Although the euro edged down on Friday, the market remained flat due to a day off in the United States. The euro went down despite a clearly overbought greenback. The currency will likely remain bearish today due to an empty macroeconomic calendar. The scale of its fall is expected to be the same as on Friday. The market will attempt to correct the long-lasting imbalance.

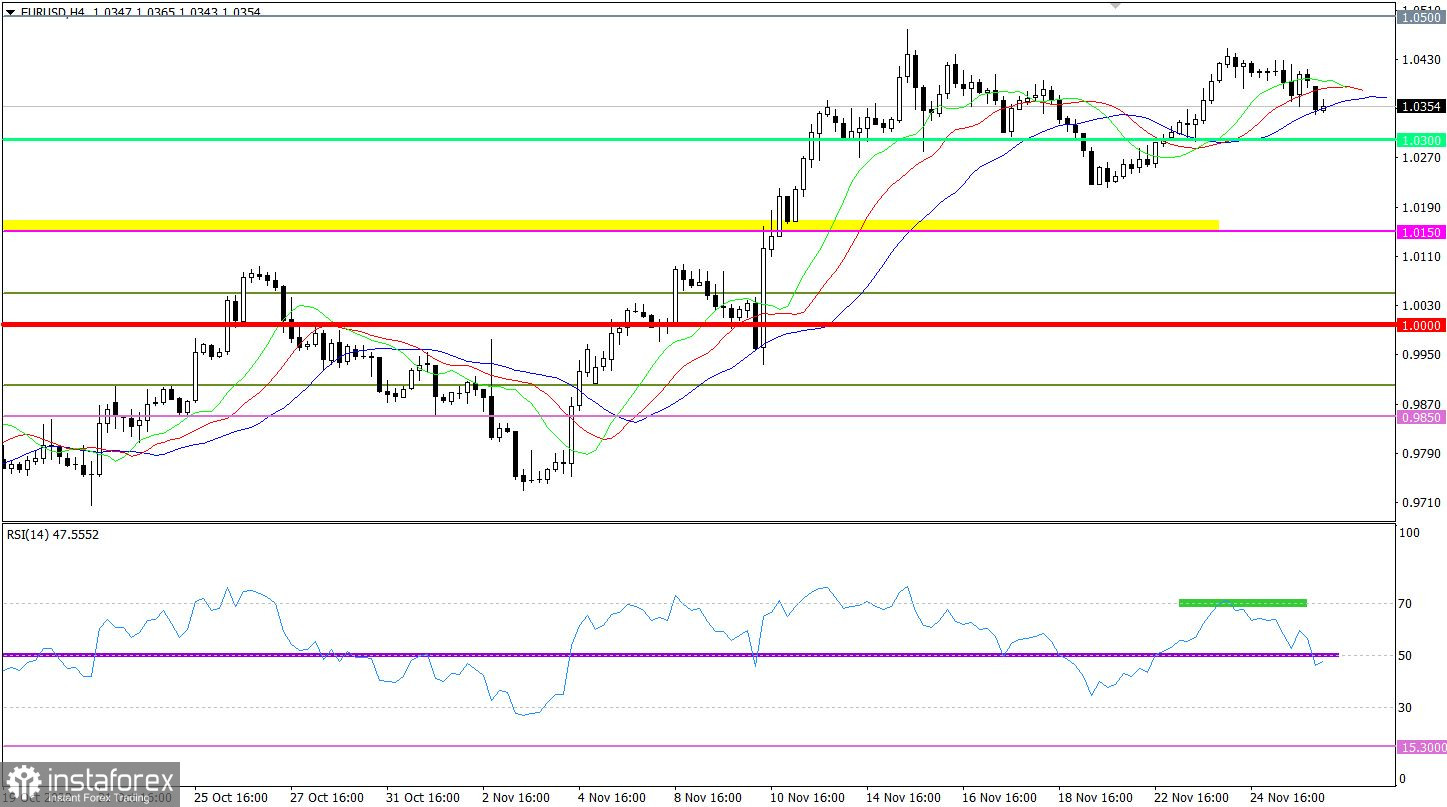

The EUR/USD pair dropped below 1.0350 when the sideways stage in the market ended.

The RSI crossed line 50 to the downside on the 4-hour chart, signaling a correction. On the daily chart, the indicator is still moving between lines 50 and 70, reflecting bullish sentiment.

The Alligator's moving averages are crossed, illustrating a flat market. On the daily chart, the Alligator is headed up, which corresponds to the uptrend seen last week.

Outlook

If the price settles below 1.0350, the sellers may push the pair to 1.0300. The sellers' further actions will depend on how the quote behaves at 1.0300.

If the price goes above 1.0400, the uptrend may resume.

As for complex indicator analysis, there is a sell signal for intraday and short-term trading. In the medium term, indicators signal an uptrend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română