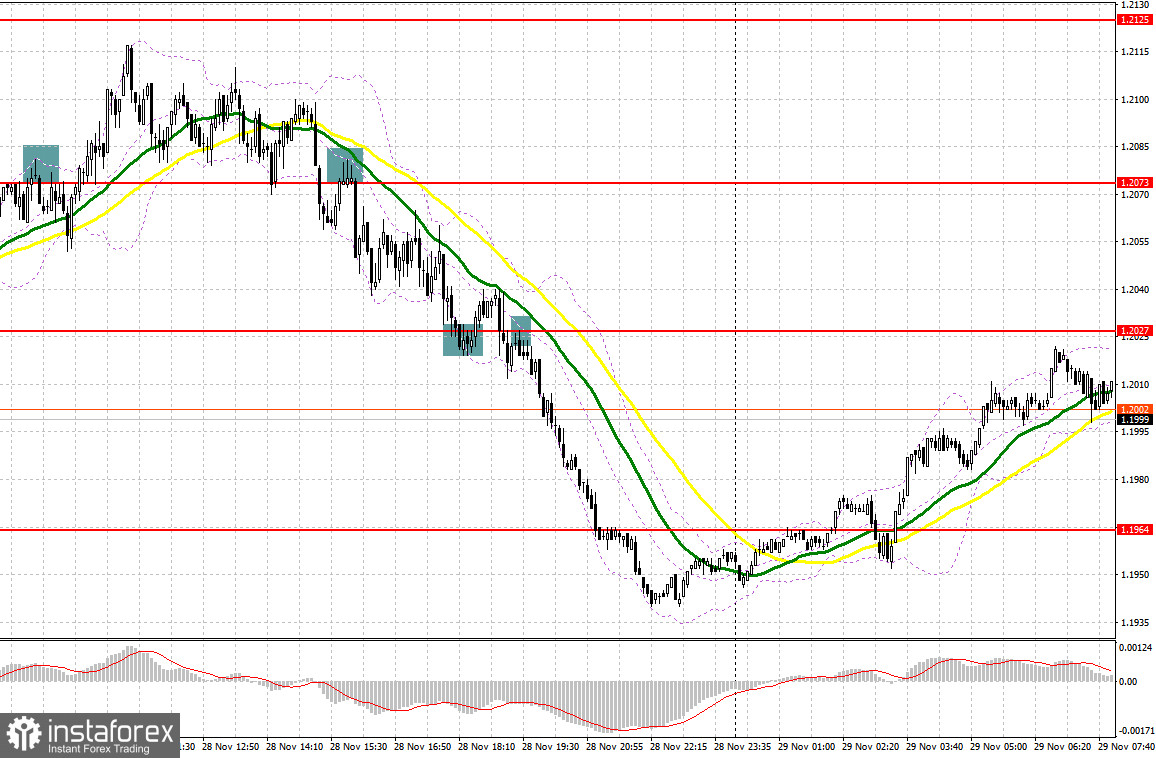

Yesterday, traders received several signals to enter the market. Let us take a look at the 5-minute chart to figure out what happened. Earlier, I asked you to pay attention to the level of 1.2073 to decide when to enter the market. A rise and a false breakout of this level led to a sell signal in the first part of the day. As a result, the pair dropped just by 20 pips. Later, demand for the asset increased and bulls managed to break above this area from the third attempt. In the second part of the day, the pair failed to hit 1.2125. That is why traders focused again on 1.2073. A breakout and an upward test of this level led to a sell signal. As a result, the price slid to 1.2027. There, bulls tried to control the market and even formed an entry point. However, the pair did not show a strong upward correction. That is why the pound sterling resumed falling.

Conditions for opening long positions on GBP/USD:

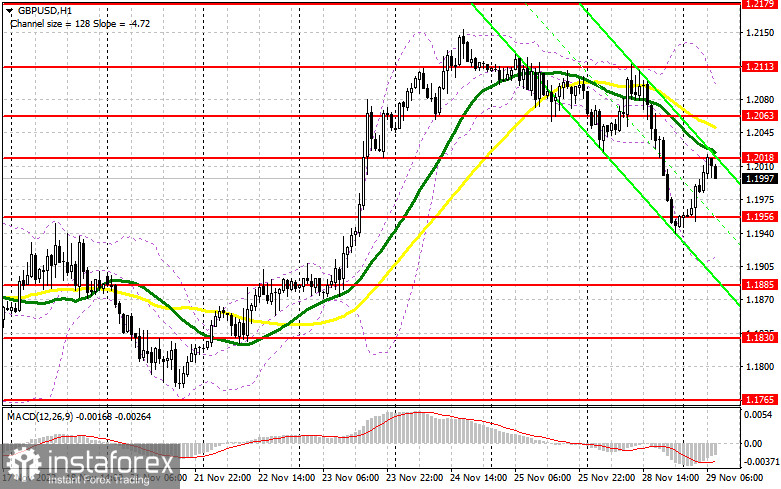

Hawkish announcements made by the Fed's representatives after some dovish comments provided last week surprised most traders. As a result, risk assets, including the pound sterling, were sold off. Today, the UK will disclose a lot of reports on the lending market. However, the speech that will be provided by Andrew Bailey is likely to be of primary importance. Traders should focus on the M4 money supply figures, mortgage approvals, and mortgage lending data. The lending sector is the most important component of the UK economy. That is why these reports are very important. If the pound sterling drops amid the data, buyers will return to the market only near the closest support level of 1.1956. Traders may go long only after a false breakout of this level. In this case, the pound sterling may return to 1.2018. A breakout of this area is the key aim of buyers. If they managed to gain control of this level, the bullish trend may continue. A downward test of 1.2018 will allow the British pound to reach 1.2063. If the asset exceeds this level, it may form a strong uptrend and return to 1.2113, a new resistance level formed yesterday. The farther target is located at 1.2179, where it is recommended to lock in profits. If bulls fail to reach the goal and lose 1.1956, pressure on the pair will increase, thus spurring a noticeable correction. In this case, traders should be very cautious. It is better to open long positions after a decline or false breakout of 1.1885. Traders may also go long just after a bounce off 1.1830, expecting a rise of 30-35 pip within the day.

Conditions for opening short positions on GBP/USD:

After yesterday's massive sell-off, sellers are not very active today. They are waiting for good entry points to enlarge the volume of short positions. This will become possible after the formation of a false breakout of 1.2018. This, in turn, will lead to a decline to 1.1956, where the pound sterling was actively bought today during the Asian trade. Bears should gain control over this level to push the price lower. A break and an upward test of 1.1956 will give a sell signal, allowing the price to return to 1.1885. This will create obstacles to bulls who expect a further rise in the pair. The farthest target is located at 1.1830, where it is recommended to lock in profits. If the price tests this level, the bullish trend is likely to stop. If the pound/dollar pair increases and bears fail to protect 1.2018, the pair will enter the sideways channel and start moving towards 1.2063. Only a false breakout of this level will give a sell signal. If bears fail to be active at this level too, traders should go short just from the high of 1.2113, expecting a decline 30-35 pips.

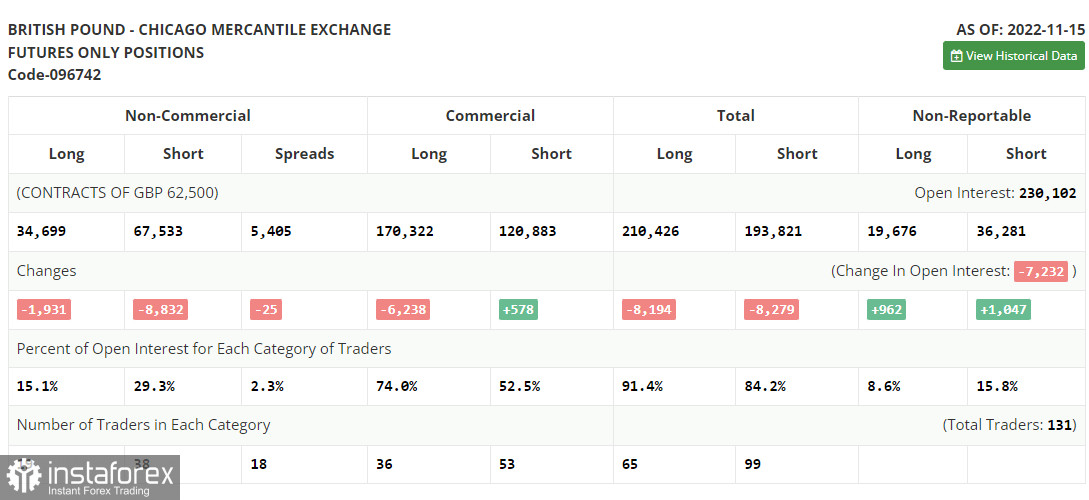

COT report

Commitments of Traders for November 15th logged a decline in both long and short positions. An unexpected surge in inflation in the UK is sure to impact the BoE's monetary policy stance. Given the persistently high inflation, the regulator has no choice but to stick to monetary tightening. If so, it will spur demand for the pound sterling. It will be able to climb higher versus the greenback. However, given the headwinds the UK economy is now facing, it will not be enough to attract investors to the market who firmly believe that the pound sterling has entered a long-term recovery cycle. Besides, the Fed remains strongly committed to aggressive tightening to cap galloping inflation. Hence, GBP/USD may be unable to start a rally in the medium term. According to the latest COT report, the number of long non-commercial positions dropped by 1,931 to 34,699 and the number of short non-commercial positions sank by 8,832 to 67,533, which led to a further increase in the negative non-commercial net position to -32,834 from -39,735 a week earlier. The weekly closing price of GBP/USD grew to 1.1885 against 1.1549.

Signals of indicators:

Moving Averages

Trading is performed below 30- and 50-day moving averages, which points to a possible change in the market sentiment.

Note: The period and prices of moving averages are considered by the author on the one-hour chart which differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the British pound rises, the upper limit of the indicator located at 1.2080 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total number of long positions opened by non-commercial traders.

- Short non-commercial positions are the total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română