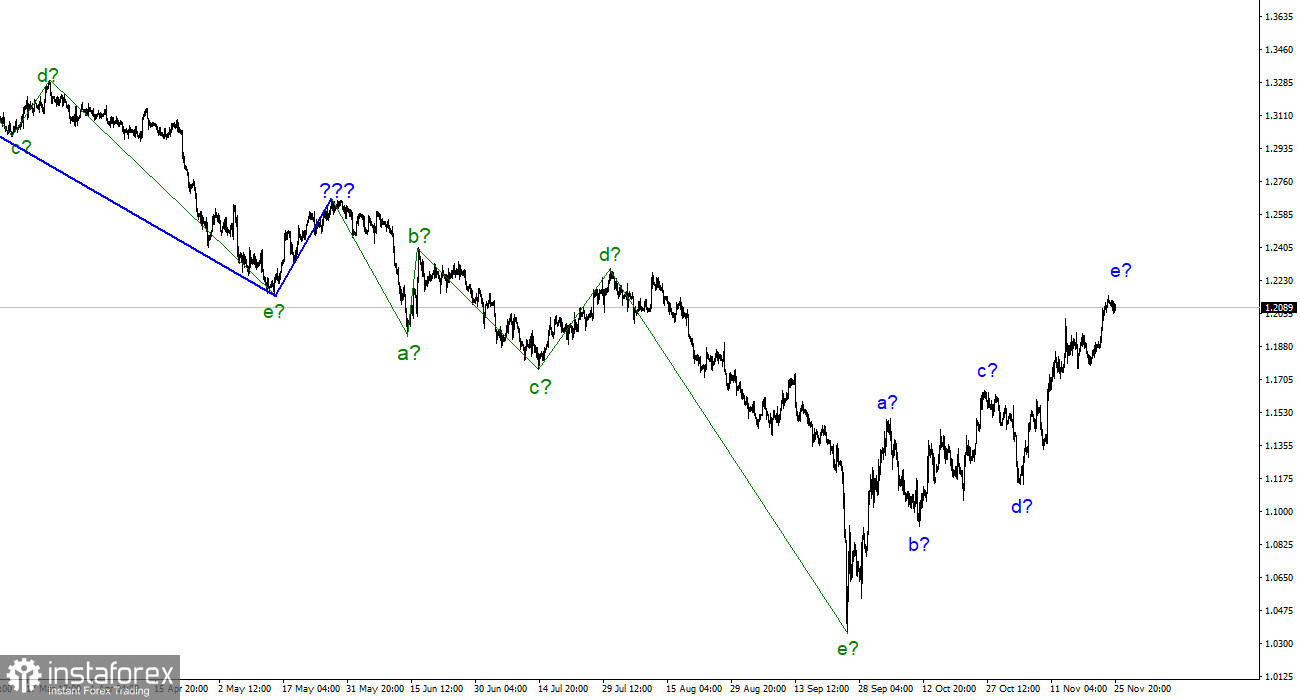

The wave marking for the pound/dollar instrument currently appears quite confusing, but it still needs to be clarified. The five-wave upward trend section has the shapes a, b, c, d and may already be finished. As a result, the instrument's quote increases may last a while. However, the European currency has recently begun to grow once again, and both instruments should ideally move in the same direction. As a result, the pound is simply waiting for the euro to finish creating another upward wave so that a mutual decline can start. Recently, Briton's news background has been so varied that it is challenging to sum it up in one word. The British man had more than enough reasons to rise and fall.

As you can see, he primarily went with the first option. The internal wave structure of wave e has become more complex due to the rise in quotes over the past week, but so far, only this wave and only part of the trend section have done so. I'm still waiting for the decline of both instruments because the wave marking on both instruments allows the ascending section to be built to completion.

As the week began, only the euro was being actively traded.

In comparison to the movement of the euro, the exchange rate of the pound/dollar instrument increased by only 15 basis points on Monday. Something like this could significantly increase the euro's value without at least causing a relative movement in the pound. These currencies typically trade similarly, but today there was no background news at all. Since only Christine Lagarde's speech is scheduled for today, it won't be in the afternoon either for the dollar or the pound.

In addition to Jerome Powell's speech this week, statistics on the US labor market and the unemployment rate will be made public. The mood of the market could be significantly affected by these occurrences. Because the demand for US currency must increase, we must wait for positive American statistics and Powell's "hawkish" rhetoric. But we'll still get what we need even if we ask for it that way. Although I concede that both instruments could continue to rise this week, it is still difficult to predict when the European and British currencies will begin to decline because a clear wave pattern keeps pointing in that direction.

Conclusions in general

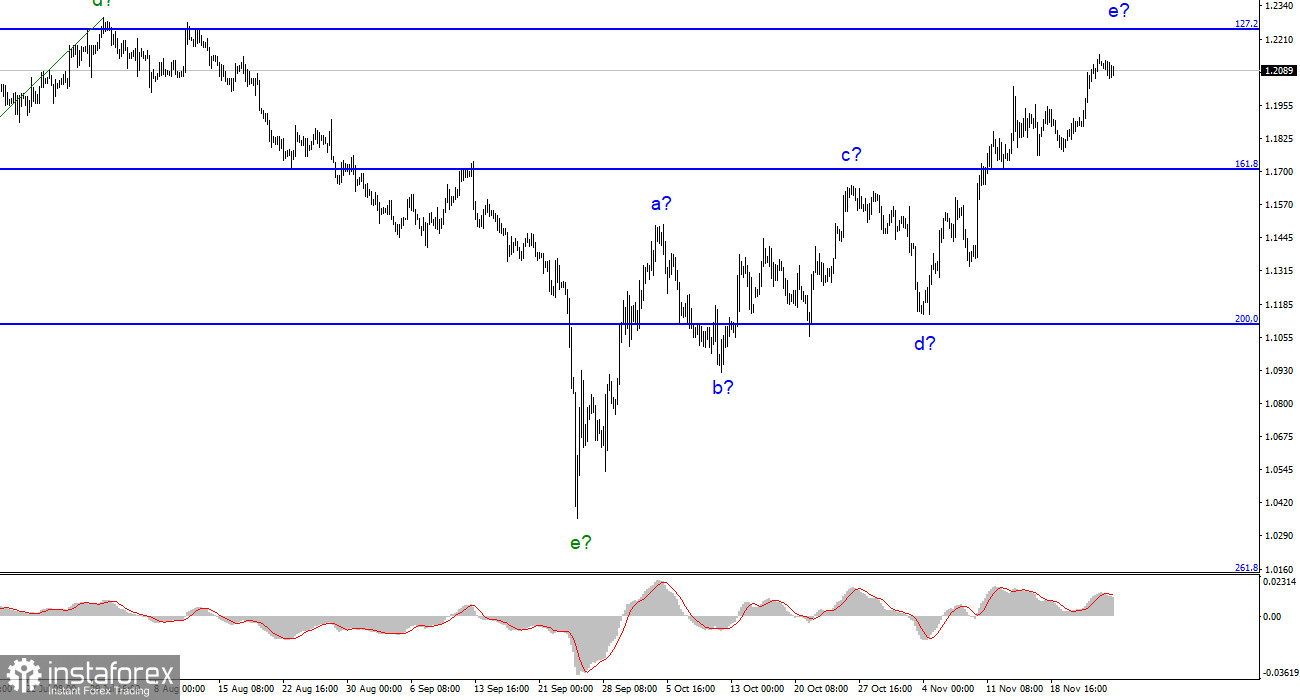

The construction of a new downward trend segment is predicated on the wave pattern of the pound/dollar instrument. I can no longer recommend purchasing the instrument because the wave marking already permits the development of a downward trend section. With targets around the 1,1707 mark, or 161.8% Fibonacci, sales are now more accurate. The wave e, however, can evolve into an even longer shape.

The euro/dollar instrument and the picture look very similar at the larger wave scale, which is good because both instruments should move similarly. The upward correction portion of the trend is currently almost finished. If this is the case, a new downward trend will soon develop.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română