of Traders (COT) report:

Last week, traders opened 7,052 long contracts and 1,985 short contracts. This indicates that large market players became more bullish on the pair. The overall amount of long contracts opened by traders stands at 239,000 while the amount of short contracts is 126,000. I can finally admit that the European currency is rising which is confirmed by COT reports. In the past few weeks, the euro had a good chance to develop growth. Yet, traders were not ready to give up on the US dollar. Now we can see that the situation is changing in favor of the euro but this process may take a long time. Also, I would like to note the descending channel on the 4-hour chart as the pair has finally managed to close above it. Therefore, we may see a continued uptrend in the euro although it does not go in line with the current information background.

Economic calendar for EU and US:

On November 25, economic calendars for both the EU and the US show no important events. Therefore, the influence of the information background on the market sentiment will be zero today.

EUR/USD forecast and trading tips:

I recommended selling the pair when the quotes settled below the trendline on the 1-hour chart, with the targets at 1.0197 and 1.0080. However, the pair hasn't declined yet. It would be possible to buy the pair when the price rebounds from 1.0173 on H4, with the targets at 1.0315 and 1.0430. Yet, this signal has not been formed. We need to wait for new signals.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română